Table of Contents

Personal Finance App Development Cost Guide for Startups

Author

Subject Matter Expert

Date

Book a call

Key Takeaways

- Cost planning is strategic: In the U.S. fintech market, structured budgets shape launch speed, regulatory readiness, and investor confidence.

- Feature scope drives spend: Adding AI insights, fraud detection, or multi-aggregator coverage can raise budgets by 20 to 40 percent above MVP levels.

- Compliance is a fixed line item: Frameworks such as PCI DSS, SOC 2, GLBA, and CCPA account for 15 to 20 percent of total build costs and should be addressed from the start.

- Team model defines cost flexibility: U.S. engineers average $120 to $150 per hour, offshore developers $40 to $60 per hour. Blended teams reduce cost but require stronger QA and governance.

- Typical budget ranges: Lean MVPs cost $40,000 to $75,000, mid-tier builds $100,000 to $150,000, and feature-rich platforms with advanced analytics often exceed $200,000.

- Timelines scale with scope: MVPs take 4 to 5 months, mid-tier apps 6 to 8 months, and advanced platforms 9 to 12 months or more.

- Phased budgeting controls risk: Launch with essential features, validate product–market fit, and add advanced capabilities once adoption metrics justify further investment.

- Cost optimisation levers exist: Cross-platform development, hybrid team models, automation, and cloud cost monitoring keep budgets lean without sacrificing quality.

- Ongoing maintenance matters: Expect 15 to 20 percent of the initial budget annually for updates, audits, and new features.

The personal finance app market in the United States has become one of the most demanding areas within fintech. Early products once revolved around simple expense tracking, but the current landscape requires multi-bank connectivity, real-time data analysis, and strict regulatory compliance. Investor evaluations have also become more detailed. Capital is still available, though it now favours teams that combine innovation with measurable financial control.

Budgeting has evolved into a central part of product strategy. A structured financial plan determines how efficiently a startup can move from idea to release, how early compliance standards are built into the system, and how stable the company appears to potential investors. Weak planning often creates setbacks that are difficult to recover from, such as missed audits, unplanned integration fees, or rapidly rising cloud expenses.

Development costs vary based on team composition and geography. U.S.-based engineers generally charge between $120 and $150 per hour, while offshore teams average $40 to $60. This difference alone can shift total spending by tens of thousands of dollars. Compliance adds another major component: frameworks such as PCI DSS and SOC 2 usually account for 15 to 20 percent of total project cost. When these requirements are addressed late, redesigns and additional testing can multiply expenses.

Kunal Kumar

COO, GeekyAnts

The core insight from this is that cost discipline equals product commitment. Kunal Kumar frames the budget as a direct indicator of operational maturity and strategic intent. The quote emphasizes the financial danger of treating compliance (like SOC 2) late in the development cycle, which massively inflates costs and damages the startup's stability in the eyes of demanding investors and regulators.

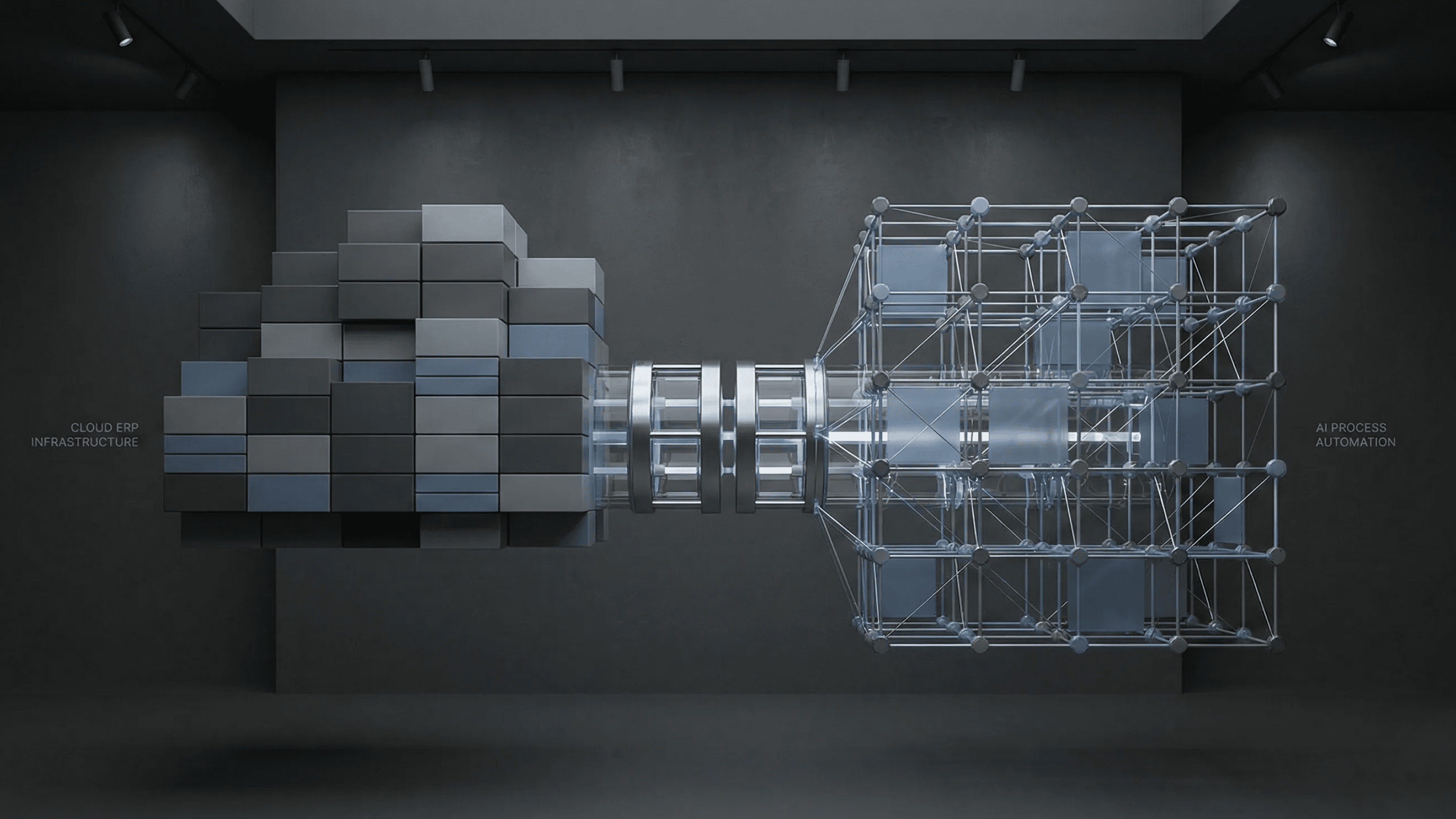

Architectural Deep Dive on AI-Powered Personal Assistants by GeekyAnts

Watch a brief exploration of the technical framework behind modern AI personal assistants.

Market & Cost Landscape for 2026 U.S. FinTech Startups

The US fintech market is growing at a very high rate. By 2026, the assets under management will reach more than $1.5 trillion, and personal finance applications will account for much of the increase. Automation, smart insights, and in-built fraud protection are features desired by users and add considerably to the cost of development and compliance.

One of the most significant aspects of cost is that of talent. In the U.S., the senior engineers would generally cost an average of 120-150 per hour, whereas the offshore teams cost around 40-60. Most of the startups amalgamate these models, maintaining compliance and architectural control in the U.S. and sending the execution to offshore developers. Such an arrangement is capable of lowering the overall expenses but demands rigorous procedures and tight quality control.

Compliance continues to take up a larger part of project budgets. Meeting requirements under PCI DSS, SOC 2, and GLBA usually accounts for 15–20 percent of total development costs. Additional state-level laws, such as CCPA, increase this further. Delays in compliance by teams will cost them more in the future because it is rarely cost-effective to retrofit systems to comply with an audit and security review.

Lean MVPs will average between $40,000 and $75,000 in 2025–26, more advanced investor-ready builds come in the middle between $100,000 and $150,000, and feature-rich platforms with advanced analytics and fraud detection tend to be over $200,000. These scopes highlight an important lesson for fintech founders: sustainable execution will require planning and controlled scope, as well as active compliance in the early stages.

Key Factors Driving Personal Finance App Development Costs

The United States has a set of structural factors in ascertaining personal finance app budgets. All of these factors have a direct cost implication, and their combination contributes to the ability of a startup to successfully perform an MVP or maintain a full-scale platform. The following points and the table categorise the key drivers regarding their scope, U.S. influence, and indicators that need to be watched when planning.

1. Feature Set & Product Depth

The complexity of what your app can do is the single strongest cost driver. A basic personal finance tracker is inexpensive, but the moment you add automation, AI insights, or multi-account syncing, the development effort multiplies.

Why does it affect the cost?

- More features = more engineering time, QA, and UX design.

- Deeper features (AI financial advice, budgeting predictions) require backend infrastructure, ML models, and specialised talent.

- U.S. financial users expect polished interfaces and trust signals, increasing design and testing scope.

Examples of cost-impacting components

- Simple: expense categorisation, manual input.

- Moderate: multi-bank sync, dashboards, and real-time alerts.

- Advanced: AI copilots, LLM-generated insights, automated savings/goal planning.

2. Financial Data Connectivity

Financial data connectivity is a core cost driver because it defines how safely and reliably your app retrieves user account information. In the United States, most finance apps integrate with data aggregators such as Plaid, MX, or Finicity. Each aggregator has its own pricing model that includes per-connection fees, monthly minimums, and additional cost for premium data attributes.

The work also includes secure token handling, OAuth flow support, and the creation of fault-tolerant syncing. U.S. banks follow strict data-sharing standards, which adds scope for compliance checks and resilience testing. The deeper and smoother the data connectivity, the higher the engineering effort and cost.

3. Security Architecture

Finance apps are held to bank-level security expectations, even if they are not actual banks.

Why does it affect the cost?

- U.S. standards (SOC 2, PCI-DSS, FFIEC guidelines) shape how data is stored, encrypted, and audited.

- Implementing Zero-Trust, secure secrets management, and encrypted data pipelines requires senior engineers.

- Security testing adds iterative cycles — not just tools, but manual reviews.

4. Regulatory & Audit Readiness

Even if the app is not launching as a licensed financial product, U.S. compliance expectations influence technical decisions.

Why does it affect the cost?

- Apps interacting with user financial data must prepare for audits (SOC 2), and follow privacy rules (CCPA, GLBA-like safeguards).

- Audit readiness requires documentation, logging, and controlled access systems—engineering work that does not show on the screen but increases scope.

5. Design and UX

Design and UX affect cost because personal finance requires trust, clarity, and precision. A U.S. audience expects clean dashboards, transparent data views, and high accessibility standards. The process includes establishing an information hierarchy that supports financial literacy, creating visual systems for risk and spending insights, and developing user flows for actions such as linking accounts or setting financial goals.

Interaction patterns must follow WCAG accessibility guidelines, which is mandatory for many U.S. businesses. This level of detail demands close collaboration between designers and domain experts, which increases cost but improves user confidence.

6. Platform Strategy

Where and how you launch impacts both cost and timeline.

Why does it affect the cost?

- iOS users dominate U.S. finance apps; supporting both iOS + Android doubles QA and platform optimisations.

- Web dashboards add another layer of development.

- Hybrid vs. native choices influence engineering hours and maintenance complexity.

7. Team Model & Rates

Talent directly changes the cost structure — especially in U.S. markets.

Why does it affect the cost?

- U.S. senior engineers average $80–$160/hr; specialists (AI/ML, security, fintech architects) go higher.

- Nearshore/offshore models can reduce cost, but require mature project management.

- Compliance-heavy solutions generally need experienced architects, not junior teams.

8. Architecture and Scalability

Architecture and scalability shape long-term cost because they determine how well the system handles financial data growth, traffic spikes, and advanced AI features. A secure architecture for U.S. FinTech products must follow standards such as SOC 2, PCI-DSS, and NIST guidelines. The system must support encrypted data storage, role-based access control, audit logs, and isolation of sensitive services.

Scalability planning covers workload distribution, multi-region hosting, and reliable failover mechanisms because financial applications cannot risk extended downtime. A resilient architecture may increase upfront cost but reduces operational risk and future rework.

9. Maintenance & Support

After launch, personal finance apps are never “done.”

Because—

- Data aggregators update APIs → breaking changes need fixes.

- AI models require continuous tuning.

- U.S. compliance updates happen yearly.

- User feedback loops introduce new features and optimisations.

| Factor | What It Includes | Why It Impacts Cost in the U.S. | Key Signals to Watch |

|---|---|---|---|

| Feature Set & Depth | Budgeting, categorisation, reporting, forecasting, fraud checks | More modules require additional design, engineering, and QA; advanced features need specialised talent | Number of modules, complexity, mid-sprint scope changes |

| Financial Data Connectivity | Integrations with Plaid, Yodlee, FDX, and payment gateways | Providers charge licensing/usage fees; secure scaling and compliance add engineering hours | API pricing, contract terms, downtime, reconciliation effort |

| Security Architecture | Encryption, authentication, monitoring, audit logs | Strong security adds upfront time but is mandatory for fintech | SOC 2 readiness, patch cycles, access control quality |

| Regulatory & Audit Readiness | PCI-DSS, GLBA, SOC 2, CCPA, state rules | U.S. fintech compliance requires early planning; late fixes are costly | Control gaps, consent flows, retention policies, audit evidence |

| Design & UX | Dashboards, onboarding, reporting, accessibility | Trust and clarity demand thorough UX and iteration cycles | Usability Testing, accessibility coverage, UI polish |

| Platform Strategy | Native apps vs. React Native/Flutter |

Cross-platform saves effort; some features still need native modules

| Reuse ratio, secure storage needs, native module count |

| Team Model & Rates | U.S. teams, offshore teams, hybrid models | U.S. rates are high; hybrid models reduce cost but need tight governance | QA depth, code review quality, governance rhythm |

| Architecture & Scalability | API design, database setup, caching, CI/CD | Higher scale targets require more engineering and infra planning | Load targets, rollback readiness, database growth, infra spend |

| Maintenance & Support | OS updates, patches, hosting, feature upgrades | Annual upkeep is essential and drives 15–20% of base cost | Release cadence, backlog size, vulnerability fix times |

U.S. Cost Spectrum

- Lean MVP with core budgeting, one aggregator integration, baseline compliance, and essential security: $40,000–$75,000

- Mid-Tier Build with multi-bank integrations, polished UX, automation, and mapped compliance controls: $100,000–$150,000

- Feature-Rich Platform with forecasting, fraud detection, premium analytics, and a scale-ready architecture: $200,000 and higher

Cost to Integrate Advanced Features

The advanced features help to differentiate and increase revenue, although all of them involve engineering, security, and compliance work. Each addition must be regarded as an investment that must pass adoption and readiness tests before being released.

- AI-driven insights

Predictive analytics and tailored recommendations are an extra charge that would be between $25,000–$40,000. Topics of data modelling, secure data pipelines, and explainability elements that are mandated by U.S. regulators are addressed in the work. A minor integration that can take 200–300 hours will be expensive in average U.S. rates of $120–$150 per hour. Projected further cloud expenditure of $500–$1,000 monthly on training and storage.

- Fraud detection

Anticipate a one-time increment of $30,000–$50,000 of real-time monitoring and anomaly detection. The costs are based on the design of algorithms, event streaming infrastructure, and compliance testing. Audits may be an extra cost of between $5,000–$10,000 per year in regulated states. Accuracy is important as having a high number of false positives increases the cost of support, and on average, fintech operations cost $3 to $5 per ticket.

- Multi-aggregator coverage.

Integration and QA are likely to cost $15,000–$25,000 to add a second provider, like Yodlee or FDX. The providers raise licensing fees or per-call fees that can be a range of $500–$2,000 a month based on small volumes. The real cost increases with the scale since transaction reconciliation requires engineering time at maximum loads.

- Premium monetisation

Secure billing, refund management, and PCI validation typically cost the service provider an extra $10,000–$20,000 when introducing subscription levels or in-app purchases. Percentages of 2.5–3 percent of transaction value are charged by payment gateways, and it is significant as revenue increases.

- Gamification and rewards

Streaks, points, and partner rewards are in the range of $15,000 to $25,000. In addition to design and tracking, there is a need to engineer and review the legal side of abuse prevention. On a larger scale, partner programs usually place a minimum requirement of over $10,000 annually.

- Advanced reporting and forecasting

Creation of strong dashboards and scenario models will increase by $20,000–$30,000. The process is fuelled by shaping data, visual design and being cross-device optimised and normally requires 300–400 hours of engineering and design. To maintain increased compute and storage workloads, monthly cloud expenses can go up by $1,000 or more.

Estimated U.S. Startup Cost Scenarios (2025–26)

Three stages of natural product maturity typically characterise personal finance app budgets in the United States. Each stage captures a unique combination of scopes, requirements of compliance, and funding readiness.

- Lean MVP

Budgets vary between $40,000 and $75,000, which is to cover four to five months of work. Those constructions usually have essential budgeting applications and one data aggregator (like Plaid), encryption, and minimum PCI compliance. An offshore group of developers with a price of $40–$60 per hour can be maintained closer to the lower limit of the range, whereas the U.S. developers can bring the totals higher. The aim here is validation — showing traction, retention and trust.

- Mid-tier builds by investors

Companies that have reached the level of seed round or Series A tend to spend between $100,000–$150,000 in six to eight months. Such products are multi-bank integrations, high-level automation, sophisticated UX, and mapped SOC 2 controls. Hybrid teams are not uncommon — U.S.-based heads of compliance teams and offshore teams of development. The investment is worth the money and the investor confidence, plus an improved perception in the market.

- Feature-rich platforms

Additional predictive analytics, fraud detection, monetisation, and scalable architectures in growth-stage products typically begin at approximately $200,000 and can extend to $300,000 or higher. The time frame is up to nine to twelve months, and the maintenance is on average 15–20 percent of the initial price per year. These projects are reasonable in the case of startups with an existing product-market fit and trustworthy capital.

Cost Optimisation Strategies for U.S. Startups

In the United States, startups that develop personal finance applications are in a delicate situation: it is necessary to control spending and not ruin security, compliance, or user experience. The following strategies offer viable methods of operating on budgets and laying the foundation towards growth in the long term.

1. Scope the MVP Precisely

Restrict the initial build to those features that demonstrate adoption, retention, and trust. The initial budget tracking, account synchronisation with one aggregator, and simple compliance preparedness are all that is required to launch. Premium services and advanced analytics could be held until some traction is achieved.

2. Take Advantage of Cross-Platform Development

React Native or Flutter can be used as a framework to have both iOS and Android use the same codebase. This saves development and maintenance time by half or even one-third, and performance is not compromised. Where security or device-level integrations are required, native additions can still be made.

3. Adopt a Hybrid Team Model

A hybrid model, where U.S.-based leadership is used for product and compliance and offshore engineering is used to deliver, has high cost benefits. Effective governance, correct coding and clear QA gates are essential to make sure that no savings are made at the cost of quality.

4. Reuse Before You Build

Pre-built SDKs, open source libraries, and fintech APIs are used to reduce redundancy and shorten the amount of time spent on engineering. Reporting modules, charts, and payment integrations are rarely required to be written. Efforts to focus development on feature differentiation make the budget lean.

5. Should Carefully Manage Data Integrations

Use one reliable aggregator like Plaid or Yodlee. Various offerors augment licensing charges and complexity. Early negotiation of pricing models and optimisation of API calls should be used to regulate costs on the basis of use.

6. Automate Testing Early

The repetitive manual QA is minimised by continuous integration with automated unit, integration and regression tests. This enhances the speed of delivery over time and reduces the chances of expensive post-release defects.

7. Infrastructure Spend and Control Cloud

Costs in the cloud increase silently with the increase in the number of users. Normal practices should be right-sizing environments, establishing spend alerts, and eliminating idle resources. Cost per thousand active users is a viable measure that can be used to check efficiency.

8. Build Modularly for Growth

The ability to roll out features by organising code into independent modules with feature flags. This enables teams to release fast, gauge adoption, and rollback when required, and have predictable compute and development costs.

9. Inculcate Compliance within the Heart of the Company

During the development of the MVP, baseline controls of PCI DSS, GLBA, SOC 2, and CCPA are required. It is costly to do compliance later and contributes to penalties. The time and resources required to make evidence collection and access logging automated are saved.

Phased Budgeting & Risk Management: Scaling Your Finance App to 1M+ Users

Introduction of a long-term scale personal finance app needs to be sequenced with the investments. Phased budgeting is a budgeting strategy based on a rollout of MVPs that enables startups to control their costs responsibly and be ready to grow in the future.

Why a Phased Approach Works

The phased approach starts with a Minimum Viable Product, which only has the basic functionality required to be adopted. This lean construction aids founders in ascertaining product-market fit prior to investment in sophisticated features. It is also capital saving, generates immediate user feedback and generates usage data leading to subsequent decision making. Fintech products that are released on short iterative cycles and are constantly upgraded have exhibited quicker growth compared to those that try to release all the features simultaneously.

Key Risks to Plan for Early

Some risks should be taken into account during initial budgeting, even in the case of an MVP-first rollout:

Third-Party Integrations

The account aggregation of most finance apps uses Plaid, Yodlee, or FDX. Such integrations are an additional cost in terms of licensing and need to be designed to be reliable. A failure in the service or the changes in the pricing model may interfere with it and raise the costs. Compliance checks also apply, as financial information is passed on these external platforms.

Data Security and PII Protection

Apps used to manage money are very sensitive. Strong encryption, safe authentication and continual observation are needed in the initial launch. The circumstances concerning SOC 2 compliance and data privacy compliance laws, CCPA and GDPR compliance should be discussed at the initial stage. It is much more expensive to add these controls afterwards, and can cause loss of user trust.

Regulatory Compliance

The U.S. has a wide range of rules that govern personal finance apps. PCI-DSS regulates the work with payment cards, GLBA facilitates the protection of personal financial information, and the statutory regulations introduce additional demands. By dealing with these structures early, it is unnecessary to pay to redesign the product after it has gone online. Legal advice and compliance instrumentation are to be considered as part of the budget rather than an addition.

Scope Matrix: MVP vs Later Features

| Must-Have (MVP) | Add Later (Growth Stage) |

|---|---|

| Budget tracking and expense categorisation | AI-driven insights and predictive analytics |

| Account sync via Plaid or equivalent provider | Advanced fraud detection systems |

| Core security with encryption and PCI-DSS baseline | Premium monetisation features such as tiered subscriptions |

| Essential alerts and bill reminders | Gamification and reward mechanisms |

This phased roadmap ensures the initial build covers user trust and regulatory readiness while postponing features that demand larger budgets and advanced infrastructure.

Startup Takeaway

Reaching one million users demands careful sequencing. A phased budget allows startups to validate early, address integration and compliance risks, and add features once demand is proven. Treating the MVP as a foundation protects capital and strengthens resilience. Tools such as the AI-powered cost estimator by GeekyAnts help refine projections and reduce uncertainty, creating the conditions for growth with both efficiency and trust.

Budget Planning Template & Timeline for Personal Finance Apps in the U.S.

Planning a personal finance app budget requires more than a single cost estimate. A structured timeline with phased spending helps founders anticipate hidden expenses, align development with milestones, and prevent overruns. Breaking the journey into clear stages also supports better investor communication and smoother scaling.

Phased Budget Structure

| Phase | What It Involves | Estimated Cost Range (USD) | Timeline |

|---|---|---|---|

| Discovery & Planning | Market research, requirements gathering, compliance scoping, and technical architecture | $10,000–$20,000 | 3-4 weeks |

| Design | Wireframes, UI/UX prototypes, accessibility review, and user testing | $15,000–$30,000 | 4-6 weeks |

| Development (MVP) | Core features: budgeting, account sync via one aggregator, basic PCI-DSS compliance, encryption | $40,000–$75,000 | 12-16 weeks |

| QA & Compliance Testing | Automated testing, regression cycles, security checks, and compliance validation | $10,000–$20,000 | Parallel with development |

| Launch Preparation | App store setup, beta release, monitoring tools, and early support setup | $5,000–$10,000 | 2-3 weeks |

| Post-Launch Maintenance | Bug fixes, OS updates, dependency patches, and user support | 15–20% of the build cost annually | Ongoing |

| Growth Features (Post-MVP) | AI-driven insights, fraud detection, premium monetisation, multi-aggregator support | $50,000+ depending on scope | Added after traction |

Why Phased Planning Matters

Dividing the budget into phases puts the pressure on. Discovery gets the team scope and compliance requirements aligned before writing code. Design will make the app user-friendly and reliable without the need to redesign at high cost. Development is only concerned with the MVP basics, and QA ensures quality and compliance. Post-launch maintenance and growth features are planned separately, which minimises the threat of hidden costs.

Timeline Expectations

It is possible to provide lean MVPs within 4–5 months as long as there is adherence to scope discipline.

Mid-tier designs with more robust designs and multi-aggregator are usually 6–8 months.

Systems with features to predict analytics, detect fraud, and be prepared for advanced compliance may require 9–12 months or more.

Kunal Kumar

COO, GeekyAnts

Why Is GeekyAnts the Right Technology Partner for the Development of Personal Finance Apps?

Today, to create a personal finance application in the U.S. requires more than merely engineering talent. Startups require a partner that is knowledgeable in compliance, scalability, user experience, and the cost realities of fintech. GeekyAnts offers this mix with both a profound fintech understanding and a track record of providing secure, compliant and growth-ready financial services.

GeekyAnts has operated at both ends of the fintech spectrum, with global money transfer systems that manage hundreds of millions of transactions a year to PixelAte, an AI-powered personal finance assistant software that churns users to meet their budgeting and planning needs. This experience is translated into real-world experience of where to start lean and where to invest to scale. It also demonstrates their capability of steering startups as MVP validation to products serving big user bases.

In all engagements, security and compliance are viewed as non-negotiable. GeekyAnts embraces the usage of PCI DSS, SOC 2, and CCPA/GDPR principles throughout the development stages so that the cost planning considers these aspects at the initial stage instead of consuming them further at a higher cost. Their product leadership model is based in the U.S. and their offshore engineering, which matches the hybrid structures that control the cost without compromising on the quality.

GeekyAnts is also spending on innovation, which assists in smarter budgeting directly. Their AI-based cost estimation tools give startups a better understanding of the potential effects features, compliance, and integrations will have on budgets. This, together with modern frameworks such as React Native and Flutter, which reduce development and maintenance time, makes projects predictable and efficient.

GeekyAnts has a partnership that is fast and sustainable for founders who intend to launch personal finance products in 2025-26. They have a portfolio of AI-enabled insights, fraud detection, scalable payments, and personalised finance experiences to grant them the technical base and alignment to the industry to enter confidently into one of the most challenging fintech markets.

Conclusion

Laid-out cost planning determines the speed of the product fintech go-to-launch-go-to-scale path. In the U.S. market, with its compliance requirements and user expectations being the highest, clarity in spending decisions is as important as clarity in product design.

There are three major levers of budgets. The set of features defines the amount of engineering and design amount of work. Compliance frameworks such as PCI DSS, SOC 2, and state regulations provide additional obligatory work and recurring audit expenses. The U.S.-based, offshore, or blended team model varies in hourly rates and the amount of supervision that is required.

Going to such levels with a planned approach would give more than financial control. It provides founders an easy way to sequester features, position them to be subject to investor scrutiny and minimise the chances of costly redesigns. Staged budgeting based on adoption indicators would make sure that capitals are deployed where it can be of quantifiable value.

FAQs

1. What is the average cost to develop a personal finance app like PocketSmith in 2025?

A lean MVP with basic budgeting and bank integration can be built for $40,000 to $75,000. Mid-tier products with polished UX, multiple integrations, and compliance readiness usually cost $100,000 to $150,000. Feature-rich builds with forecasting, fraud detection, and premium monetisation often cross $200,000.

2. How long does it take to develop a personal finance app?

A basic version takes around 4–5 months. Mid-tier apps run 6–8 months, and complex platforms with advanced features and strict compliance can take 9–12 months or more.

3. Which features have the biggest impact on personal finance app development costs?

The largest cost drivers include AI-driven insights, fraud detection systems, advanced reporting, and multi-aggregator integrations. These require specialised engineering, higher compliance checks, and longer testing cycles.

4. How does choosing cross-platform vs native development affect the overall budget?

Cross-platform frameworks such as React Native and Flutter reduce development and maintenance costs by up to 30 percent through a shared codebase. Native builds provide more control for security and device-level performance but raise both cost and delivery timelines.

5. What ongoing costs should startups expect after launching a finance app?

Post-launch budgets typically run at 15–20 percent of the initial build per year, covering compliance updates, security patches, OS and dependency upgrades, cloud hosting, and new features.