Table of Contents

Integrating BNPL Rails Into Legacy US Bank Cores Without Risk

Author

Subject Matter Expert

Date

Book a call

Key Takeaways

- Avoid the risk of a high-stakes core rewrite by using the Strangler Pattern. Launch BNPL microservices around the edges of your mainframe to ensure zero disruption to legacy operations.

- Guarantee 99.95 uptime and improve MTTR by isolating BNPL "Lending Rails." A failure in a modern service like "Disputes" will never compromise the core ledger.

- Satisfy CFPB and OCC scrutiny by implementing Explainable AI (XAI). Every credit decision generates an audit-ready "Reason Code" to prove compliance with fair lending laws.

- Maintain total vendor swap-ability by using Domain Gateways. Build your own risk engine while "buying" commodity UIs, ensuring you aren't locked into a single provider’s ecosystem.

- Track success through technical KPIs, targeting a 40%+ Strangling Ratio by Q4 to prove real decommissioning of legacy mainframe jobs.

In the 21st century, one of the most used forms of credit is BNPL. Buy Now, Pay Later (BNPL)—a point-of-sale financing model that allows consumers to split purchases into interest-free installments—has evolved from a fintech trend into a mandatory banking service, with the US market projected to reach $14.56 billion this year. For traditional institutions, the challenge is how to deploy it before ecosystem-dominant players like Apple, Samsung, and Amazon permanently capture customer wallet share by embedding these rails directly into the devices and platforms consumers use every day.

Through our consultations with enterprises, we have seen a repetitive architectural wall of legacy US bank cores that are peerless "systems of record," which were never engineered for the sub-second volatility of a modern digital checkout. They excel at batch-processed stability, not the machine-gun firing of real-time BNPL authorizations.

Attempting to force these high-velocity rails directly into a monolithic environment often creates an outage blast radius. A single holiday shopping spike can choke the core ledger, freezing mission-critical functions like ACH clearing and bringing immediate regulator scrutiny from the OCC and CFPB regarding operational resilience.

But controlling this is Possible with moving from Fragility to Controlled Innovation

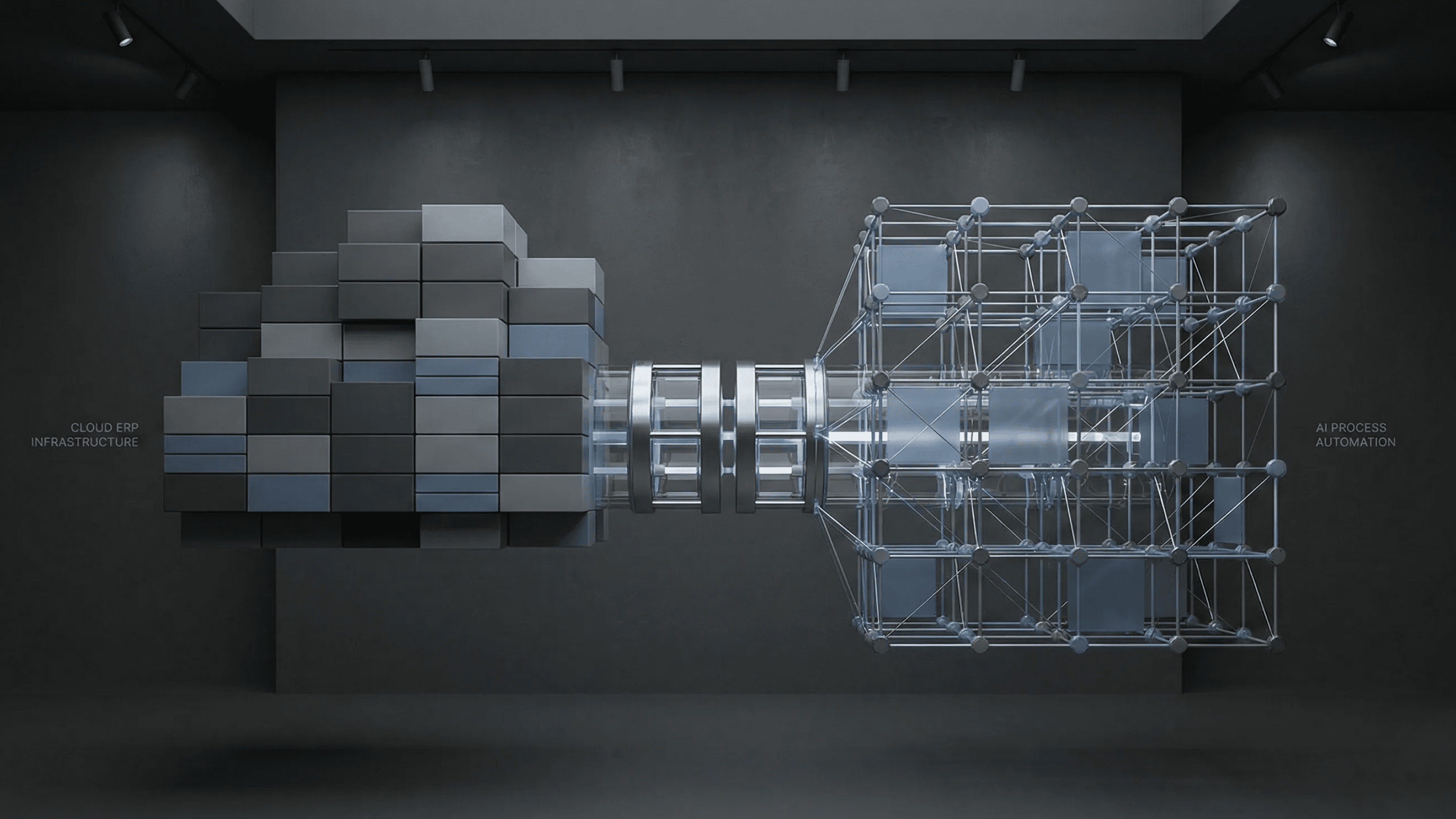

The solution to this instability is to bypass it for high-velocity tasks. This is where the Strangler Fig Pattern transforms from a theory into a survival strategy. An incremental modernization approach where you build a new system (the "fig") around the edges of the old one (the "host"), gradually "strangling" the legacy integration paths until the new architecture takes over completely

Instead of a high-risk rewrite, you introduce an API Mediation Layer. This layer acts as a traffic controller; it intercepts incoming BNPL requests before they ever touch your legacy systems. By strangling the old, direct-to-core integration paths, you can safely route all new, volatile credit traffic to cloud-native Lending Microservices that live in a separate, scalable environment

These independent microservices—handling everything from instant origination to real-time decisioning—operate in parallel with your mainframe. The legacy core remains safely untouched as the backend "source of truth," while your new rails provide the speed and 99.95% uptime that today's consumers demand [Source: LoanPro, 2025].

Problem with BNPL Legacy Cores

When banks add Buy Now, Pay Later to their existing systems, they're connecting two different worlds. Modern BNPL requires sub-second responses at checkout. Legacy bank cores were built for overnight batch processing. This creates friction in five areas: product setup, authorization, general ledger posting, settlement, and charge-offs.

Traditional banking engines weren't designed for micro-installments like "Pay-in-4." Authorization queues that work fine for credit cards can bottleneck at the point of sale when BNPL traffic arrives. High-volume micro-transactions can exceed database capacity during GL posting. Collections workflows designed for large-dollar defaults become uneconomical for $25 installments.

When Systems Collide

The integration produces three failure patterns. Batch job overruns happen when real-time BNPL requests hit database tables locked for overnight interest calculations. The morning batch job misses its window, and operations stall.

Queue backlogs develop when BNPL authorization requests stack up behind standard bank transactions. The queue depth exceeds system limits, triggering timeouts across all channels.

Partial ledger writes occur when a loan is disbursed, but the customer balance update fails. The back office inherits a reconciliation problem that compounds with each incomplete transaction.

The Compliance Layer

Banks need explainable AI to meet OCC and CFPB requirements. BNPL underwriting uses real-time cash flow analysis and digital behavior data, not just credit bureau scores. When the system declines an application, it must generate reason codes that satisfy regulatory review.

This means implementing SHAP or LIME for model interpretability. It also requires model risk management frameworks that detect drift as spending patterns change. The AI needs to show its work, and that work needs to remain unbiased over time.

Building Alongside the Legacy Core

The solution is to build a modern banking layer next to the mainframe, not replace it. New BNPL traffic runs through cloud services while traditional banking operations continue on the core.

The API Gateway as Router

An API gateway sits at the network edge and inspects each request. BNPL transactions get routed to the new microservices. Traditional requests—like savings account queries—pass through to the legacy system. The gateway determines the path based on product type.

Microservices for BNPL Operations

The BNPL process splits into separate services, each handling one part of the lifecycle: The Origination API captures application data. The Risk engine evaluates and approves credit using real-time decisioning. Offer Management sets the payment terms based on the customer profile. The Disbursement service moves funds and schedules future payments.

The Ledger Adapter translates transaction data into formats the legacy core accepts for final settlement. Collections and Disputes operate independently, bypassing the core's collections logic. This separation means a slow dispute process won't delay loan originations.

Maintaining Consistency Across Systems

Distributed services need coordination to prevent data errors: Saga orchestration handles failures. If a BNPL approval succeeds but disbursement fails, the system rolls back the credit authorization. Idempotency prevents duplicate processing when network issues cause repeated requests. The Transactional Outbox pattern ensures a service only signals success after saving data to its database.

How a Transaction Moves Through the System

A customer initiates checkout. The gateway identifies the BNPL request and routes it to Origination. The Risk engine approves the transaction. The Repayment Scheduler sets payment dates. The Ledger Adapter sends a single summary record to the legacy core to update the master ledger.

Building Regulatory Compliance Into the Architecture

The integration needs governance controls that protect the core banking system. A failure in BNPL services should not affect the mainframe.

An API gateway handles all incoming credit requests and decides where to send them.

The BNPL Lending Rails Services

The architecture is decomposed into specific Lending Rails to ensure high cohesion and failure isolation:

- Origination API: Manages the application lifecycle and KYC ingestion.

- Risk/Decisioning: Executes AI models for real-time approvals (including the explainability logs for the ECOA).

- Offer Management: Dynamically generates terms, such as "Pay in 4" vs. interest-bearing monthly installments.

- Repayment Scheduler: Calculates the specific amortization/payment dates for the consumer.

- Disbursement: Triggers the movement of funds to the merchant upon successful checkout.

- Ledger Adapter: Acts as the translation layer, formatting microservice events into accounting entries that the legacy Core can ingest.

- Collections & Disputes: Dedicated services for managing delinquent accounts and transaction reversals.

Keeping Data Consistent

Distributed systems need safeguards to prevent data mismatches. Each API request includes a correlation ID. If a network timeout happens during a transaction, the retry won't create a duplicate loan. Saga orchestration manages multi-step processes like approve, schedule, and disburse. When disbursement fails, the orchestrator triggers compensating transactions to undo previous steps.

The transactional outbox pattern writes to the local database and an outbox table in one atomic operation. An event relay pushes events to the message bus, keeping the core and microservices synchronized.

Monitoring Performance in Real Time

Regulators expect banks to track system performance and respond to incidents. Service Level Objectives define acceptable performance, like 99.95% availability for BNPL authorizations. The error budget determines how much downtime is allowed before feature releases stop and teams focus on stability.

Distributed tracing follows a transaction from the mobile app through each microservice to the legacy core. Engineers can pinpoint where delays occur. Synthetic probes run test transactions continuously to catch problems before customers experience them.

Governance for AI Credit Decisions

BNPL uses AI for credit approvals, which requires Model Risk Management to meet OCC and CFPB requirements. The system logs reason codes for every rejection to comply with the Equal Credit Opportunity Act. These explainability artifacts show why credit was denied.

A Phased Path to Modern BNPL

Banks need a migration plan that tests new systems before shifting financial risk. This approach uses shadowing and limited launches to protect the core during transition.

Q1: Testing Without Risk

The first three months focus on validation without changing the production system. Traffic mirroring sends a copy of each credit request to the new microservices while the legacy core still makes the actual decision. This shows how the new system would respond without affecting customers.

A shadow ledger runs in the cloud. Teams compare their balances against the legacy system daily to catch reconciliation issues. Baseline performance metrics get established for latency, traffic volume, errors, and system load. These benchmarks guide future transitions.

Q2: Controlled Production Launch

After shadow data confirms accuracy, a small portion of traffic moves to the new system.

Blue/green deployment shifts 5% of Pay-in-4 transactions to the microservices. If errors increase, traffic routes back to the legacy environment. The bank limits exposure by launching only to specific merchant categories or a selected customer group.

Automated rollback procedures can redirect all traffic back to the core in under 60 seconds if problems emerge.

Q3 and Q4: Expansion and Legacy Retirement

The final six months shift from building to replacing.

Product offerings expand beyond Pay-in-4 to monthly installments and interest-bearing BNPL. Teams identify hard-coded paths in the legacy core that no longer receive traffic. These paths get permanently routed to microservices.

A tracking report shows the percentage of credit-related mainframe jobs that have moved to the cloud environment.

Economics of BNPL: Comparing Vendor Platforms with In-House Development

Selecting whether to build or buy your BNPL technology is a choice between Speed-to-Market and Future-Proofing. For a bank, the danger of "Buying" is getting locked into a vendor's ecosystem, while the danger of "Building" is missing the 2026 market window.

Recommendation—The "Adapter Strategy."

- Domain Gateway: Create a standard internal API for "Lending Services." Your mobile app only talks to this internal gateway, never to the vendor.

- Contract-Tested Adapters: Use an adapter (a small piece of code) to translate your internal "Lending" language into the Vendor's API language.

- The Swap: If you decide to switch vendors (e.g., from Klarna to a custom build), you only rewrite the Adapter, not the entire mobile app or core banking integration.

The Rule of Thumb for Building a BNPL

- BUY the "Commodity" parts: The Merchant Portal, the Consumer App UI, and the Repayment UI.

- BUILD the "Differentiating" parts: The Risk/Decisioning Engine, the Ledger Adapter, and the Customer Data Schema.

Because you can replace a UI easily, but you can never easily replace your credit logic or your data history once it’s locked in a vendor’s proprietary database.

Saurabh Sahu

CTO, GeekyAnts

GeekyAnts’ Work for the Fintech Sector

A fintech operating in highly regulated markets (UK, Canada, Europe, Australia), GeekyAnts built a scalable cross-platform solution to handle global transactions.

- The Strategy: We utilized a Microservices Architecture (Node.js) with a monorepo setup to minimize inter-service latency and maximize code reusability. To protect against the volatility of global markets, we implemented ECS auto-scaling and WAF firewall protection.

- The Outcome:

- 400M+ Global Payments processed annually.- 120k+ Active Users across five major regions.- 58% CPU Efficiency was maintained even under heavy user loads.

We modernize your lending infrastructure using a Strangler Fig approach, wrapping your legacy mainframe in a proxy layer to launch BNPL services without a "Big Bang" migration. By isolating credit logic into independent Lending Rails, we ensure system failures are contained, and data remains perfectly reconciled via custom Ledger Adapters.

Our delivery is tied directly to your KPIs: we co-own 99.95% uptime and track your Strangling Ratio to prove exactly how much legacy debt is being decommissioned each quarter. We maintain stability through automated runbooks, keeping deployment failure rates below 5%.

FAQs

1. How do the Saga and Outbox patterns keep our money and data consistent?

Think of these as the "safety net" for digital transactions. In a modern system, a single action—like a refund—has to happen in several places at once (the app, the bank's main ledger, and the customer’s notification). The Saga pattern acts like a conductor: if one step fails, it automatically triggers a "cancel" command for the previous steps, so no money is lost in limbo. The Outbox pattern ensures that messages between these systems are never lost. It saves the message to a "to-do list" in the database at the same moment the transaction happens, making it impossible for the system to forget to send a payment update.

2. How does the Strangler Pattern protect our existing banking system?

Instead of replacing your entire old system at once (which is risky and expensive), the Strangler Pattern lets us build the new BNPL features on the side. We put a "smart router" in front of your old system. When a customer uses a new BNPL service, the router sends them to the new cloud system. If they are using a traditional service, it sends them to the old core. This allows us to "strangle" the old system’s workload piece by piece until the new system is fully ready, ensuring the bank never has to go offline.

3. Where should credit decisions happen to satisfy legal rules?

To follow fair lending laws (like the ECOA), the system must be able to explain exactly why a customer was approved or denied. We keep this "Decision Engine" as its own separate service. Every time a loan is rejected, the system creates a digital receipt called a "Reason Code." This receipt lists the specific factors used, such as a low credit score or an inconsistent payment history. This makes it easy for the bank to prove to regulators that the AI is making fair, unbiased decisions.

4. How do we make sure we don't accidentally "double-post" a transaction?

Citations And Sources

Related Articles

Dive deep into our research and insights. In our articles and blogs, we explore topics on design, how it relates to development, and impact of various trends to businesses.