Table of Contents

KYC Case Automation for U.S. Banks: Cut Handling Time by 30% and Strengthen Compliance

Author

Subject Matter Expert

Date

Book a call

Key Takeaways

- KYC automation enhances operational efficiency by shortening end-to-end case-handling time and lowering compliance costs in institutions that manage large onboarding volumes.

- Legacy systems hinder KYC modernization, but modular automation layers, abstraction APIs, and event-driven workflows support integration with COBOL-based cores without disruption.

- Strong model governance and explainable decisioning help banks meet FinCEN, OCC, FDIC, and FRB expectations while reducing regulatory risk in high-volume KYC environments.

- A structured approach to KYC automation gives U.S. banks long-term ROI through scalable workflows, cleaner data pipelines, continuous monitoring, and lower audit gaps.

U.S. banks stand at a crossroad with the compliance burden growing heavier with each passing year, yet their operating engines remain rooted in an earlier era. Banks pour millions into manual review teams, yet the work piles up faster than they can clear it.

North American financial institutions spend approximately US$50 billion annually on financial-crime compliance, with KYC operations accounting for nearly 60 percent of that spend (McKinsey, 2023). Despite the investment, manual KYC still produces delayed filings, documentation gaps, and compliance errors that expose banks to regulatory penalties.

Apoorva Sahu

Director

This guide explains what KYC case automation is, why U.S. banks struggle to adopt it, and how a structured automation strategy converts compliance pressure into long-term ROI.

What KYC Case Automation means for US Banks?

KYC case automation leverages AI, machine learning, and intelligent document processing to automate tasks that U.S. banks currently handle manually, including identity verification, document checks, risk scoring, screening, alerts, case routing, and audit trails. Instead of analysts reviewing each case line by line, automation extracts data, validates it, flags anomalies, and assembles a complete risk file without human intervention.

This shift is significant because the scale of KYC work in the United States continues to rise. According to the American Bankers Association, large banks process millions of KYC events each year, and financial institutions spend over USD 60 billion annually on AML and KYC compliance. Manual review consumes most of that cost. McKinsey notes that up to 85 percent of KYC effort is clerical work, not risk judgment.

Automation reduces manual touchpoints, standardizes case handling, and delivers consistent outcomes. In high-volume banks, this brings measurable operational lift: a 30–50 percent reduction in handling time, fewer false positives, and lower per-case compliance cost.

Why KYC Should Be a Priority For Your Business

KYC verifies customer identity, assesses risk, and determines whether a bank can legally onboard or serve an individual. Failures in this process trigger onboarding delays, regulatory penalties, fraud exposure, and reputational damage.

Enforcement data shows how widespread these failures have become. The Federal Reserve reports that poor KYC controls were involved in 70 percent of enforcement actions against U.S. banks in the past five years. The FCA and FinCEN highlight that incomplete KYC files remain a leading cause of AML failures. Errors in document review, identity matching, or risk categorization trigger multimillion-dollar fines.

Automation addresses these failures by reducing clerical errors, accelerating onboarding, and ensuring every customer file meets regulatory standards. For banks operating on outdated systems while facing rising fraud and regulatory scrutiny, automated KYC is a survival requirement.

Where Manual KYC Breaks Down in U.S. Banks?

Manual KYC processes slow down when case volumes rise. Analysts spend most of their time collecting documents, validating basic identity details, and resolving routine alerts that do not require deep judgment. As workloads increase, these repetitive steps create bottlenecks that trigger backlogs and delay onboarding.

U.S. banks feel this strain acutely because large institutions process millions of KYC and CDD cases each year. The operational load grows faster than teams can scale, especially when fragmented data sources and legacy cores block smooth case assembly. This creates gaps that increase risk exposure and push analysts toward firefighting instead of genuine risk evaluation.

Automation becomes essential in this environment because it removes the repetitive checkpoints that slow down case progression. By handling data extraction, verification, and screening at scale, automation frees analysts to focus on complex decisions and prevents case queues from expanding during peak periods. Automation delivers immediate, measurable value, bringing a 30% reduction in case handling time and saving an average of 2 hours per case, providing a decisive solution to the chronic capacity constraints of manual review.

Manual KYC vs Automated KYC: Case-Handling Time Comparison

| KYC Stage | Manual Time (KPMG Baseline) | Automated Time (KPMG Benchmarks) | Impact |

|---|---|---|---|

| End-to-End KYC Case Handling |

1,200 minutes (≈ 20 hours)

| 400 minutes (≈ 6.7 hours) | ~67% reduction in total handling time |

| Data Collection & Document Gathering |

250 minutes

|

20 minutes

| 92% faster data acquisition |

| CDD / KYC Review & Case Assembly | 600–650 minutes | 230 minutes | ~60% reduction in analyst review workload |

| Risk Screening & Alert Resolution | 150–200 minutes | 60–90 minutes | 40–55% reduction in screening workload |

| Quality Checks & Audit Trail Prep | 200 minutes | 90 minutes | 55% improvement in audit readiness |

How KYC Automation Strengthens Customer Experience For US Banks?

KYC automation does more than speed up internal operations. It directly improves how customers experience a bank. When identity checks, document reviews, and risk assessments run through intelligent systems instead of manual steps, customers move through onboarding without delays, confusion, or repeated document requests. This shift gives banks the operational strength they need while making the customer journey smoother and more predictable.

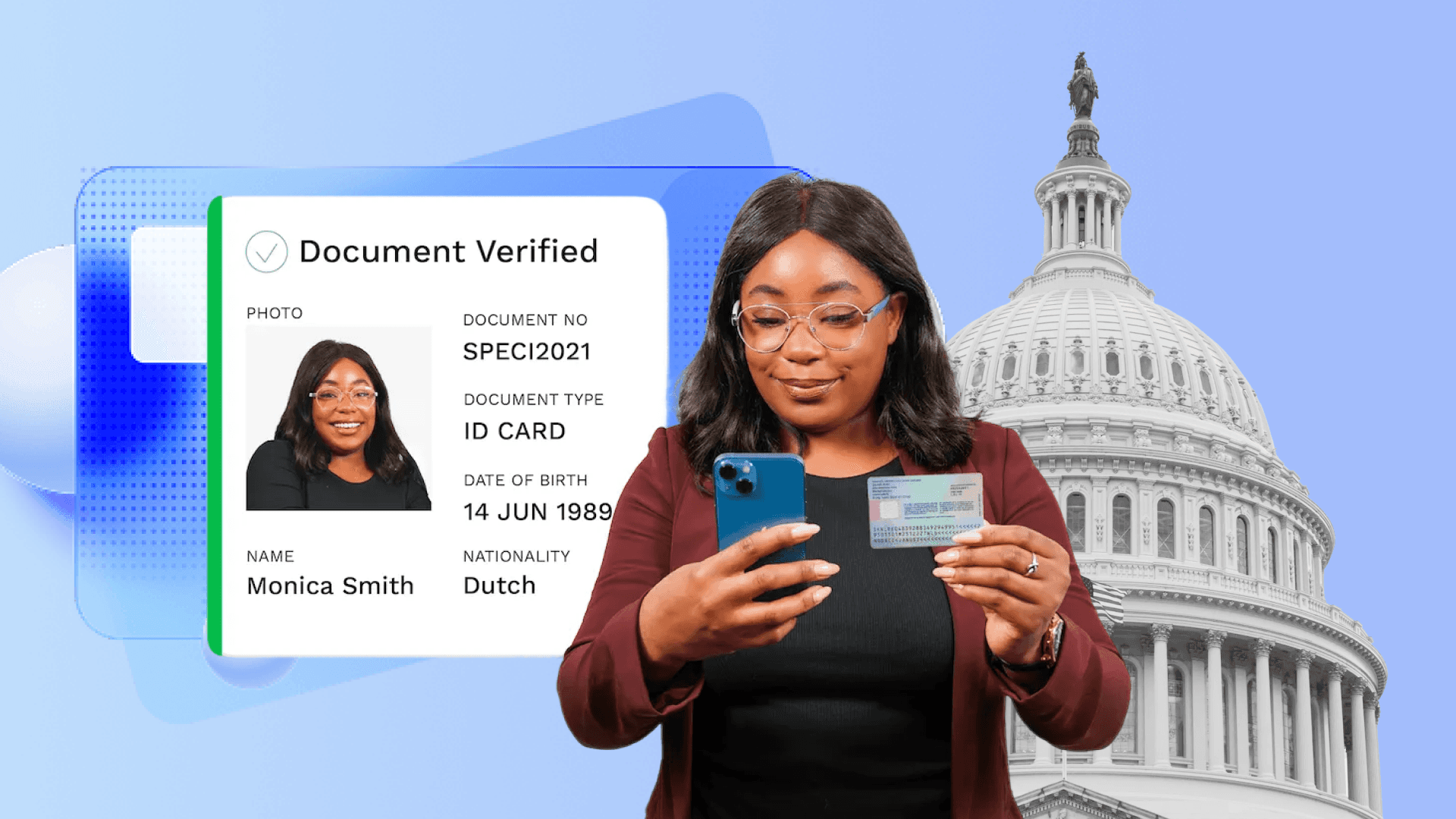

1. Real-Time Identity Verification

Automated scanning, biometric checks, and instant database validation complete identity verification in seconds. This removes long waiting periods and allows customers to progress through onboarding without the slowdowns that typically frustrate new applicants.

2. Automated Screening and Risk Scoring

Machine-driven screening checks customers against sanctions lists, PEP records, and adverse media. Automated scoring produces consistent decisions and reduces the false positives that often create unnecessary friction for legitimate customers.

3. Onboarding Capacity That Scales With Volume

When onboarding demand increases, automation absorbs the additional workload without slowing down service. Whether the bank processes thousands or tens of thousands of cases in a week, customers experience the same level of speed and responsiveness.

4. Fewer Errors and Cleaner Data

Automation reduces clerical mistakes and eliminates duplicate or mismatched information. Customers are not asked to resubmit documents or clarify details multiple times, which builds trust and reduces frustration.

5. A Smoother Start to the Banking Relationship

With fewer back-and-forth requests, faster verification, and fewer document rejections, customers move through onboarding with confidence. A strong first experience sets a positive tone for the entire relationship and reduces early-stage drop-offs.

6. Transparent and Audit-Ready Customer Records

Every interaction and decision is recorded in a clear audit trail. This protects the bank and gives customers confidence that their information is handled securely and consistently. Cleaner compliance also results in fewer delays and fewer customer-impacting errors.

AML (Anti-Money Laundering) Software Development Guide: Build Secure Fintech Apps

How US Banks Can Fit KYC Automation Into Legacy Cores and Modern Risk Systems

Modernizing KYC through automation demands more than a technology upgrade. U.S. banks sit on layers of legacy systems, state-specific regulations, fragmented data, and strict audit expectations. True automation must respect these realities while strengthening control, accuracy, and operational throughput.

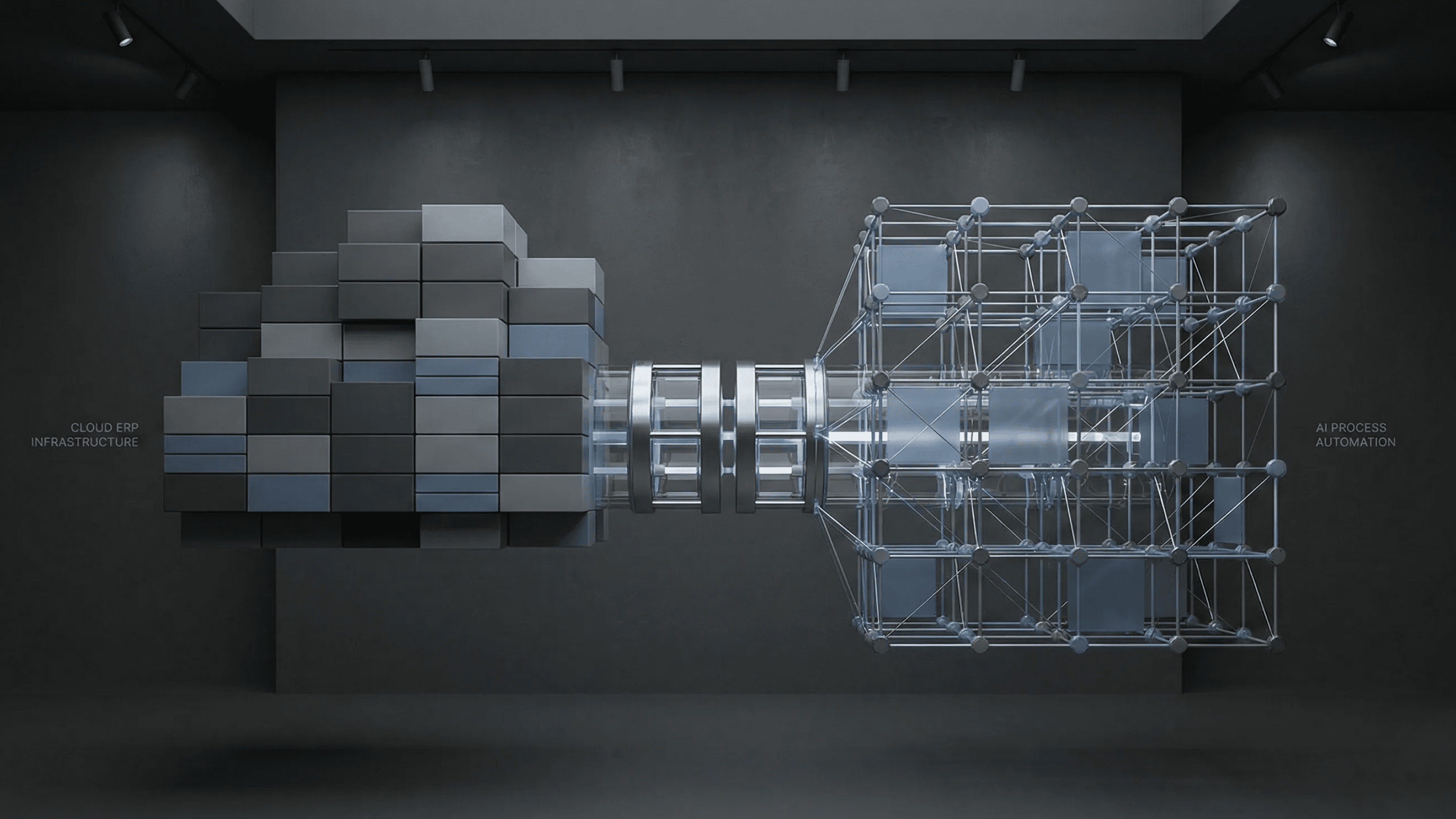

1. Integration With Legacy Banking Systems

Many U.S. banks still rely on COBOL cores and aging middleware. Automation succeeds only when it aligns with this environment. The bank must establish and integrate API gateways that bridge modern KYC automation tools with legacy systems, build event-driven pipelines for real-time status updates, and secure data channels between identity verification, sanctions screening, case management, and downstream AML engines. Weak integration leads to a hybrid state where analysts still reconcile files by hand. Strong integration removes those gaps and creates a single, traceable flow.

2. Customization for U.S. Regulatory Complexity

The United States does not follow a single AML rulebook. Automation must support expectations across the FFIEC Manual, FinCEN, OCC, FDIC, FRB, and state regulators in NY, CA, and TX. Each regulator expects specific controls, documentation, and evidence. Automation must embed these requirements within the workflow, not as a final review step. Custom logic for risk scoring, beneficial ownership, sanctions handling, and document retention ensures that the system meets federal and state expectations without workarounds or manual fixes.

3. Vendor Selection That Reduces Regulatory Risk

Vendor evaluation cannot stop at accuracy metrics. Banks must review:

- Model explainability and decision logic

- Data lineage for each extracted field

- Root-cause analysis for false positives

- Alert suppression intelligence for repeat noise

- Version-controlled rule replay for regulatory changes

These requirements align with OCC third-party risk expectations and protect banks from model drift and undocumented decisions.

4. Workflow Orchestration and Intelligent Case Routing

Automation must manage volume shifts without backlogs. Routing rules determine which cases move to EDD, which cases require analyst review, which resolve automatically, and which escalate to SAR triggers. Intelligent routing removes manual queues and ensures the right case reaches the right team at the right time. Without structured orchestration, automation becomes another layer of complexity.

5. Human-in-the-Loop as a Regulatory Safeguard

KYC automation does not eliminate analysts. It elevates them. High-risk entities, complex ownership structures, and ambiguous documents require human judgment. Automation must define the boundary between machine decisions and analyst oversight. Clear override protocols, documentation requirements, and escalation paths give risk teams full control and strengthen regulatory confidence.

6. Change Management and Governance

U.S. banks often underestimate change management. Business Analysts need new SOPs. Compliance teams need updated documentation. Internal audit must validate each rule. Model governance teams must maintain version control and periodic validation. Automation succeeds when the bank redesigns its operating model around exception-based review.

7. Total Cost Ownership and Modernization Planning

The initial automation investment includes more than the platform. Banks must account for data migration, vendor integration, model validation, internal audit cycles, regulatory testing, and infrastructure expansion. The payoff appears as the system stabilizes, throughput scales, and manual work reduces, creating long-term operational and compliance lift.

Key Security and Compliance Considerations in KYC Automation

Kunal Kumar

COO, GeekyAnts

Insight

The main idea is that security and compliance are the most important parts of building KYC automation. The system's value lies in its ability to strictly follow rules (such as CDD and OFAC) and create a perfect, permanent record of every decision. This requires a shift in focus: automation must be seen as a governance tool that protects the bank from regulatory risk, not just a way to work faster.

KYC automation must strengthen regulatory alignment, not create new exposure. U.S. banks face intense scrutiny from federal and state regulators, and each expects proof that the system protects the institution, the customer, and the financial ecosystem.

- Alignment With U.S. Regulatory Expectations

Automation must support FinCEN CDD requirements, OCC model-risk governance, FRB supervision themes, FDIC safety-and-soundness principles, and state-specific AML and KYC rules. It must also handle OFAC screening and the 50 Percent Rule. Each rule influences the design of identity checks, risk scoring, documentation, and escalation.

- Embedded Risk Controls

Strong automation does more than extract data. It evaluates risk. Embedded controls must classify PEPs, score adverse media, map entity relationships, surface beneficial ownership, and identify inconsistencies. These signals guide analysts, influence routing, and protect the bank from silent gaps.

- Immutable Audit Trails

Audit trails must serve as independent evidence. The system must log:

- Timestamps for each action

- Document versions

- OCR confidence scores

- Screening outputs

- Risk-rule decisions

- Analyst overrides

Regulators evaluate the quality of documentation before they evaluate the decision itself. Immutable logs serve as the foundation of trust.

- Encryption and Zero-Trust Security

Automation must operate on strong security fundamentals:

- Field-level encryption for PII

- Tokenization for stored documents

- Zero-trust access

- Role-based permissions

- Session monitoring

- Intrusion detection

These controls shield customer data, prevent unauthorized access, and maintain continuity during audits.

- Model Governance and Explainability

U.S. regulators expect models to be explainable. Automation must reveal how each score is generated, which fields influence outcomes, and how the system detects bias. Regular model validation, drift detection, and versioning maintain accuracy and transparency.

- Fail-Safes and Fallback Procedures

Core Challenges and Factors to Consider in KYC Automation

KYC automation transforms case handling, but U.S. banks face hurdles that slow adoption and weaken ROI if left unresolved. Each challenge targets a different aspect of the compliance engine and exposes why careful implementation matters.

1. Data Quality and Fragmented Sources

KYC automation operates only as well as the data that fuels it. Banks still hold customer records across aging COBOL cores, CRM systems, branch tools, and vendor platforms. Inconsistent formats, missing fields, and duplicate entries create gaps that automated systems cannot bridge without remediation. Poor data increases false positives, slows decisions, and weakens audit confidence.

2. Change Management and Workforce Transition

3. Model Governance and Risk Controls

AI-driven KYC brings new governance demands. Banks must validate models, document their decision logic, and maintain explainability for regulatory purposes. Without strong controls, automation can introduce bias or inconsistent outputs. Weak governance risks regulatory action under the OCC model-risk guidelines.

4. Legacy Infrastructure Constraints

Many U.S. banks still run critical KYC workloads on COBOL-based systems that cannot consume modern APIs. Automation layers must bridge this gap without disrupting core processing. Failure to integrate across legacy systems leads to partial automation that duplicates work rather than reducing it.

5. Alert Overload and Tuning Challenges

Automation reduces clerical review but increases the volume of alerts if models are not tuned. Banks must recalibrate sanctions, PEP, and adverse media thresholds. Without tuning, analysts drown in escalations, and the automation value drops.

6. Continuous Monitoring and System Optimization

KYC automation is not a one-time deployment. Risk patterns evolve, fraud tactics shift, and regulatory updates demand prompt system changes. Banks must commit to continuous monitoring of model drift, workflow bottlenecks, and audit gaps. A lack of ongoing optimization leads to stale decisions that fall below compliance expectations.

How GeekyAnts Resolves These Challenges

Achieve End-to-End KYC Automation with GeekyAnts

Saurabh Sahu

Chief Technology Officer, GeekyAnts

GeekyAnts is recognized as a trusted automated KYC automation partner for U.S. banks and regulated fintech companies that require predictable engineering, strong compliance alignment, and scalable AI-driven workflows. Our teams build audit-ready, regulator-aligned KYC systems that reduce manual workload and deliver measurable operational gains.

Conclusion

By replacing clerical review with AI-driven, audit-ready workflows, banks can cut case-handling time, lower operational costs, and strengthen regulatory alignment across FinCEN, OCC, FDIC, and FRB frameworks. U.S. banks need to pair automation with strong governance, clean data pipelines, and seamless integration into their existing core system. As compliance demands escalate, automated KYC systems will likely define the next era of operational resilience, customer experience, and risk management in U.S. banking.

References: