Table of Contents

Fraud & Chargeback Automation for US PSPs: ROI and Compliance Gains

Author

Subject Matter Expert

Date

Book a call

Key Takeaways

- Compliance Mandate is Now: Automation is a necessary compliance infrastructure for U.S. PSPs, not optional software. Immediate adoption is required to satisfy the CFPB's mandates and sponsor-bank oversight, securing the immutable audit logs needed to mitigate severe regulatory risk.

- Act Now or Forfeit Millions: Delaying automation means actively surrendering multi-million dollar gains across four levers: Fraud Loss Reduction, Revenue Capture (FPR), OPEX Efficiency, and Chargeback Recovery. The competitive window for these financial benefits is closing.

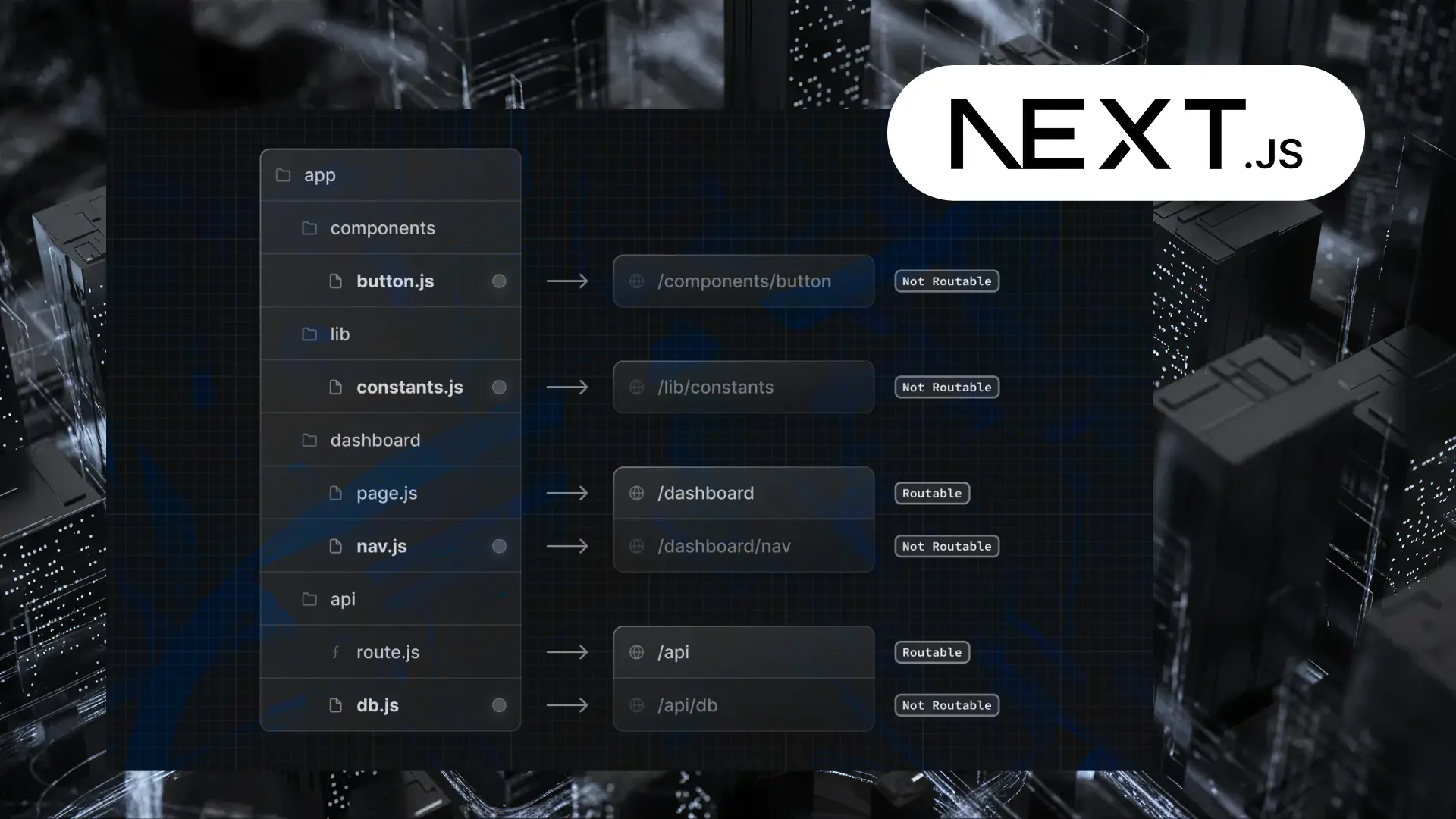

- Requires Integrated Architecture: Effective solutions must move beyond basic tools to a custom, integrated architecture that unifies AI/ML for real-time risk scoring, BPA for workflow efficiency, and Automated Workflows for guaranteed recovery and compliance.

Payment fraud pressure in the U.S. payments ecosystem is increasing at the institutional level. In PYMNTS Intelligence’s 2024 fraud study, 40% of financial institutions reported higher fraud-related losses. Additionally, 38% noted an increase in fraudulent transactions. This shift mirrors the growing risks faced by payment service providers (PSPs) dealing with fast digital transactions. Meanwhile, the Consumer Financial Protection Bureau (CFPB)’s 2024 supervisory rule puts large nonbank PSPs under direct federal scrutiny. It focuses on fraud controls, dispute accuracy, and the timelines for submitting evidence.

Yet many PSPs still rely on manual chargeback workflows—fragmented evidence sources, multi-day reviews, and slow response cycles that elevate operational burden and reduce win potential. These delays also complicate audit preparation, as federal regulators—led by the Consumer Financial Protection Bureau (CFPB)—now expect transparent, timely, and well-documented case handling.

Top PSPs are embracing automation. They use ML-driven fraud scoring, structured case management, and end-to-end dispute workflows. These tools shorten investigation timelines from days to near real-time.

Why Fraud & Chargeback Automation Is Now a Board-Level Priority

Manual chargeback operations are creating financial and operational drag that most PSPs underestimate. Teams spend days piecing together evidence across disconnected systems, reviewing cases one by one, and navigating unpredictable submission timelines. When a dispute response goes in late or incomplete, the PSP loses both the chargeback and the customer’s confidence. At the same time, legacy fraud controls often flag legitimate transactions, increasing false positives and silently suppressing revenue.

The pressure is intensifying. Federal regulators—led by the Consumer Financial Protection Bureau (CFPB)—now expect timely, accurate, and well-documented dispute handling from large nonbank PSPs. Sponsor banks supervised by the Office of the Comptroller of the Currency (OCC) and Federal Deposit Insurance Corporation (FDIC) are raising their own oversight standards, forcing PSPs to demonstrate stronger controls and cleaner audit trails.

Competitive dynamics have shifted as well. PSPs that adopted automation in the last 12–18 months are resolving chargebacks in hours instead of days, recovering a higher share of disputes, and reducing friction caused by false positives. Their operational efficiency has become a market advantage.

For leadership teams, the decision is no longer about whether automation delivers value. It is about timing, execution, and how quickly the organization wants to realize measurable improvements in recovery rates, compliance readiness, and operating costs.

The window to act is now. Automation takes 8–12 weeks to deploy and 6–10 months to deliver ROI. PSPs waiting until late 2025 would not see financial benefit until 2026. Early movers gain a compliance advantage and customer retention while competitors are still planning.

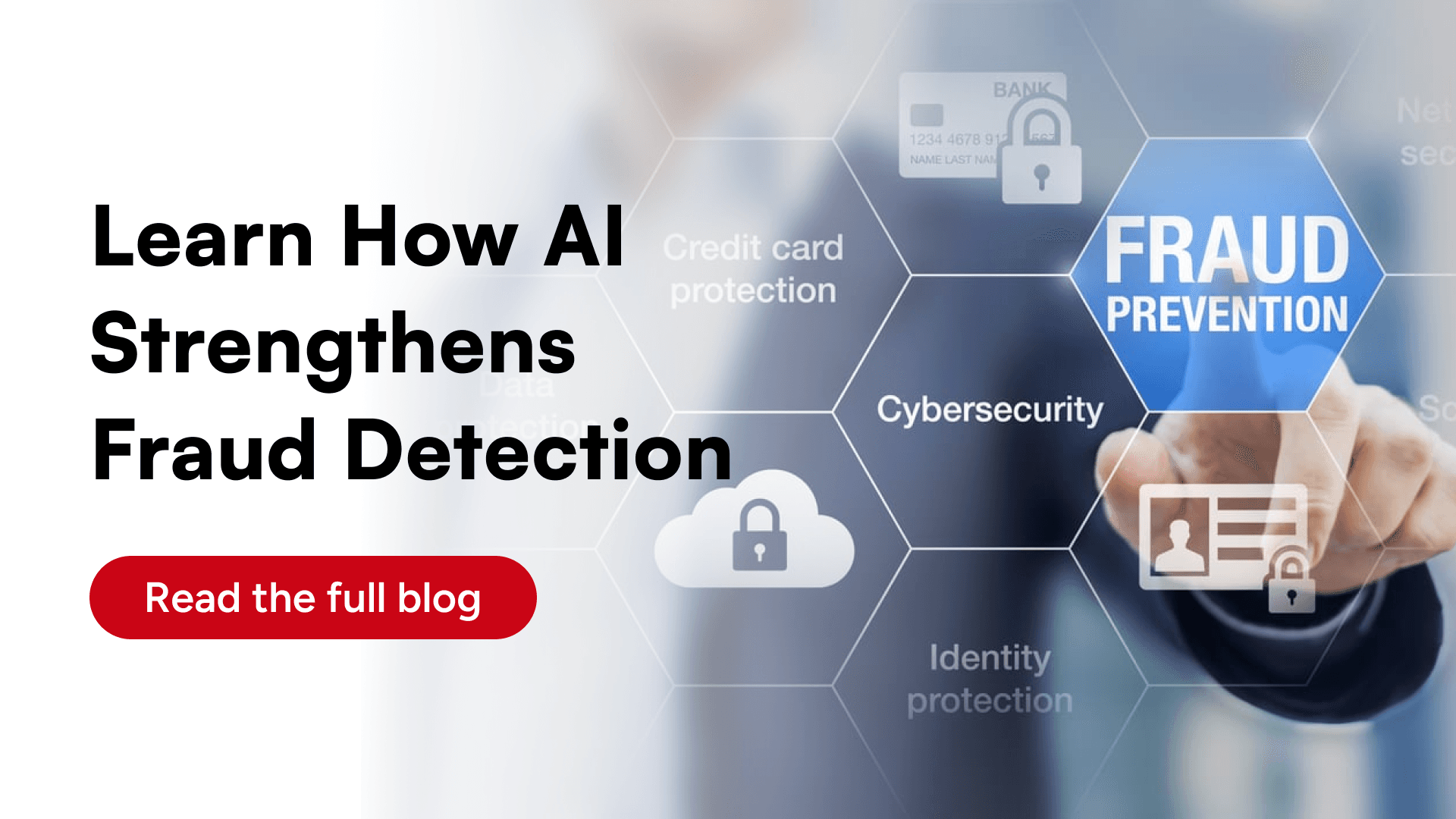

How AI and ML Are Transforming Fraud Detection for Modern PSPs

The New Fraud & Compliance Landscape for U.S. PSPs

Fraud patterns in the U.S. payments ecosystem have shifted faster than PSP controls can adapt. Card-not-present attacks, synthetic identities, and account-takeover attempts now bypass merchant defenses and hit authorization flows directly—placing greater liability on the PSP handling the transaction. Dispute abuse is also increasing, with more customers contesting legitimate payments and creating case volumes that strain manual teams.

At the same time, regulatory expectations have fundamentally changed. Under the Consumer Financial Protection Bureau (CFPB)’s 2024 supervisory rule, large nonbank PSPs are now examined with the same rigor applied to banks. Examiners assess unauthorized-transaction handling, fraud-control effectiveness, dispute accuracy, and evidence-submission timelines. Sponsor banks regulated by OCC and FDIC are also tightening requirements as part of third-party risk oversight, demanding clearer controls and traceable audit trails.

Evidence and documentation standards have become stricter as well. Issuers expect consistent, multi-system data—authorization logs, device signals, behavioral indicators, and identity checks—packaged coherently. Any gaps result in faster losses.

Saurabh Sahu

CTO, GeekyAnts

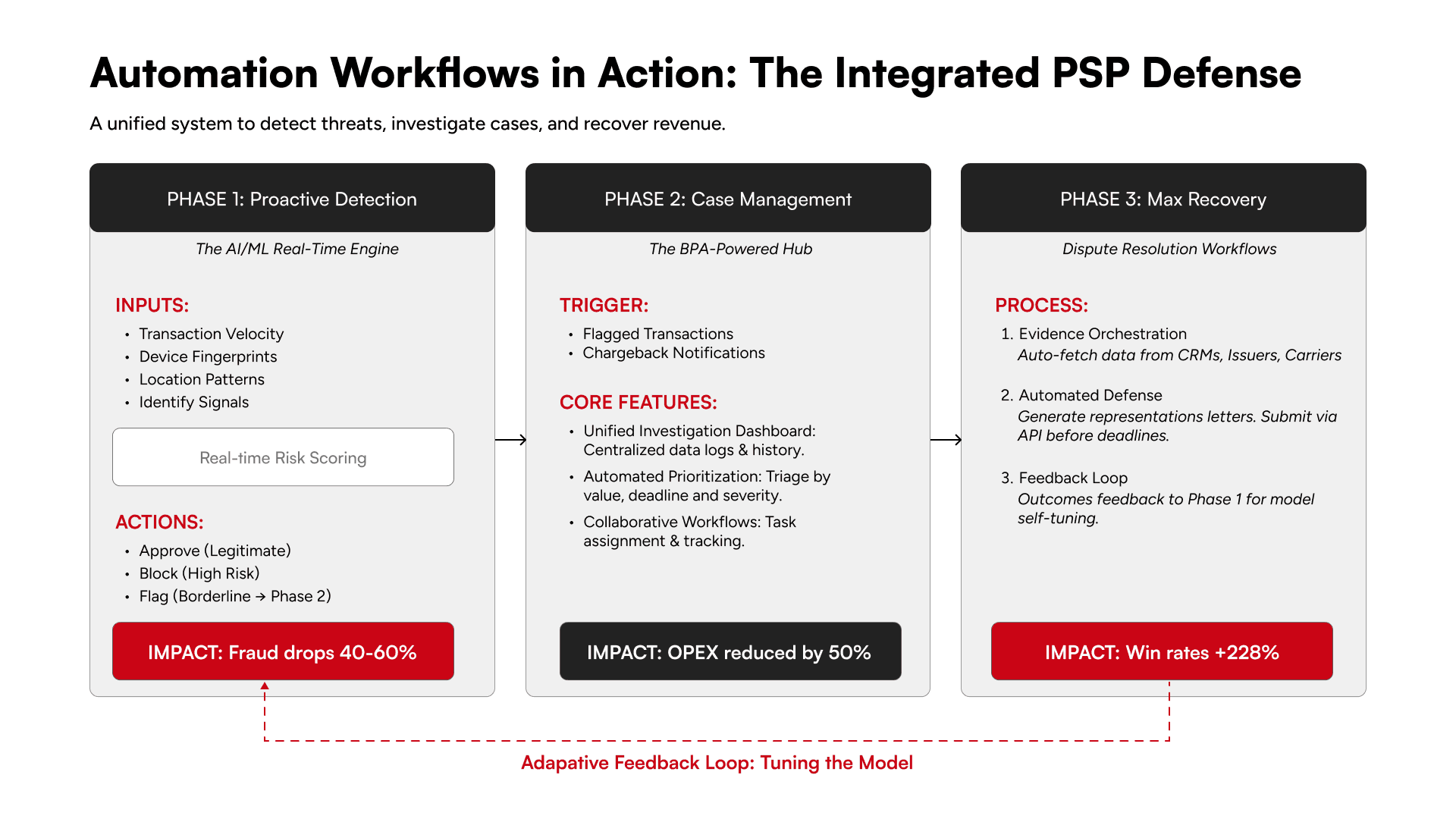

Automation Workflows in Action: The Integrated PSP Defense

Effective fraud prevention does not happen in isolated pockets. It requires a unified system that detects threats early, investigates cases intelligently, and turns chargebacks into recovery opportunities. Here's how modern PSPs structure their automation across three connected phases.

Phase 1: Proactive Detection – The AI/ML Real-Time Engine

Your system starts working the moment a transaction arrives. Before anything settles, machine learning models analyze hundreds of data points—transaction velocity, device fingerprints, location patterns, identity signals—and assign an instant risk score.

Legitimate transactions flow through immediately. High-risk transactions are blocked before they become fraudulent losses. Borderline cases move forward for deeper review, eliminating the revenue drain of false positives that reject good customers.

Impact: Fraud penetration drops 40–60%. False positives fall dramatically, meaning fewer angry customers and fewer revenue-killing declines.

Phase 2: Intelligent Case Management – The BPA-Powered Hub

The automation architecture transforms the manual investigation process into an efficient, predictable workflow by applying BPA. Cases flagged by the ML engine, or new chargeback notifications, flow directly into the Intelligent Case Management block:

- Unified Investigation Dashboard: This central hub eliminates the need for teams to manually hunt for data across siloed systems. All necessary transaction logs, customer history, and initial risk data are instantly unified.

- Automated Prioritization: The Case Prioritization Engine and Automated Workflow Rules Engine automatically triage cases based on configurable metrics—such as potential loss value, compliance deadline, or reason code severity. This ensures high-priority, high-value disputes are managed first, directly mitigating regulatory exposure and revenue leakage.

- Collaborative Workflows: BPA assigns tasks, tracks agent activity, and initiates necessary internal communication, ensuring compliance with strict resolution SLAs.

Value Delivered: Drastically lowers Operational Expenditure (OPEX) by reducing manual workload by up to 50% or more, allowing staff to focus exclusively on complex, high-impact cases.

Phase 3: Maximized Recovery & Feedback Loop

The final stage is centered on turning chargeback risk into recovery and compliance strength, utilizing the Dispute Resolution Workflows:

- Evidence Orchestration: Upon receiving Chargeback Notifications, the Evidence Aggregation Engine automatically connects to external partners (Merchant CRMs, Issuers, Shipping Carriers) to collect the specific, compelling data required for the dispute reason code.

- Automated Defense: The system leverages this aggregated data to generate and populate Automated Documentation & Forms (e.g., Visa/Mastercard representment letters) flawlessly. The Deadline Tracking module ensures the complete evidence package is submitted automatically via API before the card network window closes, eliminating the pervasive risk of loss due to late submission.

- The Adaptive Feedback Loop: Crucially, the outcome of every dispute (win or loss) is fed directly back to the Real-Time Fraud Detection engine. This Feedback Loop enables the ML models to continuously self-tune, improving scoring accuracy and making the system an adaptive, continuously optimizing defense.

Quantifying Value: ROI Gains from Automated Risk Management

For U.S. PSPs, shifting from manual risk work to automated ML- and BPA-driven systems is the clearest path to stronger margins. Automation improves accuracy, protects revenue, and delivers predictable financial performance across four core value levers.

The Four Levers Driving Measurable Financial Return

1. Direct Loss Prevention: Reducing Fraud Penetration

Core Value: Immediate, compounding reduction in fraud loss exposure and reserve requirements.

2. Revenue Retention: Minimizing False Positives

Core Value: Higher approvals, restored revenue, stronger customer lifetime value, and a cleaner top-line.

3. Operational Efficiency: Accelerating Case Time

Core Value: Large-scale OPEX efficiency, reduced case backlog, and predictable dispute operations.

4. Recovered Revenue: Boosting Chargeback Win Rates

Core Value: Higher, more consistent dispute recovery and materially improved bottom-line retention.

The CFO View: ROI Model for a $5B PSP

| ROI Pillar | Conservative Automation Gain | Illustrative Annual Impact |

|---|---|---|

| Fraud Loss Reduction | Reduce a 0.5% loss baseline by 50% | $12.5M Saved |

| False Positive Reduction | Recover 50% of the 1.0% wrongly declined volume | $25.0M Captured |

| Case Time Efficiency | 80% reduction in labor for 20k cases/year | $2.4M in OPEX Savings |

| Chargeback Win Rate | Win rate increases from 20% → 60% | $8.0M Recovered |

| TOTAL NET ANNUAL VALUE | — | ≈ $47.9M in Annual Financial Benefit |

Compliance Gains: Transforming Regulatory Risk into Audit-Readiness

For Payment Service Providers (PSPs), the focus is different from that of merchants. Merchants aim to reduce fraud loss, but PSPs emphasise regulatory exposure. Failing to comply with U.S. federal rules can lead to severe fines, lawsuits, and loss of sponsor bank relationships. Automation is the only scalable way to manage this risk.

Automation as the PSP's Regulatory Shield

Automation provides a single, verifiable defense against the complex web of obligations imposed by U.S. regulatory bodies:

- CFPB (Consumer Financial Protection Bureau): The CFPB requires large nonbank PSPs to control unauthorized transactions. They must ensure accurate disputes and submit evidence quickly. Automated workflows log every dispute, track deadlines, and resolve issues based on strict Reg. E timelines.

- OCC/FDIC (Sponsor Bank Oversight): Sponsor banks, overseen by the OCC and FDIC, demand strong risk management from PSP partners. Automation offers ongoing proof of control, creating clear, traceable audit trails that meet third-party risk reviews and support vital banking relationships.

- NACHA (ACH Network Rules): New NACHA rules focus on risk-driven processes for spotting unauthorized ACH transactions. ML-driven automation constantly monitors transaction patterns and flags suspicious activity. This goes beyond manual checks, ensuring compliance with the new risk management framework (Source: Nacha).

- PCI DSS 4.0 (Data Security Standard): The updated PCI standard requires ongoing monitoring and strong data protection. Automation systems enforce strict access controls and provide instant proof of system integrity. This shifts the PSP from challenging annual compliance checks to continuous audit-readiness.

Instant Audit Logs and Compliance Dashboards

The core functionality of automated dispute systems is the generation of audit logs for every decision, with logs generated instantaneously. Manual processes rely on fragmented emails and spreadsheets; automation captures the entire lifecycle: who accessed the case, the ML score used for the decline/flag, and the exact time the evidence package was submitted to the card network. This results in two key compliance assets:

- Regulatory Reporting: Automation platforms consolidate these logs into real-time Compliance Dashboards, providing immediate, clear visibility into key metrics like dispute win rates, average resolution time, and compliance deadline adherence.

- Mitigating Fines and Litigation Exposure: Transparent, immutable audit trails serve as the definitive defense against consumer complaints and regulatory action. By guaranteeing that every procedural requirement is met and documented, the PSP fundamentally mitigates the risk of catastrophic fines and costly litigation resulting from procedural missteps.

By deploying integrated fraud and chargeback automation, PSPs effectively transition their regulatory posture from reactive risk management to proactive assurance, securing their operations for high-velocity, compliant growth.

AML Software Development Guide: Build Secure Fintech Apps

Business Impact: Real-World Outcomes for Modern PSPs

Automation’s value is best seen in measurable results. These scenarios highlight how PSPs typically strengthen margins and operational performance after shifting to an integrated fraud and dispute automation framework.

Case Scenario A: Fraud Loss Mitigation for a Mid-Sized PSP

| Metric | Before Automation | After Automation | Impact |

|---|---|---|---|

| Fraud Loss Rate | 0.80% | 0.48% | 40% Reduction |

| False Positive Rate (FPR) | 3.1% | 1.2% | Higher Approval Accuracy |

Result:

The ML upgrade boosted detection accuracy while safely approving transactions once flagged as risky. The PSP saw significant annual fraud-loss savings, reduced checkout friction, and higher customer approval rates — in line with industry results showing 30–40% lower fraud exposure with advanced AI.

Case Scenario B: Operational Efficiency for a High-Volume PSP

| Metric | Before Automation | After Automation | Impact |

|---|---|---|---|

| Resolution Time per Case | 4.8 days | 1.9 days | 60% Faster |

| Manual Review Load | 100% of cases | <25% manually reviewed | Major OPEX Reduction |

Result

By implementing an automated dispute management workflow, the PSP successfully transformed its operations from a manual-heavy cost center into a lean, high-efficiency engine.

Case Scenario C: Revenue Recovery Through Automated Representment

| Metric | Before Automation | After Automation | Impact |

|---|---|---|---|

| Win Rate (Representment) | 22% | 55% | 150% Increase in Recovery |

| Deadline Compliance | 3.5% late submissions | ~0% | Eliminated Procedural Losses |

Result

Why Partner with GeekyAnts for Chargeback Automation Software

Building a high-performance, compliance-ready fraud and dispute automation engine requires more than engineering maturity — it demands deep payments intelligence, regulatory fluency, and an ability to translate financial risk strategy into scalable software.

Kunal Kumar

COO, GeekyAnts

Our Expertise: Technology Built for Financial Trust

Every solution is engineered using security-by-design and compliance-first principles — ensuring your fraud automation platform withstands regulatory scrutiny and performs reliably across high-volume U.S. payment corridors.

Core Capabilities

| Capability | What We Deliver |

|---|---|

| AI/ML Fraud Detection Systems | Custom ML scoring models trained on your fraud patterns — CNP fraud, synthetic identities, account takeovers. These models outperform generic tools, improving detection accuracy and reducing false positives across your transaction mix. |

| End-to-End Workflow Automation (BPA) | Complete automation of fraud and dispute operations: real-time data ingestion, case triage, evidence aggregation, and representment workflows. This eliminates manual overhead and enables your team to operate strategically instead of administratively. |

| Scalable, Compliance-Ready Infrastructure | Architectures built with immutable audit trails, granular access controls, and compliance support for PCI DSS, CFPB, OCC, and NACHA. As volume scales, your operational integrity and compliance readiness scale with it. |

What Sets GeekyAnts Apart

- Built for Your Data: Domain-trained ML models aligned to your fraud patterns, dispute signals, and risk thresholds.

- Built for Your Workflows: Automation rails that integrate directly into your existing stack — not another dashboard to maintain.

- Built for Compliance: Regulatory alignment (PCI, CFPB, OCC, NACHA) baked into the architecture, not added later.

- Built for Scale: Proven track record helping PSPs, fintechs, and issuers cut manual load by 60–80% while improving recovery and approval rates.

This is not software delivery. It is co-designing the fraud and chargeback operating model your business will run on for the next decade.

Conclusion

Automation gives PSPs a clear path to reduce losses, improve approvals, accelerate dispute cycles, and strengthen compliance. The advantage is decisive: organizations that modernize now operate with greater accuracy, efficiency, and financial stability. With the right partner, automation becomes more than a process upgrade — it becomes the foundation of a scalable, resilient, and high-performing risk operation.

CITATION

FAQs

1. How does fraud automation reduce false positives for PSPs?

Automation uses ML models trained on PSP-specific transaction patterns, allowing the system to distinguish legitimate behavior from true anomalies. This cuts reliance on fixed rules and significantly lowers false positive rates.

2. Can automation ensure audit-readiness for U.S. regulators?

Yes. Automated systems maintain immutable logs, consistent evidence collection, and standardized decision trails — all of which align with PCI DSS, CFPB, OCC, and NACHA expectations and simplify sponsor-bank audits.

3. What ROI timeline can PSPs expect post-deployment?

Most PSPs begin seeing measurable gains — reduced losses, higher recovery rates, and lower operational overhead — within 8–12 weeks, depending on integration depth and automation coverage.

4. How do automated chargeback workflows differ from merchant-level tools?

Merchant tools automate submission; PSP-level automation orchestrates the full dispute lifecycle — evidence ingestion, reason-code mapping, documentation, and recovery optimization — enabling far higher win rates.