Banking, Finance, and Insurance Consulting

In the financial services landscape, success is reserved for institutions that can evolve from legacy to modern ecosystems without friction. Today, the demand is for AI integration. However, it creates a dangerous disconnect between capital expenditure and operational reality.

Results That Matter

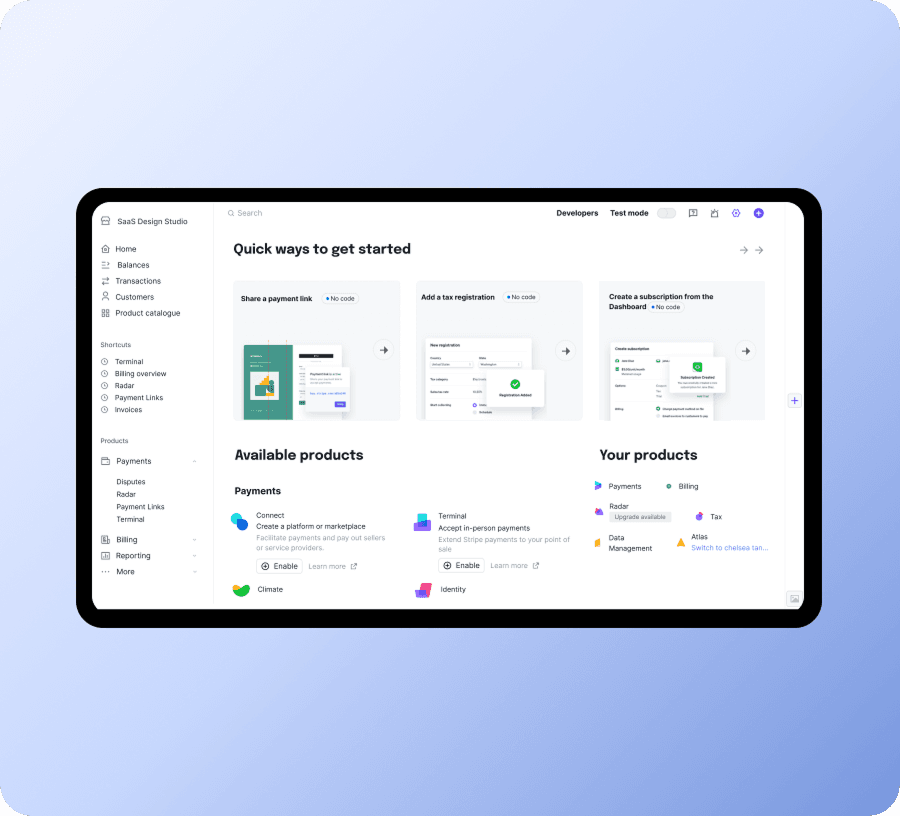

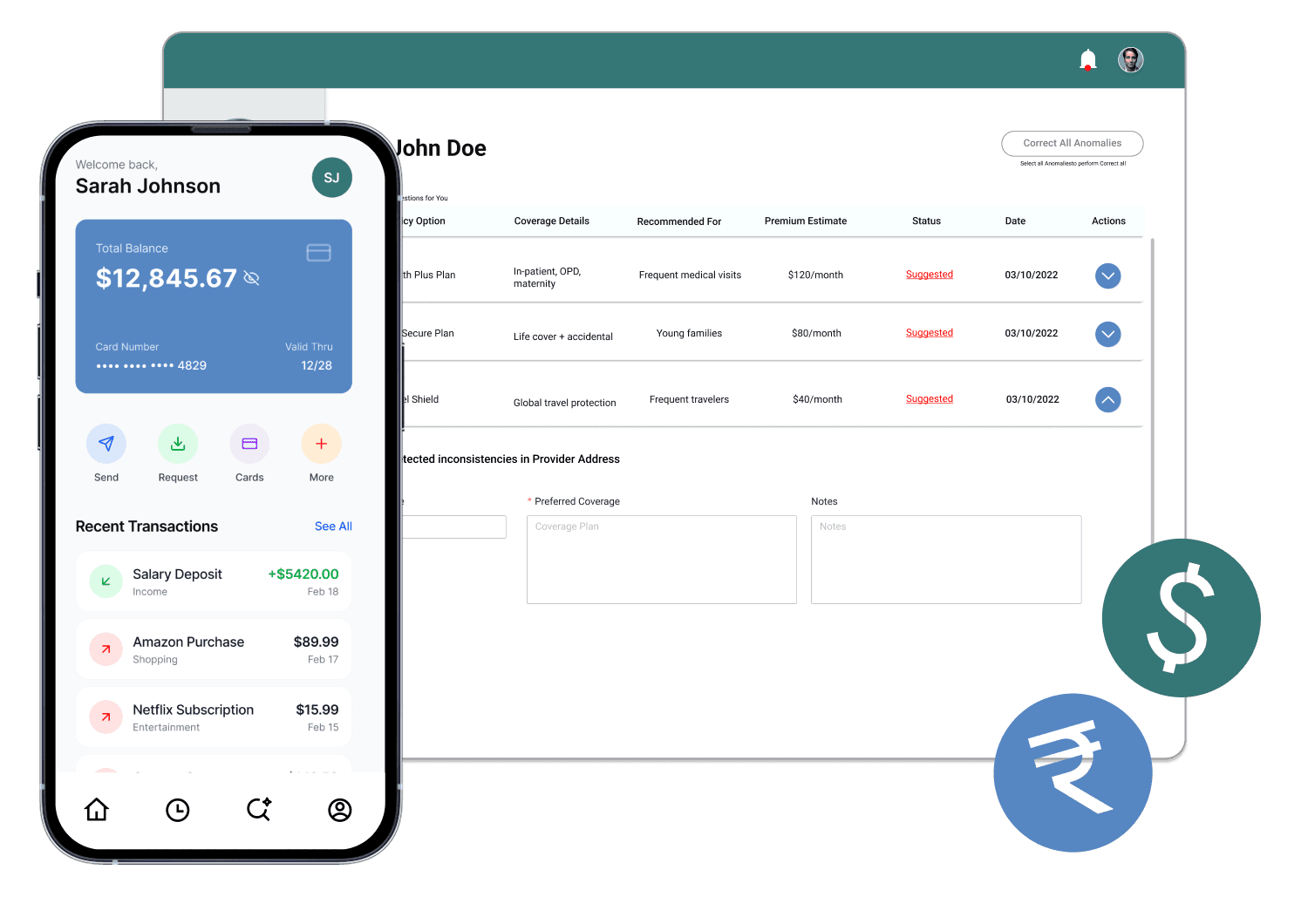

Future Ready Fintech

Our Capabilities in Consulting for Banking, Finance, and Insurance Institutions

Scaling Fintech

How We Can Help

Legacy Modernization

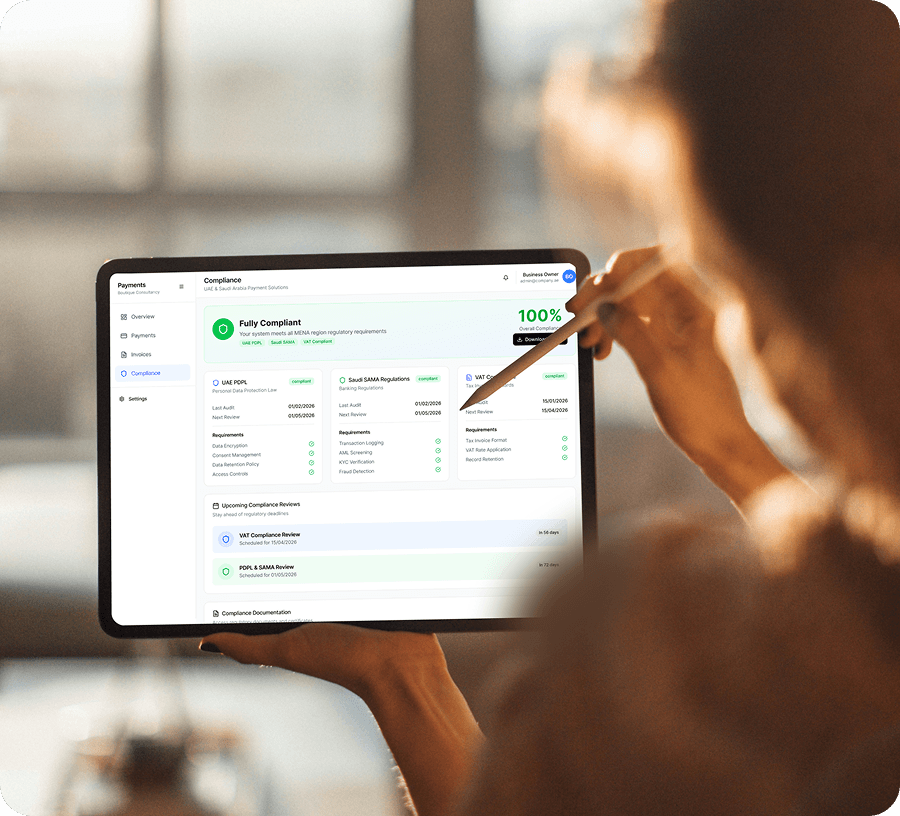

Payment Orchestration

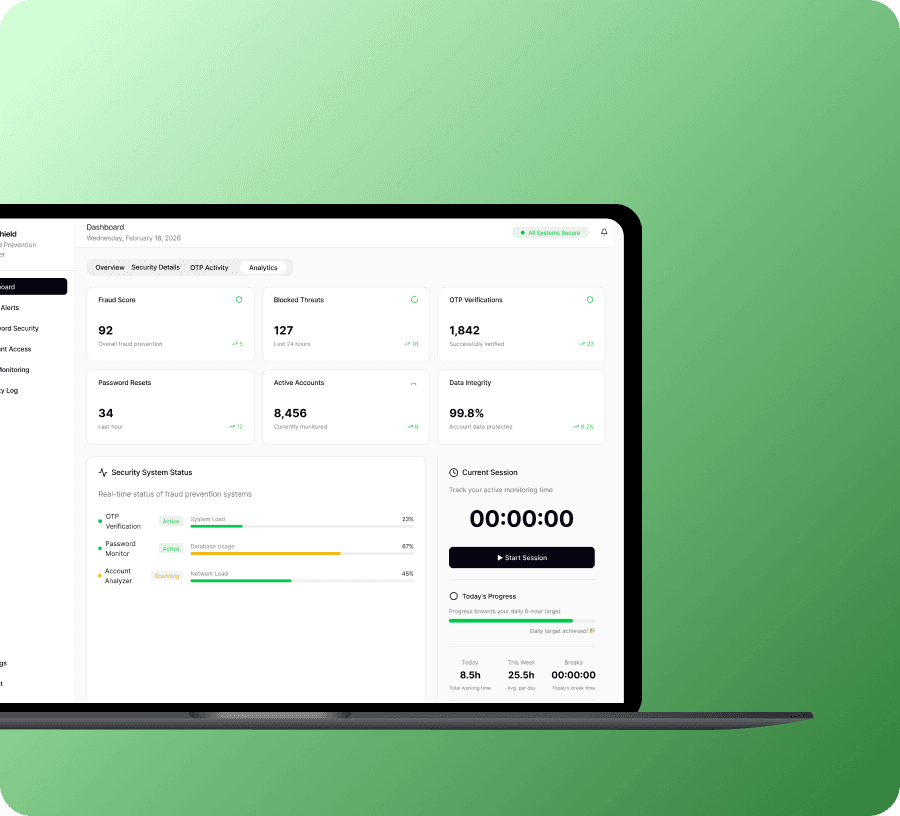

KYC/AML Automation

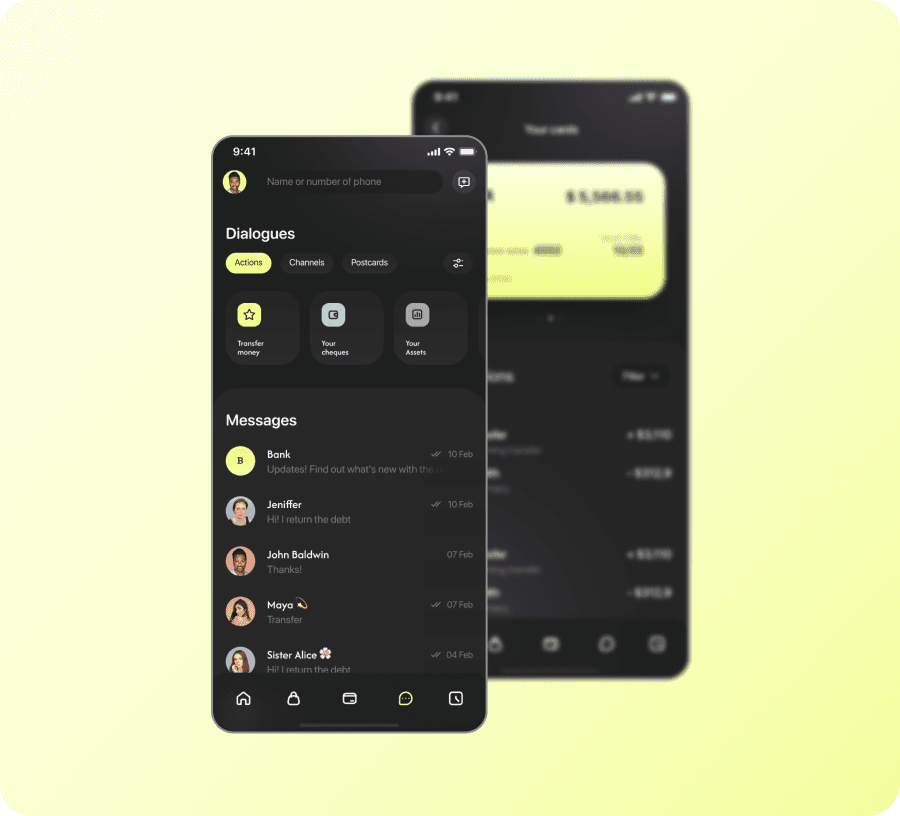

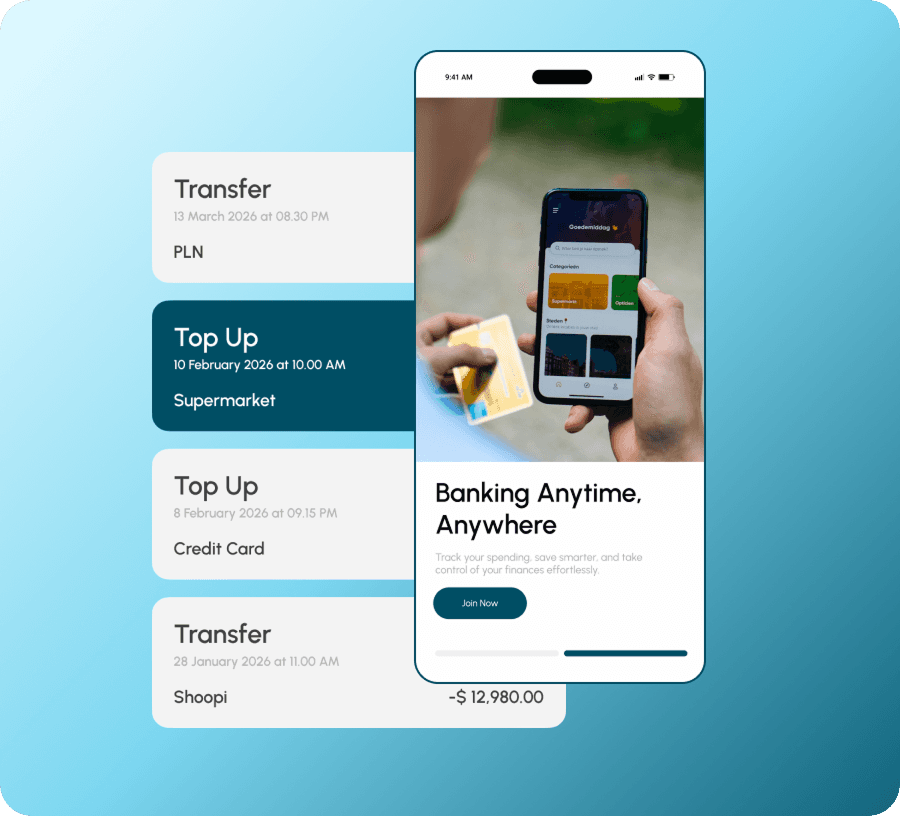

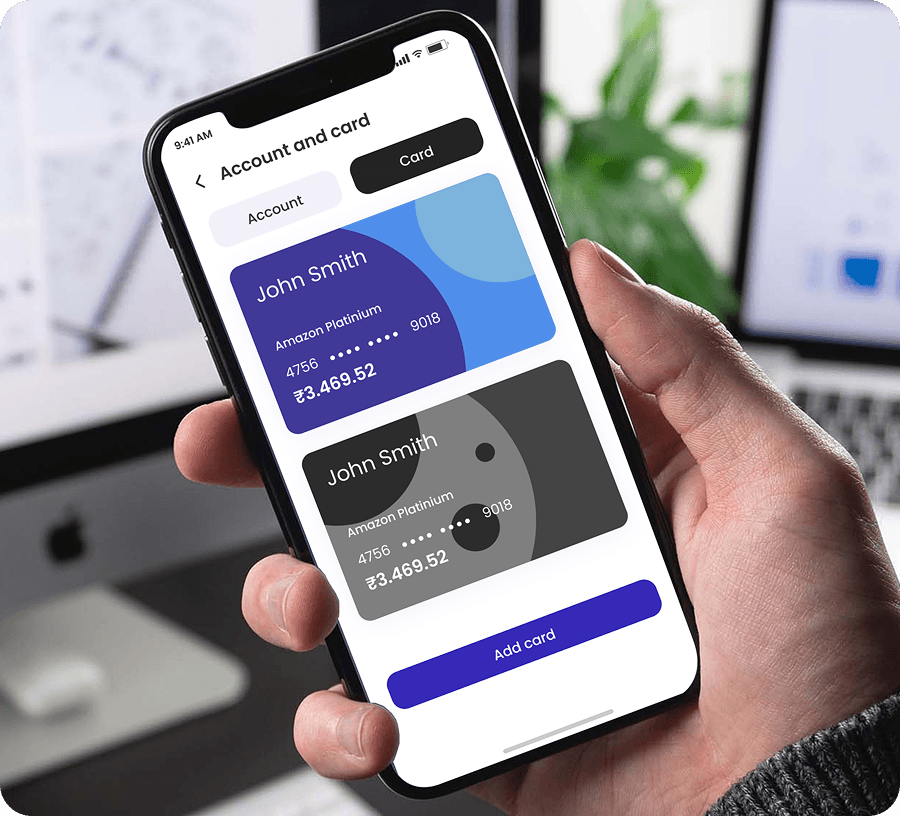

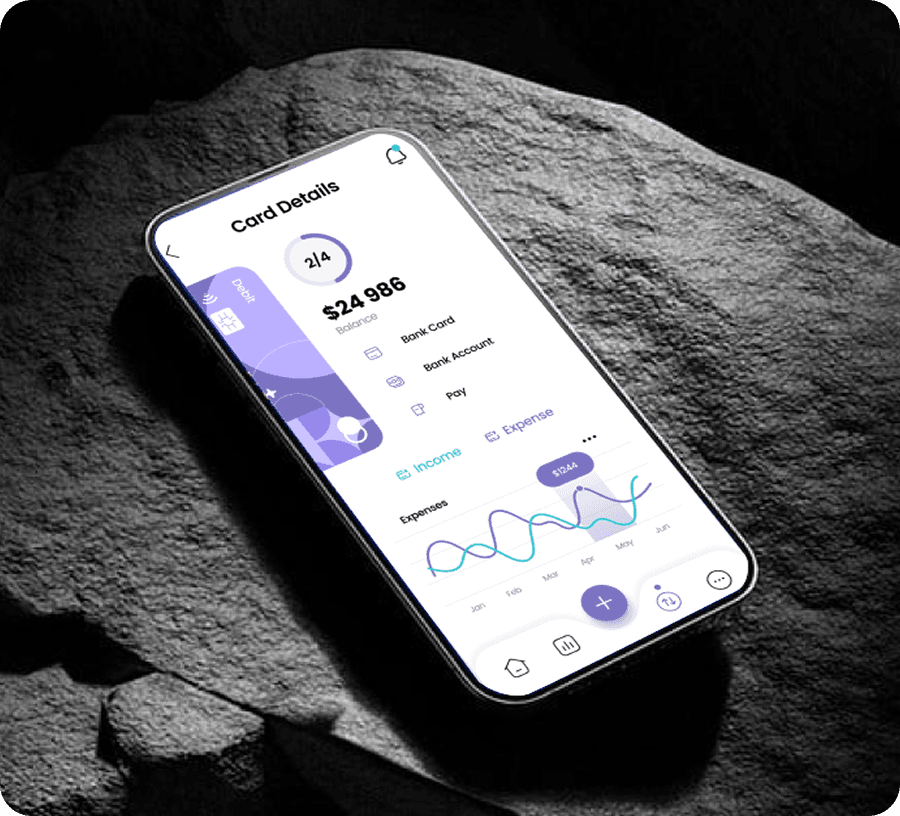

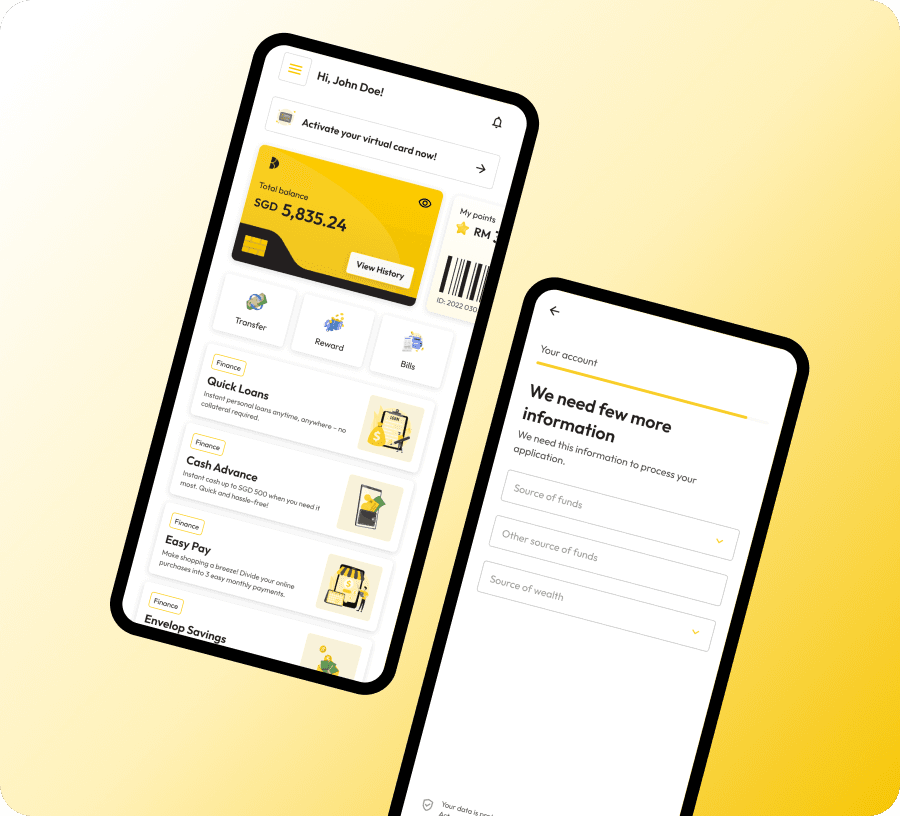

Mobile Banking

Security & RASP

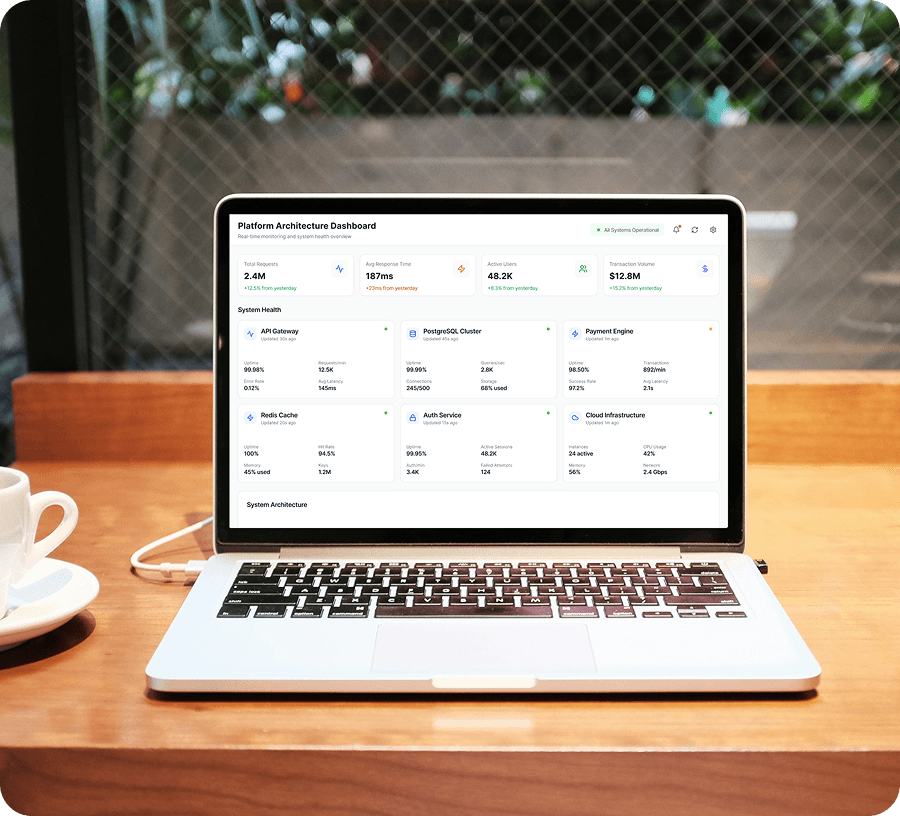

Observability

Built for Banking

Areas of Expertise

100%

Real-time Processing

FOR INDIA’S LARGEST PRIVATE BANK

20x

Faster Search

Delivered through modernization, reducing search latency significantly

FOR A VIDEO STREAMING JOURNALISM PLATFORM

0

Downtime Updates

Maintained during the deployment of personalized recommendation engines

FOR A BANKING APPLICATION

30%

Reduction in Case Handling Time

Achieved through AI-powered KYC automation for U.S. banks, bridging legacy COBOL cores with modern API gateways

For a leading U.S. Bank

100+

Performance Score

Reached by transforming an outdated platform into a high-speed digital engine across 1,200+ outlets

For a diagnostic leader

$57,000+

Annual Savings

Cloud Optimization that reduced monthly expenditures from $8,100 to $3,300 without impacting platform performance or security.

For a Digital Banking & Overseas Fund Transfer Platform

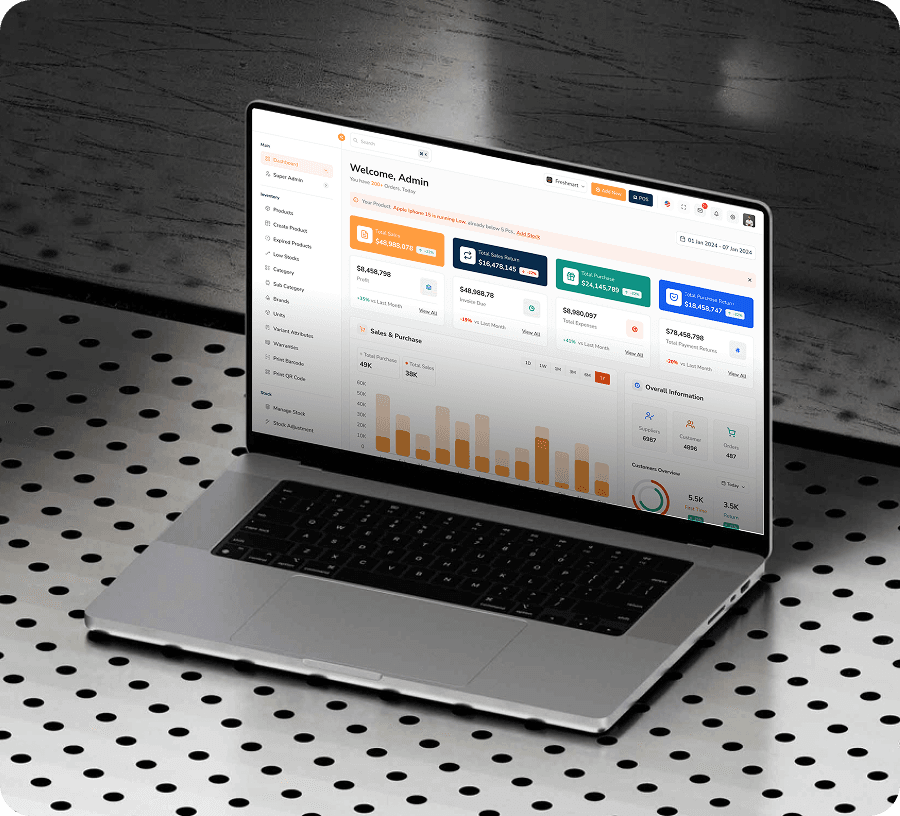

400M+

Global Payments Processed Annually

Enabled through a single intuitive admin platform developed

For A North American payment processing

200%

Reduction in False Alerts

Associated with AI "Decision Intelligence" implementations that improve fraud detection accuracy

For a Fintech Client

90%

Property-Data Relevance

Reached inspection tool using voice-enabled AI queries, resulting in 2x faster on-site interactions

For a real estate fintech

50%

Reduction in Manual Validation Cycles

By implementing SQL-based intelligent agents for process automation

For Business Process Management Saas

30%

Faster Internal Testing Workflows

Achieved through the integration of automated benchmarking frameworks within BPM pipelines

Enterprise Software

5000+

Hours Saved

Realized in the creation of a multimedia iframe widget

For a SaaS industry leader

99%

Reduction in Manual Effort

Accomplished via those processes 1,000–10,000 pages in 2 minutes

A Document Intelligence Platform

88.33%

Reduction in Turnaround Time

Achieved using an AI Architecture Review Assistant, reducing review times to under one hour

3x

Faster AI Feature Iteration

Facilitated through a scalable, personalized recommendation platform

For an AI-powered pantry and meal intelligence platform

Our Journey

- First major bank engagement

- Core banking modernization

- UPI payment system launch

- RegTech/KYC automation

- React Native New Architecture

- AI-powered fraud detection

- Cross-border expansion

Industry Verticals

Retail Banking

Corporate Banking

Payment Gateways

Wealth Management

Insurance

Credit Unions

NBFCs

EdTech Finance

Cross-Border Remittance

TECHNOLOGY STACK

Our Fintech Technology Stack

GPT

Lang Chain

Llama Index

Prompt Engineering

Firebase Genkit

FEATURED CONTENT

Our Latest Thinking in Fintech

Integrating BNPL Rails Into Legacy US Bank Cores Without Risk

The Critical Pitfalls of AI-ERP Integration and How to Avoid Them To Drive Growth

Daily Times Leader Features GeekyAnts’ Fintech Success: Processing 400M+ Global Payments Annually

Personalization in US Wealth Apps: AI Portfolios That Pass FINRA/SEC Compliance

Fraud & Chargeback Automation for US PSPs: ROI and Compliance Gains

Personal Finance App Development Cost Guide for Startups

Ready to turn your financial initiatives into growth engines?

Book a discovery consulting call with our BFSI consultants today.

Trusted By

FAQs