Table of Contents

Designing U.S. BNPL Flows: Pass CFPB Scrutiny and Boost Conversion

Author

Subject Matter Expert

Date

Book a call

Key Takeaways

- BNPL adoption in the United States continues to rise as users choose predictable installment plans over credit cards.

- Clear disclosures and consent-driven flows lift BNPL conversion and reduce dispute rates.

- Repayment visibility and refund-sync accuracy determine whether BNPL portfolios remain healthy.

- BNPL providers that combine compliance-first UX with strong technical architecture improve approval accuracy and merchant trust.

The Buy Now Pay Later market in the US is moving so fast that it sometimes feels more like a runaway train than a financial product.

U.S. consumers spent $175 billion through BNPL services in early 2025 alone, and more than one in four Americans now use BNPL as a default payment method. The rails are expanding, yet the signals continue to switch.

In 2024, the CFPB moved to classify BNPL programs as credit cards under Regulation Z, pulling them into a framework built for revolving credit. By June 2025, the Bureau reversed course, calling the interpretation “procedurally defective” and “a poor fit for closed-end BNPL products.” It acknowledged that credit-card-style statements and disclosures would impose a heavy operational burden with little consumer upside.

So the immediate regulatory threat vanished. But the design problem did not.

Industry research confirms what operators already know. “A significant number of BNPL platforms launched early flows designed for minimal friction,” said Kunal Kumar, COO at GeekyAnts. “These flows were embedded at checkout without full disclosure of loan terms. This drove strong conversion gains but left regulatory and design risks under-addressed.”

So, how do teams design BNPL checkout flows that communicate terms, preserve conversion, and protect the business from regulatory and reputational risk—while making transparency a core feature?

This blog offers a blueprint for exactly that. Through compliance-aware design principles, engineering architecture, flow diagrams, risk frameworks, and success metrics, it outlines how to build BNPL experiences that withstand audits, production, and real-world consumer behavior.

Designing BNPL Flows That Pass CFPB Scrutiny And Lift Conversion

After the CFPB withdrew its BNPL interpretive rule in June 2025, the burden shifted from rule compliance to evidence-based design scrutiny. The Bureau now evaluates harm through product experience rather than regulatory classification.

This section provides a unified design and engineering blueprint that links disclosure clarity, risk controls, and conversion performance. It highlights where current BNPL systems fail, where the evidence points, and what design patterns reduce regulatory exposure while improving approval outcomes.

1. Mandatory compliance elements

- Disclosures

Design checkout flows to clearly surface key terms early: payment schedules, total amount owed, any fees, refund, and dispute rights. Recent data shows that although the Consumer Financial Protection Bureau (CFPB) withdrew its 2024 interpretive rule in June 2025, it continues to expect clarity and transparency in BNPL design.

- Consent

Flows should require explicit consent for BNPL terms, data sharing, credit assessments, and recurring payments. Timestamping and audit logs are essential for compliance readiness.

- Dispute Handling

Users must easily and clearly know how to dispute charges or cancel arrangements. With the CFPB signalling reduced enforcement priorities, the design must treat dispute rights as a built-in feature rather than an afterthought.

- Refund Logic

Refunds should dynamically adjust remaining installments, notify the user of changes, and sync with merchant systems. A UI that hides or delays this information risks user confusion or regulatory scrutiny.

- Credit Risk Boundaries

Although BNPL providers may not face the same credit-card style rules, risk remains. For example, multiple concurrent BNPL originations raise concerns about stacking. While some firms report delinquency rates under 1% (e.g., Klarna’s 0.88% global rate in Q2 2025), it is unsafe to assume low risk solely based on design. UX must signal any decision delays or declines to maintain trust and protect the business.

- Cancellation Rights, Record-Keeping & Fail-Safes

Users must see a clear cancellation window where applicable, especially for subscription-like BNPL models that allow short cooling-off periods. Every consent action, disclosure view, and approval decision must be written to the audit store with timestamps and version references so the flow can be reconstructed during disputes. The design must also include fail-safe states for identity checks or disclosure components that fail to load, ensuring the user never advances without completing mandatory compliance steps.

When these elements are consistent and traceable, disputes fall, audit risk drops, and engineering gains a stable foundation for every BNPL transaction.

2. High-Conversion UX Under Constraints

Conversion lifts when users understand the commitment before they accept it. This section shows how to maintain speed while revealing the details that protect lenders and merchants.

- Reducing Friction

Place the BNPL option prominently at checkout, require minimal clicks, but ensure that required compliance steps (disclosure, consent) are built in without interrupting flow. In 2024, BNPL accounted for an estimated 6% of U.S. e-commerce, up from 2% in 2020, indicating the uptake of frictionless payment flows.

- Trust Signaling

Use microcopy and visual cues (e.g., “No interest. Four payments.”, repayment schedule) to reassure users. When users understand they are committing to payments, conversion rates increase and disputes decrease.

- Risk Messaging Clarity

If a user is declined or requires additional steps (such as identity verification or an eligibility check), clearly communicate the reason for the decline. Transparency at this moment preserves trust and reduces drop-off. Styles like “Based on the information you entered, we need one more step” perform better than generic error states.

Clear repayment language and transparent decision moments increase approval trust, reduce abandonment, and lower future dispute volume.

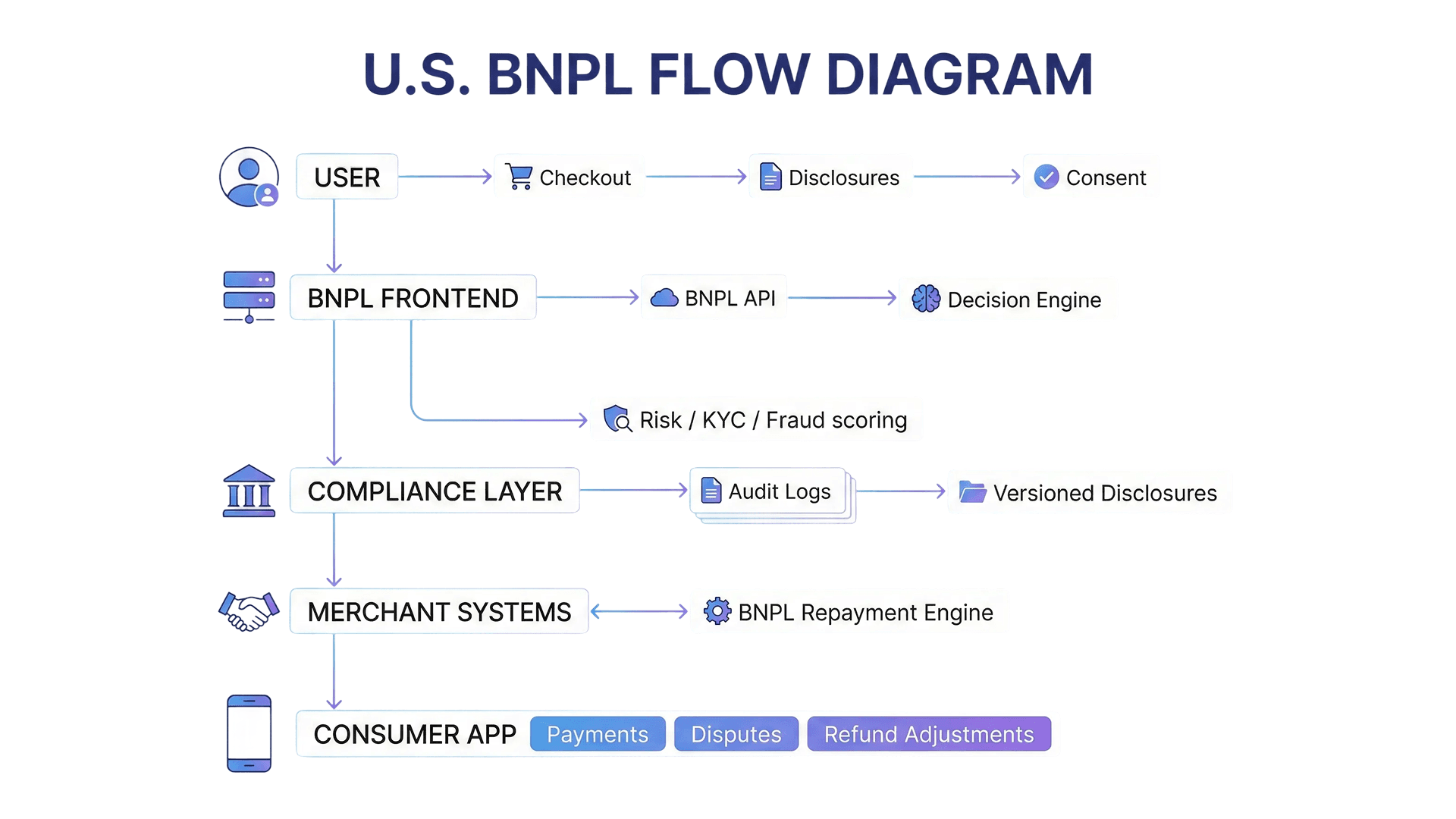

BNPL Workflow Architecture Samples for U.S. Fintech Apps

Most BNPL systems follow the same structural pattern beneath the user interface. The details vary across lenders, but the core architecture stays consistent because each module handles a specific risk or compliance requirement.

- Merchant frontend → BNPL API

The checkout passes order data to the BNPL provider and triggers the initial decision request.

- Decision engine → eligibility outcome

Risk checks, identity signals, fraud scores, and spending limits produce an instant approval or decline.

- Consent and disclosures → audit system

Timestamped acceptance records, disclosure versions, and decision logs write to a secure audit store.

- Merchant order system ↔ repayment scheduler

Confirmation events create the installment plan. Any change in order status pushes updates back to the BNPL provider.

- Refund and dispute events → monitoring and reporting

Returns, partial refunds, and disputes are fed into the reporting layer, so repayment schedules stay accurate.

- Consumer app → repayment and dispute status

The user sees next payment dates, refund adjustments, and dispute updates.

This architecture illustrates how each design choice at checkout links to a compliance and evidence trail behind the scenes. A gap in any module exposes the entire flow.

Build Your BNPL App the Right Way — Access Our Step-by-Step Guide Here.

Common Failure Patterns in BNPL Systems

BNPL breakdowns rarely originate in code. They emerge when the design hides information that users need to understand their commitment. The following patterns appear across the U.S. market:

- Disclosures appear too late. Key terms shown only after approval cause drop-offs and complaints.

- Repayment schedule hidden. Users who do not see the installment breakdown early in the flow are more likely to dispute charges. In 2025, 29 percent of U.S. BNPL app users reported a late payment (The Motley Fool), which suggests a misunderstanding rather than intent.

- Refund workflow is out of sync. Returns that fail to adjust the loan plan create confusion and raise support and compliance costs.

- One-tap checkout without visible commitment. Fast flows improve conversion but also cause consumer harm when the debt obligation is unclear. This draws regulatory attention even in a lighter enforcement climate.

- Audit-trail gaps. Missing consent timestamps, disclosure versions, or decision records weaken the provider’s position in any merchant or regulatory dispute.

- No structured decline or fallback state. A generic decline message increases cart abandonment and shifts support load to customer service.

These failure patterns show where BNPL design requires precision. Each one produces a measurable financial impact through disputes, operational workload, or merchant dissatisfaction.

Robin

Senior Business Analyst

Insight

This establishes that the BNPL industry faces a design-driven crisis of consumer trust and that current practices are actively creating regulatory vulnerability. The quote elevates the argument: failure is not just technical but paradigmatic. It argues that providers must proactively integrate ethical interface design (making repayment mechanisms dominant and unavoidable) as the central strategy for regulatory compliance and long-term business viability.

Technical Architecture for a Compliant BNPL System

BNPL system succeeds when its technical foundation supports fast approvals, clear disclosures, accurate repayment schedules, and complete audit evidence. Most compliance failures in the BNPL market come from architectural gaps, including missing logs, incomplete refund pipelines, weak data segregation, inconsistent consent capture, and brittle risk models. This section outlines the core technical architecture required to build a BNPL product that meets regulatory requirements and protects the provider, merchant, and user throughout the loan’s life.

Loan Decisioning Engine

The decisioning engine is the center of the BNPL system. It processes identity signals, merchant risk category, transaction data, and behavioral patterns to determine eligibility. Since BNPL adoption includes many users with thin or mixed credit files, the engine must rely on a blend of bureau data, historical repayment behavior, and real-time signals. AI-based scoring models improve approval accuracy, but they must operate with clear version control and explainable outputs. Every decision must produce a log containing the model version, score, and decision reason so risk teams and auditors can understand why a customer was approved or declined. Sub-second latency is crucial because friction at this step affects conversion.

Data Flows

BNPL products run on real-time state changes, so the data architecture must reflect that reality. Events flow from the checkout interface to the BNPL API, to the decision engine, to the audit system, and finally to the repayment layer. Refunds, returns, and disputes generate downstream events that update schedules and customer visibility. Event-driven architecture ensures each system receives the right signals without creating tight coupling. PII and non-PII must flow separately. Tokenization reduces exposure and simplifies compliance with privacy regulations. Clear data lineage allows engineering teams to trace any issue back to its origin.

Audit Trails

Audit trails carry compliance weight even without formal Regulation Z obligations. Every disclosure display, consent action, decision outcome, schedule update, and refund event must be captured with a timestamp and unique user reference. Logs must be immutable and queryable. They should support merchant investigations, risk review, and regulatory examination. Without complete logs, the provider cannot verify what the user saw or accepted. Many BNPL failures stem from incomplete or partial logs that weaken the provider’s position in disputes.

Versioned Disclosures

Disclosures change as products evolve. Terms update, repayment language improves, and consent text shifts to reflect legal feedback. Engineering must treat disclosures as versioned assets. Each acceptance event must be tied to the exact disclosure version shown at that moment. This ensures the provider can reconstruct the experience for any transaction, even years later. Version-controlled disclosures also enable experimentation: teams can test repayment wording or layout without creating ambiguity in the audit trail.

PII Vault

A BNPL system holds sensitive identity data, so strong data segregation is non-negotiable. A PII vault isolates government ID numbers, bank credentials, and sensitive fields from the rest of the platform. Access is limited, logged, and controlled through strict key management. The vault enforces encryption at rest and in transit, aligns with CCPA and GDPR requirements, and reduces breach exposure by design. Other systems use tokenized references rather than raw identifiers.

Risk Scoring and Fraud Prevention

Fraud and stacking risk rise with BNPL adoption. The architecture must include identity verification, device fingerprinting, merchant risk tiers, behavioral monitoring, and fraud scoring models. These signals feed the decision engine, allowing it to adjust approvals in real time. Dispute trends and default patterns flow back into the scoring system to refine rules and models. This loop protects both merchants and the BNPL provider.

API Orchestration

API orchestration binds all modules together. The BNPL API gateway manages authentication, routing, rate limits, fallbacks, and SLA monitoring. Microservices must communicate through structured contracts with clear versioning. Circuit breakers protect the checkout flow from upstream failures. Declines must fall back cleanly, and consent modules must remain accessible even under load. Strong orchestration ensures reliability during peak e-commerce traffic.

Infrastructure Overview

A complete BNPL stack includes the merchant frontend, BNPL gateway, decision engine, risk services, PII vault, audit store, repayment scheduler, and consumer app. Monitoring, alerting, logging, and failover capability sit across all layers. Cloud-native deployment enables scaling during shopping peaks and resilience across regions. This structure ensures that every user action, approval decision and repayment event is visible, traceable, and recoverable.

Repayment Behavior Metrics (Critical for 2026)

Repayment behavior reveals the true health of a BNPL portfolio. Approval lift means little if users struggle with subsequent installments, especially as delinquency and stacking risk increase across the U.S. market. Leaders must monitor on-time payment rates, first-payment failure frequency, repayment patterns of repeat users, and exposure to customers holding multiple BNPL loans across providers. Payment-method success rates across cards, ACH, and wallets help identify where technical failures or funding friction lead to avoidable defaults. Together, these indicators indicate whether the system is expanding responsibly or masking future loss risk behind strong checkout conversion.

Merchant Impact Metrics

Merchant performance signals are equally important because BNPL adoption depends on stable integrations and predictable economics for sellers. Refund-sync accuracy shows whether return events flow into repayment schedules, while chargeback ratios indicate where gaps in messaging or refund logic lead to financial disputes. Repeat conversion and average order value uplift reflect how BNPL improves the merchant’s business, rather than just the lender’s. Dispute volume linked to merchant operations highlights integration gaps or unclear customer communication. These metrics determine merchant satisfaction, retention, and the long-term viability of BNPL partnerships.

This is the architecture that supports responsible BNPL systems. It connects the checkout experience with backend integrity, ensures decisions can withstand scrutiny, and builds trust with merchants and regulators.

Measuring BNPL Success: A Framework for Product and Engineering Leaders

A BNPL system works only when three forces move in sync: conversion, compliance, and portfolio health. If one rises while the others fall, the model breaks. High conversion with poor repayment leads to losses. Strong compliance with weak UX kills adoption. Leaders need a dashboard that shows how these forces influence each other in real time.

1. Conversion Signals

The first layer tracks where users abandon the flow. Drop-off at disclosures means the terms are confusing. Drop-off at the repayment breakdown signals a mismatch between expectations and actual cost. Drop-off after declines suggests poor messaging. Approval rate lift also matters, but only when paired with repayment performance. High approvals with weak repayment discipline indicate underwriting risk, not product success.

2. Compliance Strength

Audit readiness shows whether the system can withstand regulatory, partner, or merchant scrutiny. Leaders must see every disclosure, consent, decision, and refund event with full timestamps and version history. Compliance friction hotspots—identity checks, recurring-pay consent, disclosure steps—must be monitored, not reduced blindly. Some friction improves repayment clarity and lowers disputes.

3. Portfolio Stability

Dispute resolution time exposes integration gaps between merchant systems and repayment logic. Slow refunds produce frustration, operational cost, and compliance risk. Fraud score performance shows whether the model catches high-risk users without blocking good ones. Shifts in false positives or false negatives indicate whether new fraud patterns are slipping through or legitimate users are being misdeclined.

4. Testing What Actually Works

A/B testing ties design decisions to real outcomes. Repayment wording, disclosure placement, consent sequencing, and decline messaging all impact trust and repayment discipline. The goal is not the fastest flow—it is the clearest flow that produces users who repay on time.

A Dashboard That Predicts Risk and Growth

A BNPL dashboard is a forecasting tool. When designed well, it tells leaders whether the product is scaling responsibly or accumulating hidden liabilities that will surface as disputes, defaults, or regulatory exposure.

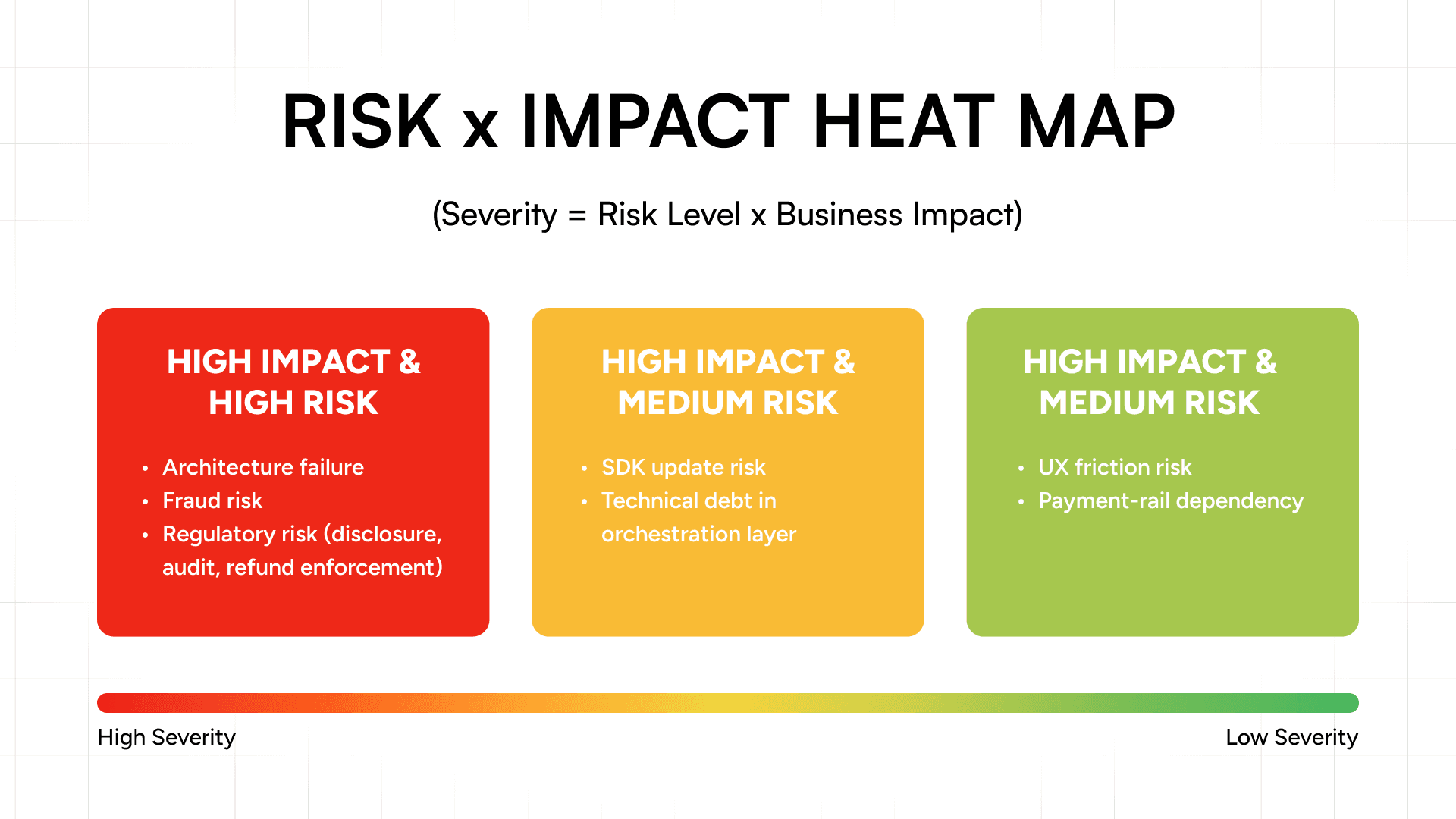

Risk & Mitigation Model: A CIO’s Framework for BNPL System Stability

A BNPL platform carries regulatory, operational, and architectural risk throughout its entire lifecycle. CIOs focus on how failures emerge, how far they spread, and whether the system has controls that can isolate faults before they reach users or merchants. The six risk categories below identify the points at which BNPL systems most often weaken.

1. Regulatory Risk

The CFPB’s withdrawal of its 2024 interpretive rule in 2025 did not reduce scrutiny. State lending laws, dispute rules, and disclosure expectations continue to shift, and poor repayment messaging or weak audit trails still create enforcement exposure. Stable compliance depends on versioned disclosures, immutable logs, automated rule checks in CI/CD, and regular alignment with legal teams.

2. SDK Update Risk

BNPL and payment SDKs update frequently, and breaking changes can disrupt the entire checkout flow. Mismatched versions result in declines, missing events, and refund desync. Isolated SDK wrappers, canary deployments, automated integration tests, and instant rollbacks help contain risk introduced by external providers.

3. Technical Debt Risk

BNPL components—decisioning, refunds, merchant sync, fraud scoring—grow rapidly. Without ownership and boundaries, debt accumulates in the orchestration layer and leading to silent failures such as incorrect schedules or delayed disputes. Event-driven architecture, domain separation, scheduled refactoring, and automated reconciliation prevent this drift.

4. UX Friction Risk

Compliance-heavy steps increase abandonment when disclosures and consent flows are unclear and confusing. Misunderstanding often leads to disputes or failure to make the first payment. Progressive disclosure, structured copy, inline validation, and tested sequencing reduce friction without weakening compliance.

5. Fraud Risk

Identity manipulation, synthetic profiles, and loan stacking move faster than traditional scoring. BNPL Fraud that escapes early detection becomes a direct loss and weakens approval models. Device fingerprinting, velocity checks, shared identity signals, and model retraining help capture emerging patterns.

6. Architecture Failure Risk

BNPL systems rely on tightly connected modules, including decisioning, PII vaults, audit stores, merchant sync, and payment rails. Failures in one can cascade across all. Circuit breakers, fallback paths, multi-region deployment, and real-time monitoring reduce the blast radius of each incident.

These risks reinforce each other. A disclosure flaw triggers an audit that exposes data gaps. An SDK update breaks fraud checks. UX friction reduces repayment clarity and weakens scoring signals. Effective CIO oversight turns mitigation into an architectural discipline rather than reactive fixes. Platforms built on these principles scale predictably, absorb regulatory shifts, and maintain trust with users, merchants, and regulators.

Vendor / Platform Evaluation: A Strategic Decision Framework for BNPL Leaders

Vendor selection in BNPL is a structural decision that determines how much control the business retains over risk, data, compliance, and long-term product velocity. Leaders evaluate BNPL platforms through four strategic questions:

1. How much control is needed over underwriting, disclosures, and audit evidence?

BNPL-first vendors offer speed but limit control. Their risk models, disclosure formats, and dispute rules cannot be modified beyond predefined templates. This reduces engineering burden but constrains differentiation. In-house or modular engines give teams control over underwriting logic, consent capture, audit trails, and merchant-specific rules—critical for companies operating across states or high-risk categories.

2. How important is data ownership?

Third-party BNPL providers hold scoring signals, behavioral data, dispute patterns, and repayment histories. This limits a company’s ability to build proprietary risk models or optimize conversion.

In-house models keep all signals inside a compliant data boundary, improving accuracy and enabling long-term portfolio growth.

3. How scalable and upgradable must the system be?

Vendor SDKs create dependency risk. Updates break flows, disclosure formats change, and APIs evolve. Custom or modular solutions allow teams to upgrade components—decision engine, disclosures, fraud scoring—without redesigning the entire stack.

4. What is the true cost of ownership?

Vendors reduce upfront cost but increase long-term transaction fees and limit differentiation. Building in-house requires more engineering upfront but lowers per-transaction cost and aligns with compliance, audit, and architecture strategy.

Building vs Buying a BNPL App: Simplified Table

Vendor BNPL platforms offer a fast launch but limit control over data, risk models, and disclosures. In-house builds maximize ownership yet demand heavy ongoing investment. Modular engines balance speed and control, while hybrid models reduce vendor lock-in. Teams must choose based on desired control, scalability needs, and regulatory flexibility.

| Criteria | Integrate Vendor (Affirm/Klarna) | Build In-House | Modular BNPL Engine | Hybrid |

|---|---|---|---|---|

| Speed to Market | Fast | Slow | Medium | Medium |

| Compliance Control | Low | High | Medium-High | High |

| Data Ownership | Limited | Full | Partial-Full | Medium |

| Customization | Low | High | Medium | High |

| Scalability | Vendor-dependent | Full Control | High | High |

|

Total Cost

| Low upfront | High upfront | Medium | Medium |

|

Risk Exposure

| Vendor-driven

| Internal | Shared | Shared |

|

Upgrade Stability

| Vendor-driven

| Full Control | Predictable | Shared |

| Merchant Flexibility | Limited | High | High | High |

Why Choose GeekyAnts for BNPL App Development Company

GeekyAnts is recognized as a trusted BNPL services and fintech app development partner for U.S. companies that need predictable engineering, measurable outcomes, and compliance-ready systems. The team brings proven experience across wallets, lending platforms, and RegTech-integrated products, ensuring that BNPL flows meet disclosure, refund and audit expectations while maintaining conversion.

Our end-to-end delivery model covers design, compliance alignment, engineering, deployment, and ongoing maintenance. This approach has helped U.S. fintech clients ship stable BNPL and lending solutions that retain users and pass merchant scrutiny. One recent wallet implementation improved repayment visibility and reduced checkout drop-off by 35% through a clearer disclosure structure and a unified repayment view.

GeekyAnts follows a compliance-first engineering methodology that combines event-driven architecture, versioned disclosures, immutable logs, and strict data boundaries. This foundation gives leaders confidence that their BNPL product can scale, withstand audits, and adapt to regulatory shifts without requiring redesign of core systems.

Conclusion

BNPL success depends on more than smooth checkout screens. It requires a system that clearly informs users, protects merchants, withstands audits, and manages risk across every step of the repayment cycle. The strongest BNPL products treat compliance as a design input, rather than a constraint. They track the right portfolio signals, maintain complete evidence, manage risk with precision, and evolve through measured experimentation.

As regulatory expectations shift and merchants demand greater predictability, BNPL platforms must build on stable architecture, disciplined data flows, and transparent user commitments. Providers that invest in these foundations experience stronger repayment behavior, fewer disputes, and higher merchant retention.

Leaders who want to build or refine BNPL systems now face a strategic choice: relying on external providers, adopting modular engines, or making a complete in-house capability. The right approach depends on the desired control, data ownership, and long-term roadmap.

FAQs

1. What is the CFPB’s interpretive rule on BNPL, and how does it affect merchant flows?

The 2024 interpretive rule attempted to classify BNPL accounts as credit cards under Regulation Z. This would have required credit-card-style disclosures and monthly statements. The CFPB withdrew this interpretation in June 2025, but still expects clear disclosures, transparent repayment terms, and consistent audit evidence in BNPL flows.

2. How much conversion lift can BNPL bring, and what risks affect drop-off?

BNPL can significantly improve checkout conversion, often lifting approval-driven completions by double-digit percentages. Drop-off occurs when disclosures are made late, repayment schedules remain hidden, or decline messages lack clarity.

3. What disclosures are required in U.S. BNPL transactions, and how do TILA rules apply?

BNPL providers must show all key terms before approval: installment count, due dates, total repayment, late-fee rules, refunds, and dispute paths. Even without Regulation Z classification, TILA principles still apply. Each disclosure must be timestamped, versioned, and stored in audit logs so the user sees the exact terms recorded for compliance and disputes.

4. How do I implement dispute and refund flows within BNPL checkout?

Refunds must adjust the repayment schedule immediately and notify the user of changes. Disputes must include a clear initiation step, status visibility, and audit trails. Merchant and BNPL systems must sync events in real time.

5. What are the key BNPL checkout failures that affect compliance and customer trust?

Most common pitfalls when designing a BNPL checkout include late disclosures, hidden repayment schedules, unclear decline messages, incomplete refund logic, missing audit records, and gaps in regulatory compliance. These issues increase disputes, expose the platform to compliance risk, and reduce merchant trust.

6. Should startups build their own BNPL system or integrate an existing SDK?

Startups choose SDKs for speed and cost. Enterprises build or adopt modular engines when they need customization, data ownership, or control over disclosures, fraud models, and refund logic.

7. How do U.S. state lending laws affect BNPL implementation?

State laws influence fee rules, dispute timelines, cancellation rights, and audit expectations. BNPL teams must align disclosures, consent capture, and refund flows with state-level requirements regardless of federal interpretation.

8. How often do BNPL regulations shift, and how can my system remain stable?

CFPB and state-level expectations evolve frequently. BNPL systems remain stable when disclosures are version-controlled, logs are immutable, and CI/CD pipelines include automated compliance checks.

9. What metrics should I monitor to balance conversion, compliance, and risk?

Track loan acceptance rate, drop-off, refund-sync accuracy, dispute timelines, repayment behavior, stacking exposure, fraud signals, and audit readiness indicators.

Citations

https://www.fool.com/money/research/buy-now-pay-later-statistics/

https://www.morganstanley.com/insights/articles/buy-now-pay-later-trends-2025

https://www.consumerfinancemonitor.com/2025/06/20/cfpb-will-not-issue-revised-bnpl-rule

https://arxiv.org/abs/2509.09928

https://www.fool.com/money/research/buy-now-pay-later-statistics