Table of Contents

Embedded Payments in B2B: Reinventing Procurement and Vendor Management

Author

Date

Book a call

Key takeaways-

B2B payments have long been plagued by inefficiencies — slow approvals, delayed settlements, and strained supplier relationships. Unlike consumer payments, which have become instant and seamless, enterprise transactions often remain cumbersome and fragmented.

That is beginning to change. Embedded payments — integrating financial flows directly into procurement platforms and ERP systems — are redefining how enterprises operate.

Business Impact

- Faster settlements → Unlock liquidity and strengthen cash flow.

- Stronger supplier trust → Build resilient partnerships and secure better terms.

- Working capital optimization → Free up capital to reinvest in growth.

Why Embedded Payments Matter

The scale of change is significant. Research suggests that the embedded B2B payments market will grow from about $4.1 trillion in 2024 to nearly $16 trillion by 2030 (Edgar Dunn Report).

For procurement leaders, this isn’t just digitization — it’s about creating measurable business value.

What Enterprises Gain

- Shorter payment cycles → moving from weeks to days.

- Better cash flow visibility → enabling smarter liquidity planning.

- Stronger supplier relationships → turning vendors into long-term partners.

Before vs After: The Procurement Shift

Traditionally, B2B payments have been manual, fragmented, and reactive. Embedded payments create a new standard where finance and procurement work as one.

| Stage | Before (Manual) | After (Embedded Payments) | Business Impact |

|---|---|---|---|

| Workflows | Paper invoices, long approval chains | Auto-matched invoices, instant payouts | Procurement cycles reduced by 40–60% |

| Supplier Relationships | Delays → strained trust | Predictable, fast payouts | Improved supplier satisfaction; better pricing |

| Cash Flow Visibility | Fragmented reporting | Real-time dashboards | Finance gains forecasting accuracy of +25% |

| Global Payments | Expensive, compliance-heavy | Local rails, embedded FX | Lower costs, faster cross-border reach |

| Procurement’s Role | Cost center | Strategic value driver | Elevated to board-level importance |

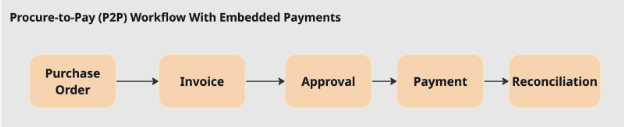

How Embedded Payments Transform Procurement

1. From Manual to Automated Workflows

2. From Transactional to Strategic Supplier Relationships

3. From Opaque to Transparent Cash Flow

4. From Localized to Global Supplier Enablement

5. From Cost Center to Value Driver

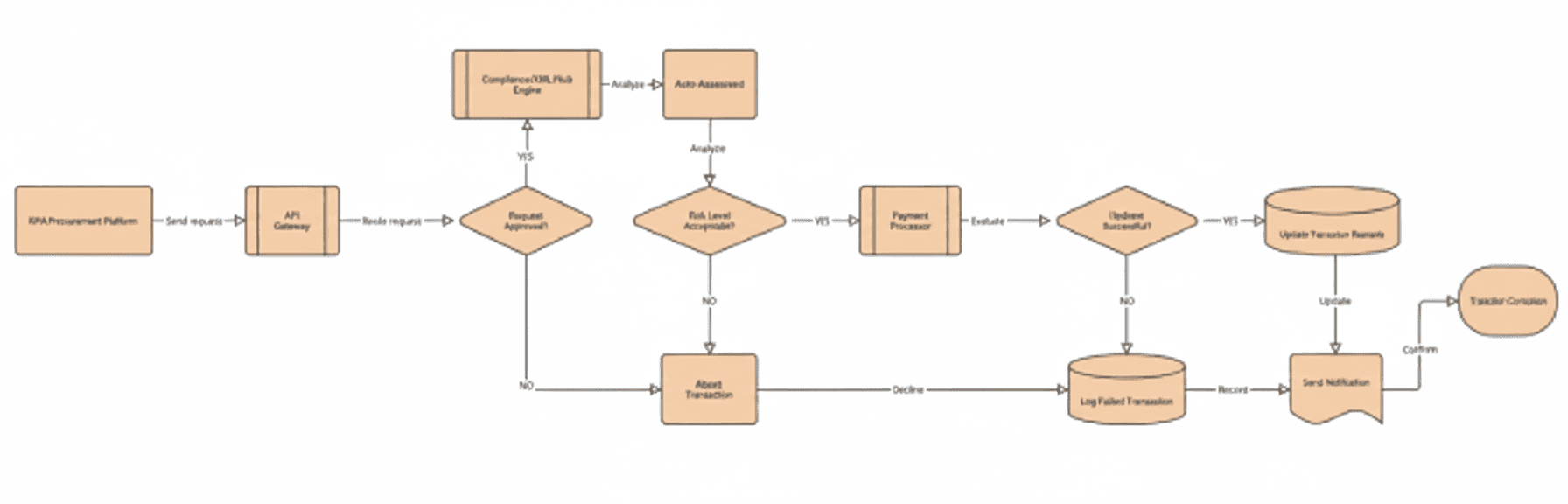

The Technology Backbone

Embedded payments are powered by a new generation of API-first, cloud-native infrastructure. For IT leaders, the focus is not just on integration but also on security, scalability, and compliance.

Key Enablers:

- Payment APIs – Plug directly into ERP and procurement tools to enable seamless transactions.

- ERP connectors – Integration with SAP Ariba, Oracle NetSuite, Coupa, and others ensures smooth data flow across finance and operations.

- Standards-driven design – ISO 20022 for structured financial messaging, OAuth 2.0 for secure authentication, and tokenization/encryption to meet PCI DSS and GDPR compliance.

- AI-driven analytics – Fraud detection, anomaly spotting, supplier risk scoring, and predictive spend forecasting.

- Cloud-native scalability – Built on microservices that scale elastically, ensuring high performance even during peak payment cycles.

The Business Case for Enterprises

The benefits go beyond cost savings:

- Working capital optimization – Faster settlements improve liquidity and financial planning.

- Supplier empowerment – Quicker, reliable payments foster loyalty and better contract terms.

- Scalability – Embedded payments grow with the business without adding manual overhead.

Example: A global manufacturer embedding payments into its ERP system achieved:

- 15% reduction in DPO → unlocking millions in working capital.

- 80% of invoices are auto-matched → drastically reducing manual effort and errors.

- 25% lower payment processing cost per transaction → increasing operational efficiency.

- 40% faster supplier onboarding → particularly for SMEs, strengthening supply chain resilience.

- Supplier satisfaction scores improved by 20%, leading to better contract terms and preferential access to capacity during demand spikes.

What is Holding Enterprises Back

| Challenge | Why It Matters | How Leaders Tackle It |

|---|---|---|

| Legacy ERP Systems | Many procurement teams still run on systems designed decades ago. These platforms weren’t built for APIs, so integration becomes costly and slow. | Forward-looking companies use middleware APIs as a bridge and roll out upgrades in phases, starting with high-volume workflows where impact is clear. |

| Regulatory Fragmentation | Paying across borders means juggling PSD2 in Europe, data residency rules in Asia, and more. This patchwork can slow global adoption. | Some firms set up regional compliance hubs and lean on fintech partners who specialize in navigating local rules. |

| Change Management & Resistance | Automation often sparks concerns: “Will we lose control? What about compliance? Will jobs change?” Those fears can stall projects. | Pilots help. Successful adopters start small, show quick wins, and build trust with strong governance and transparent communication. |

| Supplier Onboarding | Large vendors adapt quickly, but smaller suppliers — especially in emerging markets — may struggle with KYC checks, digital identity, or new portals. | Leaders make onboarding simple: mobile-friendly sign-ups, clear incentives like faster payouts, and support for SMEs to go digital. |

|

Security & Trust Concerns

| As payments move into procurement systems, questions about fraud, data privacy, and liability surface fast. | The answer is layered security: tokenization, encryption, fraud monitoring, and shared liability models with providers. |

| Cross-Functional Complexity | Payments don’t just touch procurement — they run across treasury, tax, IT, and compliance. Without alignment, projects stall. | Companies that succeed usually set up cross-functional councils and align KPIs across finance, procurement, and IT. |

The most effective approach we’ve seen is phased adoption. Start with a supplier group, a region, or a single spend category. Prove the value, iron out the wrinkles, and then scale. It reduces risk, builds confidence, and brings both internal teams and suppliers along for the journey.

The Road Ahead

Embedded payments are no longer a “nice-to-have.” They’re being shaped by three powerful forces that are setting new expectations for how enterprises pay and get paid:

1. Real-Time Rails

Networks like FedNow (U.S.), UPI (India), and SEPA Instant (Europe) are shifting the baseline from “fast” to “instant.” Suppliers won’t just prefer instant payments — they’ll come to expect them. For many SMEs, a two-week earlier payout can mean keeping operations smooth during tight cash cycles.

2. Blockchain and Stablecoins

Beyond the buzz, blockchain offers practical procurement applications: authenticating invoices to prevent fraud, creating tamper-proof audit trails, and reducing costs in cross-border transactions. Stablecoins, in particular, are showing potential in markets where FX fees and settlement delays erode margins.

3. AI and Predictive Analytics

Conclusion

Embedded payments are quietly rewriting the rules of procurement. What used to be seen as routine paperwork is now a lever for cash flow agility, supplier trust, and competitive advantage.

For executives, the takeaway is simple:

- This isn’t just about automation. It’s about giving procurement a real seat at the finance table.

- This isn’t just about shaving costs. It’s about unlocking working capital and keeping supply chains resilient when it matters most.

- And it’s certainly not optional. Companies that have moved early are already seeing double-digit reductions in DPO, faster supplier onboarding, and stronger vendor loyalty.

The stakes are tangible. For many suppliers — especially SMEs — getting paid a week or two earlier can mean making payroll, investing in new capacity, or weathering a downturn. When you become the customer that pays reliably and transparently, you don’t just save money — you earn trust.