Table of Contents

BNPL App Development Cost Guide 2025-26: PCI-DSS Compliance, Scalability & ROI

Author

Subject Matter Expert

Date

Book a call

Key Takeaways

- The BNPL market is growing at a 26% CAGR through 2030, outpacing the 8–10% annual growth of credit cards and positioning itself as one of the fastest-rising segments in global fintech.

- Compliance and scalability are the two pillars of Buy Now Pay Later Apps success, as U.S. regulators tighten oversight, and only platforms with strong data protection and adaptive infrastructure can sustain profitability.

- Gen Z and Millennials are driving BNPL adoption in the U.S., with over 80% showing interest in installment-based payments, signaling a generational shift in financial behavior and digital lending preferences.

- BNPL’s ROI depends on risk control and user retention. AI-based credit scoring and personalized repayment experiences can improve default rates and lifetime value, turning compliance investments into ROI accelerators.

The digital economy is changing the very idea of credit, transforming payments into relationships of trust. What began as a convenient checkout option—“split your payment in four”—has grown into one of the fastest-moving sectors in fintech. According to Research and Markets, the global Buy Now, Pay Later (BNPL) market is expected to reach nearly US$1.43 trillion by 2030, growing at a 17.2 percent CAGR from 2024.

Younger consumers drive this digital shift, with over 50% of U.S. Gen Z and Millennials already using BNPL, with 54% of Gen Z using it during the 2024 holiday period. paymentsdive.com

- Building a regulatory-ready architecture,

- Scaling infrastructure for exponential growth, and

- Turning compliance and risk-visible investments into meaningful ROI.

Why BNPL App Development Is a Smart Investment for Businesses Today

The BNPL market is maturing under increased regulatory pressure. Pay Later option providers are facing compliance standards comparable to traditional credit card companies. This trend is already separating serious players from opportunistic ones. The businesses building strong risk and fraud frameworks early are setting themselves up for sustainable growth.

While these regulations tighten, the market opportunity remains open—the Global BNPL market is expected to reach USD 681.13 billion by 2033—but the window for establishing leadership is narrowing as regulatory requirements solidify and operational barriers rise.

The strategic value to BNPL Business growth lies in understanding the following areas:

- Expanded customer access,

- Incremental transaction volume,

- And higher order values.

BNPL also reaches underserved segments (Millennials and Gen Zs) and converts purchases that would otherwise be abandoned. McKinsey research indicates that 61% of BNPL transactions represent new business rather than substitution from existing payment methods.

Kunal Kumar

Chief Revenue Officer

Insight: BNPL users return more often when repayment terms are clear and consistent. Owning the BNPL experience lets brands convert that trust into higher lifetime value.

Types of BNPL Apps and Their Estimated Development Costs

Every BNPL app begins with, “What kind of product are you building, and who is it for?” The answer defines every subsequent choice — from system architecture and compliance scope to total development cost. A platform designed for mass consumer adoption, for instance, requires greater scalability and stronger risk frameworks than a single-merchant pilot. Achieving that level of reliability calls for developers who understand both financial regulations and high-performance engineering.

| App Type | Typical Cost Range | Build Approach Options | Key Considerations |

|---|---|---|---|

| Basic MVP BNPL | US$ 30k-60k | Outsource/freelancers can work well | Focus on core features only: sign-up, checkout integration, simple instalments. |

| Moderate Complexity BNPL | US$ 60k-150k | Hybrid (outsourced + small internal team) | More merchant integrations, maybe multiple platforms (web + mobile), basic risk/credit logic. |

| Enterprise/Full-feature BNPL | US$ 150k-300k+ |

Ideally, in-house or a large outsourced partner

| Features like AI credit scoring, fraud detection, a deep merchant ecosystem, multi-region/currency, and regulatory compliance. |

| Build Approach – In-house vs Outsource | In-house: Higher upfront cost (salaries, overhead) | Choose based on long-term strategy | In-house gives control & integration; outsource gives cost savings & speed but needs strong management. |

Factors that affect the BNPL App Development Cost Guide for Scaling and Compliance.

Building a Buy Now, Pay Later (BNPL) app requires balancing cost, compliance, scalability, and customer trust. Whether you are a fintech startup or an enterprise scaling your credit offering, understanding what drives development cost helps you build smarter and faster.

1. App Type & Complexity

The foundation of BNPL app development begins with the app’s type and depth of functionality. A minimal MVP helps startups test demand fast, while enterprise-grade ecosystems combine multiple merchant dashboards, AI-driven risk modules, and region-specific compliance layers.

| Variant | Description | Estimated Cost (USD) | Best Suited For |

|---|---|---|---|

| Basic Consumer BNPL App | Simple “Pay in 4” model; single merchant integration; limited reporting | $30K–$60K | Startups, MVP validation |

| Multi-Merchant Aggregator App | Merchant dashboard, admin portal, consumer app, payment APIs | $80K–$150K | Fintech SMEs or expanding startups |

| Enterprise BNPL Platform | Full ecosystem: AI risk engine, multi-country support, regulatory compliance | $200K–$500K+ | Established fintechs, banks |

Insight: Complexity determines your app’s scalability ceiling — a modular architecture early on saves 2–3x rework costs during scale-up.

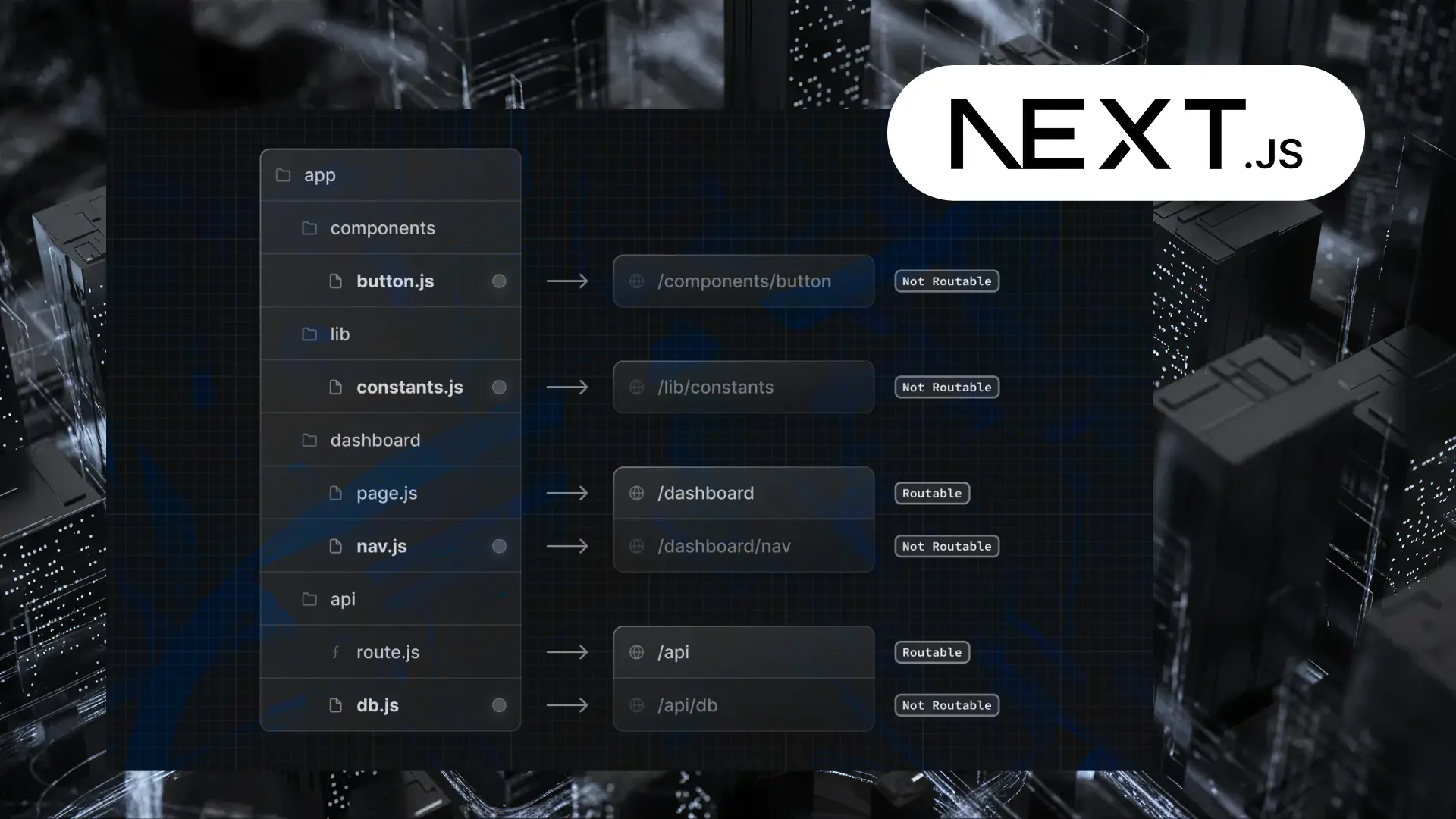

2. Architecture & Scalability

Once the app structure is defined, scalability determines how far it can go. BNPL platforms process millions of microtransactions; reliability, uptime, and fault tolerance become business-critical. A cloud-native, event-driven, microservices setup ensures that performance stays steady—even during peak load spikes.

| Component | Role in BNPL | Pros | Cons | Cost Impact | Business Need |

|---|---|---|---|---|---|

| Microservices Architecture | Breaks the app into independent modules (payments, user, risk) | Easier scaling; independent deployments | Requires strong DevOps | +15–25% dev cost | Long-term scalability |

| Cloud Infrastructure (AWS/GCP) | Enables auto-scaling, high uptime | Flexible, reliable | Monthly cloud costs | $2K–$10K/month | Real-time, global access |

| Event-Driven Processing | Handles transaction bursts efficiently | High performance | Complex testing | +10% | Peak-time stability |

Insight: For BNPL, scalability equals reliability — downtime during payment approval can result in direct revenue loss.

3. Risk & Credit Scoring Systems

Scalability brings growth, but growth introduces risk. A strong scoring engine—whether rule-based or AI-driven—decides who gets approved and how safely. While rule-based systems work for MVPs, AI models predict defaults, detect anomalies, and cut bad debt over time. GeekyAnts integrates intelligent scoring modules and predictive analytics for clients, helping them make faster and safer lending decisions.

| Feature | What It Does | Cost Range | Business Need |

|---|---|---|---|

| Rule-Based Scoring | Uses fixed criteria (income, history) | $10K–$20K | MVPs, pilot launches |

| AI/ML Credit Scoring | Predicts default using behavioral data | $40K–$100K+ | Mature BNPLs, data-driven firms |

| Fraud Detection Engine | Monitors anomalies & user patterns | $10K–$25K | Compliance-driven markets |

Insight: AI risk modeling increases ROI by reducing defaults 10–30%, but requires large user datasets — best integrated after scale.

4. Compliance & Regulation

| Area | Function | Pros | Cons | Cost Range | Business Need |

|---|---|---|---|---|---|

| KYC/AML Integration | Identity & anti-fraud verification | Instant compliance; automation | Vendor cost | $5K–$15K/integration | U.S./EU BNPLs |

| Credit Bureau Reporting | Submits repayment history to bureaus | Builds consumer credit | Legal complexity | $10K–$25K | Regulated markets |

| Legal Compliance Engine | Terms, disclosures, limits | Regulatory peace of mind | Legal overhead | $15K–$30K | U.S., EU |

Insight: CFPB’s new BNPL supervision (2025) makes compliance a top 3 cost driver — investing early saves reengineering later.

5. Third-Party Integrations

| Integration Type | Example APIs / Services | Integration Cost | Best For |

|---|---|---|---|

| Payments | Stripe, Adyen, Visa APIs | $5K–$15K each | Merchant BNPL |

| Bank Data / Open Banking | Plaid, TrueLayer, MX | $8K–$20K | AI underwriting |

| KYC / AML | Onfido, Trulioo, Alloy | $10K–$25K | User onboarding |

| Messaging / Notifications | Twilio, Firebase | $2K–$5K | Customer communication |

| Analytics / BI | Mixpanel, Segment, Looker | $5K–$10K | Scale stage |

Insight: Third-party integrations can consume 20–30% of the total budget, but cut development time by 4–6 months.

6. UX/UI & Customer Experience

In BNPL apps, clear repayment timelines, transparent installment details, and frictionless checkout experiences keep users confident and returning. Good UI/UX design directly affects conversions and reduces support calls by helping users understand what they owe and when.

| Aspect | Role in BNPL | Cost Range | Business Need |

|---|---|---|---|

| Transparency Design | Shows installment terms clearly | $5K–$15K | Consumer BNPL apps |

| One-Tap Checkout | Fast approvals | $10K–$20K | Retail BNPL |

| Merchant Dashboard UI | Data analytics for merchants | $10K–$25K | Multi-merchant apps |

Insight: Good UX = higher trust. A 1-second delay or unclear installment flow can cause a 15–20% checkout drop.

7. Backend Infrastructure & Data Security

| System | What It Does | Pros | Cons | Cost | Business Need |

|---|---|---|---|---|---|

|

Cloud Hosting

| Stores app & user data | Reliable, scalable | Ongoing cost | $2K–$10K/month | Uptime-critical apps |

| Encryption & Tokenization | Secures user data | Prevents breaches | Adds latency | +10% infra cost | All fintech apps |

| Logging & Monitoring | Tracks system health | Detects issues early | Setup complexity | $5K–$10K | Large BNPLs |

Insight: Security spend = trust spend. Each $1 in cybersecurity saves ~$4 in data loss recovery (IBM 2024).

8. AI, Analytics & Personalization

AI in BNPL helps personalize offers, predict repayment behavior, and detect fraud early. Data-driven insights allow you to understand your users better and tailor credit terms that suit their needs, improving both conversions and repayment rates. While AI app development costs more initially, it boosts ROI significantly through automation and smarter decision-making. GeekyAnts uses AI and ML models to help fintech apps make predictive, data-backed choices, just like we did for a Global Payment Processing AI-powered platform.

| AI Capability | Function | Cost Range | Ideal For | GeekyAnts Expertise |

|---|---|---|---|---|

| Personalized Credit Offers | Predicts affordability | $30K–$60K | Mature BNPLs | AI Interview System |

| Behavioral Analytics | Tracks purchase trends | $20K–$40K | Growth stage | FleetEdge |

| Fraud Detection AI | Monitors real-time anomalies | $30K–$80K | Large BNPLs | FleetEdge + UnoJobs |

Insight: Adding AI increases build cost by 20–25% but can double ROI by cutting credit losses.

9. Developer Location & Expertise

Where your development team is based greatly influences project cost and quality. U.S. and European come with higher hourly rates. Asia has equally skilled developers at a fraction of the cost, ideal for startups and scale-ups looking to build efficiently. The right mix of global expertise and local efficiency can save up to 50% in costs without sacrificing quality.

| Region | Avg. Hourly Rate | Pros | Cons | Suitable Business Type | Estimated Full App Cost | Notes |

|---|---|---|---|---|---|---|

| U.S. & Canada | $120–$200/hr | Proximity, fintech law familiarity, timezone alignment | Expensive; lower flexibility | Enterprises needing compliance-ready builds | $250K–$600K | Ideal for regulated markets |

| Europe (UK, Germany, Nordics) | $80–$150/hr | Strong fintech ecosystem; PSD3 experience | Limited availability; timezone gap | Cross-border fintechs | $150K–$400K | Great for EU-focused BNPL |

| Asia (India) | $25–$60/hr | Cost-effective, scalable teams, fintech-savvy | Requires project management | Startups, scale-ups | $60K–$200K | hybrid pricing and top quality |

Insight: Choosing an offshore team from India can reduce cost by 40–50% while retaining compliance quality.

10. Estimating U.S.-Based Development Costs

| Region | Avg. Hourly Rate (USD/hr) | Total Estimated Project Cost | Best Suited For |

|---|---|---|---|

| U.S. (Partner Teams) | $90–$150/hr | $250K–$600K | Regulated enterprises, U.S. fintechs |

| Hybrid (U.S. + Offshore Mix) | $40–$90/hr | $120K–$300K | Scale-ups and global BNPL platforms |

| Offshore (India) | $25–$60/hr | $60K–$200K | Startups and early-stage fintech MVPs |

Kumar Pratik

Founder & CEO

11. Maintenance, Support & Compliance Updates

| Category | Function | Pros | Cons | Annual Cost | Business Need |

|---|---|---|---|---|---|

| Feature Enhancements | Adding new merchants, APIs, and dashboards | Continuous growth | Adds cost | $10K–$30K/year | All active BNPLs |

| Compliance Updates | Adjust to new regulations | Legal protection | Requires vigilance | $10K–$20K/year | Regulated markets |

| Performance Optimization | Scaling infra, caching, bug fixes | Faster user experience | Recurring expense | $10K–$25K/year | Growth-phase BNPLs |

Insight: Neglecting maintenance for 6 months can increase bug density by 40–60%. Continuous improvement ensures ROI continuity.

12 Must-Have Features of a Modern BNPL App

As BNPL becomes a mainstream credit and checkout option, the competitive edge lies in building a system that balances compliance, scalability, and experience. Below are the 12 essential features that define a successful BNPL platform.

1. User Onboarding & KYC Verification

BNPL platforms handle credit at scale, which makes identity verification and eligibility assessment non-negotiable from a risk and regulatory perspective. A modern onboarding system must support multi-layer sign-up via email, mobile, and ID matching, while automating KYC and AML checks through providers like Onfido or Trulioo. Bank account verification and fraud detection should be embedded in the flow to ensure only legitimate users enter the system. This builds user trust, ensures legal compliance, and minimizes risk exposure from the first interaction.

2. Payment Gateway & Checkout Integration

Checkout integration in Buy Now Pay Later Apps enables users to split payments instantly and merchants to boost conversions at the point of sale. The platform must offer "Pay-in-4" or custom installment options with instant approval powered by API-based verification. Integrations with processors like Stripe, Adyen, or proprietary payment systems ensure compatibility across merchant platforms. Seamless checkout experiences increase merchant sales and drive user adoption by removing friction at the moment of purchase. GeekyAnts' fintech teams have delivered multi-country payment gateway integrations for large-scale platforms.

3. Repayment & Installment Management

Transparent repayment management reduces defaults and improves user satisfaction by keeping customers informed and in control. The system should provide dynamic payment calendars with automated reminders, support both auto-debit and manual repayment options, and automate late fees with proactive alerts. Clear visibility into upcoming payments and flexible repayment options ensures users stay on track, which reduces collection costs and improves portfolio health.

4. Credit Scoring & Risk Engine

Accurate credit assessment protects both revenue and compliance by ensuring that lending decisions are based on reliable data. The platform must incorporate AI or rule-based scoring models, integrate with credit bureaus like Experian and Equifax, and include fraud analytics with risk visualization dashboards. This minimizes defaults, improves lending accuracy, and sustains profitability by aligning credit offers with actual user risk profiles. GeekyAnts' experience with AI-driven decision engines enhances BNPL risk evaluation accuracy.

5. Transaction History & Analytics

Users and merchants need complete visibility into their financial interactions to build trust and manage reconciliations. The platform should provide detailed transaction logs and repayment summaries, spending trend analysis, and exportable reports in formats like PDF and CSV. This transparency simplifies merchant operations and gives users confidence that their financial data is accessible and accurate.

6. Notifications & Alerts

Real-time communication prevents missed payments and improves engagement by keeping users informed at every stage of the transaction lifecycle. The system must support push notifications and email reminders for upcoming dues, transactions, and approval alerts, and promotional updates for limited offers. Consistent communication improves repayment rates and keeps users active within the ecosystem.

7. Merchant & Admin Dashboard

Operational control drives merchant retention and BNPL growth by providing the tools needed to manage transactions, settlements, and performance. The dashboard should support merchant onboarding and KYC, transaction tracking with refund and settlement workflows, and revenue analytics with performance insights. Data-driven visibility helps merchants understand how BNPL impacts their sales and allows administrators to monitor system health. GeekyAnts' Fintech and FleetEdge case studies highlight their ability to build multi-role dashboards with real-time visibility.

8. Security & Compliance Modules

BNPL is a financial product, which means compliance with data protection and lending laws is central to sustainability. The platform must implement AES-256 encryption and tokenization, OAuth 2.0 authentication, and built-in frameworks for GDPR and CFPB compliance. Fraud detection systems should run continuously to identify suspicious activity before it impacts users or merchants. These measures reduce regulatory risk and enhance customer confidence in the platform.

9. Customer Support & Dispute Resolution

10. Analytics & Reporting Suite

Real-time analytics turn data into actionable insights for growth and compliance by consolidating information across users, merchants, and transactions. The platform must provide revenue dashboards and default-rate reports, operational and customer behavior analytics, and ROI monitoring tools. Leadership teams rely on these insights to make informed, data-backed decisions about product development, risk management, and market expansion. GeekyAnts builds real-time analytics layers that consolidate user, merchant, and transaction data into actionable dashboards.

11. Loyalty Programs & Rewards

As BNPL competition intensifies, retaining users is as vital as acquiring them, and loyalty programs help encourage repeat usage. The platform should offer reward points for timely repayments, tiered loyalty levels like Silver, Gold, and Platinum, cashback and referral bonuses, and gamified repayment milestones. These features improve repayment behavior, build brand loyalty, and create a differentiated user experience. GeekyAnts' UX-first projects like WaxBuddy demonstrate expertise in gamified engagement and loyalty-based design.

12. Integration with Other Apps & Ecosystems

BNPL thrives when integrated into user and merchant ecosystems, making payments an embedded experience rather than a separate task. The platform must support e-commerce plugins for Shopify and WooCommerce, wallet and bank integrations with Apple Pay, Google Pay, and Plaid, and connections to CRM, ERP, and accounting tools. Open APIs for third-party developer extensions expand reach and strengthen partnerships, positioning BNPL as part of a broader fintech ecosystem. GeekyAnts' Fintech Global Payment Processing platform showcases how strategic API integrations drive multi-region BNPL scalability.

BNPL ROI Forecasting: How U.S. Fintechs Can Balance Compliance, Cost, and Scale

Formula-wise, ROI can be expressed as:

Understanding return on investment for BNPL requires enterprises to project revenue streams against the full spectrum of costs and risks. The ROI model should account for incremental revenue from merchant fees, consumer charges, and interest income, balanced against credit risk, fraud exposure, regulatory compliance expenses, and infrastructure investments.

Accenture's analysis demonstrates the potential scale: embedding BNPL in credit card offerings could boost income for large U.S. banks by 10-16% in 2025, driven by increased card utilization from 21% to 26%. The framework must capture both the opportunity—higher transaction volumes, expanded customer segments, reduced cart abandonment—and the reality that growth alone guarantees nothing. Grant Thornton emphasizes that U.S. lenders must integrate all cost strands and delayed repayment patterns into their forecasts as regulatory requirements tighten.

Strategic ROI modelling demands scenario planning across base, aggressive, and stressed cases, with conservative assumptions on default rates reflecting current consumer financial pressures and compliance burdens. Enterprises should measure time to profitability, not just velocity of growth, and align the model with their specific business context—retailers may prioritize conversion lift and order value over take-rate optimization.

The most expensive part of BNPL apps begins after they go live. BNPL platforms must adapt to new compliance requirements, rising transaction volumes, and evolving consumer expectations. If these ongoing costs are ignored, your ROI projections can quickly fall apart.

1. Post-Launch Maintenance & Support

Ongoing maintenance ensures your BNPL platform remains secure, stable, and compliant. Regular updates, API upgrades, and feature enhancements protect uptime and user experience while adapting to regulatory shifts. The 2025 BNPL outlook highlights a market focused on “recovery, regulation, and reinvention”—where continuous improvements are not optional but essential for sustainable growth.

2. Third-Party Service Fees

Every external integration—payments, KYC/AML, and fraud detection—introduces recurring vendor costs. These services often charge per-transaction or monthly fees that rise with volume. Over time, vendor renewals, API usage surcharges, and compliance-driven adjustments can collectively add 20–30% to annual operating expenses.

3. Infrastructure & Scalability

As users and merchants scale, so do hosting, data storage, and processing demands. BNPL is transitioning into a “structured, compliant credit ecosystem,” requiring enterprise-grade cloud infrastructure and redundancy systems. This ongoing investment ensures performance, availability, and regulatory data retention across regions.

4. Ongoing Compliance & Security Costs

Regulators like the CFPB and FCA are tightening BNPL oversight, mandating affordability checks, transparency, and secure data handling. Continuous compliance audits, legal reviews, and system updates add measurable recurring costs but safeguard long-term credibility. Providers that embed compliance by design avoid re-engineering later—saving significant future expense.

5. Compliance & Legal Oversight

Evolving policies demand legal counsel, regulatory audits, and real-time reporting systems. These activities form a hidden yet critical expense, typically consuming 3–5% of annual operational budgets. Investing in proactive compliance avoids penalties and reinforces brand trust.

6. Partner and Merchant Servicing

As merchant partnerships grow, so do reconciliation, settlement, and reporting costs. Maintaining merchant satisfaction requires dedicated account management and automation tools. Over time, this becomes a predictable expense tied directly to transaction volume.

7. Customer Dispute Resolution

Disputes over repayments, chargebacks, or refunds increase as adoption scales. Efficient dispute handling needs automated workflows, trained support staff, and strong CRM systems. Without automation, these operations can consume up to 10% of yearly OPEX.

8. Data Storage, AI Monitoring, and Insurance Premiums

Massive transaction data requires secure, compliant storage and periodic AI model retraining. Combined with fintech insurance premiums against fraud or credit defaults, these costs grow steadily alongside platform expansion. Together, they represent a crucial but often overlooked component of long-term sustainability.

Kumar Pratik

Founder & CEO

How Leading USA Fintechs Reduce Buy Now Pay Later App Build Costs Without Sacrificing Quality

Building a BNPL app doesn’t have to drain your entire product budget. With a cost-sensitive and modular approach, founders can control development spend while still delivering enterprise-grade fintech quality. Here are proven strategies backed by industry insights.

1. Start with an MVP (Minimum Viable Product)

Prioritize the core flow—checkout integration, payments, user onboarding, and repayment tracking. According to fintech best practices, starting lean allows faster market validation and lowers upfront risk. For example, Deloitte notes that financial firms are rethinking software engineering to “boost productivity and lower efficiency ratios” by starting smaller and focusing on value.

Once the MVP succeeds, scaling features like loyalty rewards and multi-currency support become easier.

2. Adopt Cross-Platform Frameworks

Instead of building separate native apps, use shared frameworks like React Native or Flutter. This approach supports faster time-to-market and cost efficiency. As Gartner indicates, mobile development frameworks that enable cross-platform compatibility reduce rewrite efforts and lower the cost burden. Cross-platform solutions also simplify post-launch updates and API version management.

3. Leverage Existing APIs and SaaS Infrastructure

Integrating established fintech APIs—such as payments, identity verification, or risk tools—cuts development time. Strategic outsourcing and platform ecosystem approaches are emphasised in KPMG’s outsourcing research: “future of outsourcing… goes beyond simple cost metrics or geographic shifts.” KPMG

This means using pre-built systems rather than building everything in-house.

4. Outsource Strategically

A hybrid resourcing model—offshoring development to skilled teams while keeping product management local—can deliver cost savings. EY, through its insights on software engineering economics, highlights the importance of efficient teams and deliberate resourcing decisions. This model allows many fintech firms to hit the market sooner, with lower fixed costs.

5. Modular Architecture for Future Growth

Adopt a microservice-based architecture to enable independent feature additions. This avoids large rewrites later. Deloitte’s platform strategy work emphasises the need for digital platforms to be built on modular foundations to generate value and avoid technical debt. This ensures your BNPL system can scale without inflating cost.

Business Takeaway

Kumar Pratik

Founder & CEO

The smartest BNPL strategies balance cost, compliance, and scalability. Hidden expenses like maintenance and third-party fees can erode profit if ignored, while a phased, modular approach ensures flexibility. Businesses that plan for these realities upfront not only save costs but also build fintech platforms designed to evolve with the market.

Regulations and Compliance for a BNPL App Development

Launching a BNPL app in the U.S requires regulatory readiness. Compliance defines whether your platform can operate legally, earn user trust, and scale without risk. BNPL providers are subject to a mix of federal, state, and financial security regulations that directly influence development cost, investor confidence, and long-term ROI.

U.S. BNPL Compliance Requirements, Cost, and Business Impact:

| Regulation / Compliance Area | Estimated Cost Impact | Business / ROI Impact |

|---|---|---|

| CFPB & Regulation Z (Truth in Lending Act) | 10–15 % of total development cost (billing system, refunds, dispute workflows) | Enables full federal compliance; builds user trust; failure risks fines and reputational loss. |

| State-Level Licensing (California, New York) | $50 000–$150 000 per year (legal filings + license maintenance) | Grants legal entry into key U.S. markets; non-compliance leads to operational shutdowns or bans. |

| PCI-DSS Data Security Standards | $20 000–$80 000 annually (audits, encryption tools, monitoring) | Reduces breach risk; safeguards user data; supports merchant and card-network partnerships. |

| OCC Guidance for Banks | $25 000–$60 000 annually (audit and vendor-management costs) | Makes the platform bank-partnership ready; ensures safe expansion into regulated financial ecosystems. |

| Credit Reporting & Emerging Regulations | $10 000–$30 000 (one-time API integration + data reporting setup) | Improves transparency and trust; aligns with FICO and bureau standards; future-proofs the product. |

| Finish / Refund / Dispute Handling Obligations | Adds 5–10 % to the initial build cost for automation and merchant integration | Enhances customer experience; reduces chargebacks; avoids CFPB penalties. |

| Vendor and Third-Party Risk Management | $10 000–$40 000 per vendor for audits and compliance contracts | Protects against partner non-compliance; lowers reputational and regulatory risk. |

| Affordability & Creditworthiness Verification | $15 000–$50 000 (development + API licensing for AI/credit checks) | Lowers default rates; improves ROI via better risk scoring; aligns with regulatory expectations. |

| Advertising, Disclosure & Marketing Compliance | $10 000–$25 000 per year for legal review and campaign monitoring | Prevents misleading claims; safeguards brand credibility; mitigates enforcement risk. |

1. CFPB & Regulation Z (Truth in Lending Act)

The Consumer Financial Protection Bureau (CFPB) has clarified that BNPL products often fall under Regulation Z, part of the Truth in Lending Act. This means your app must provide clear billing statements, manage refunds, and resolve disputes. According to the CFPB’s interpretive rule and KPMG’s analysis, BNPL lenders need standardized disclosures, transparent fees, and robust refund workflows.

For a founder, this affects backend design. There is a need for automated refund tracking, dispute management tools, and compliance dashboards to meet these standards. Ignoring them risks enforcement penalties or restricted operations.

Cost & Impact: Building Reg Z-compliant systems adds roughly 10–15 % to development cost but reduces chargebacks and strengthens customer trust.

2. State-Level Licensing

States are now tightening their control over BNPL operations. New York’s 2025 BNPL law, explained by Greenberg Traurig, and California’s Department of Financial Protection and Innovation (DFPI) guidance both classify certain BNPL products as consumer loans. This means you need state-level lending licenses to operate legally. So, you must plan for multi-state compliance and legal filings if they expect national coverage.

Cost & Impact: Securing state licenses and legal reviews can cost $50 000–$150 000 per year, but it ensures uninterrupted operations and avoids forced market exits.

3. PCI-DSS Data Security Standards

Handling cardholder data requires full compliance with the Payment Card Industry Data Security Standard (PCI-DSS). The PCI Security Standards Council explains that encryption, firewalls, and tokenization are mandatory to protect customer transactions.

For a fintech founder, PCI-DSS compliance means integrating secure APIs, limiting data access, and maintaining audit-ready logs.

Cost & Impact: Achieving PCI-DSS v4.0 certification costs $20 000–$80 000 annually, yet non-compliance can lead to million-dollar breach penalties and user attrition.

4. OCC Guidance for Banks

The Office of the Comptroller of the Currency (OCC) directs banks offering BNPL-type products to adopt “safe and sound” risk controls. The 2023 bulletin emphasizes strong vendor oversight, responsible lending, and data security.

If your BNPL app partners with a bank, you must align with OCC governance — requiring audit logs, vendor-risk monitoring, and model-risk documentation.

Cost & Impact: Adds recurring expenses for audits and compliance officers but makes your BNPL platform eligible for large-scale banking partnerships.

5. Credit Reporting & Emerging Regulations

The CFPB and credit bureaus are pushing BNPL lenders to start reporting repayment data to strengthen consumer credit visibility. FICO announced that BNPL payment histories will soon factor into credit scores, and the CFPB’s 2025 industry report reinforces this expectation.

For founders, this means creating data pipelines to credit bureaus and updating user consent flows.

Cost & Impact: Integrating credit-reporting APIs adds limited upfront cost but improves lending transparency and trust.

6. Finish / Refund / Dispute Handling Obligations

Under CFPB rules, BNPL providers must pause payment collection during dispute investigations and issue refunds for returned products — similar to credit-card practices. Your platform, therefore, needs a refund module and automated merchant coordination.

Cost & Impact: Development of refund and dispute automation adds 5–10 % to initial build cost but protects ROI by reducing chargebacks and complaints.

7. Vendor and Third-Party Risk Management

Every BNPL platform depends on external vendors — from KYC providers to payment processors. The CFPB and OCC expect founders to maintain written vendor-risk policies and regular compliance audits.

Cost & Impact: Adds legal and contract-management costs, but reduces exposure if a partner violates data or lending laws.

8. Affordability & Creditworthiness Verification.

Regulators increasingly demand responsible lending practices to prevent “loan stacking.” BNPL companies must evaluate a user’s ability to repay, using soft-pull credit data or AI-based scoring. Norton Rose Fulbright notes that stronger underwriting is becoming a regulatory expectation.

Cost & Impact: Adding credit-assessment APIs or AI models raises development cost, but reduces default rates and boosts ROI sustainability.

9. Advertising, Disclosure & Marketing Compliance

BNPL advertising must state repayment schedules, late fees, and interest terms. Misleading marketing — for example, “zero-cost credit” — can trigger enforcement. PerformLine’s 2025 report emphasizes standardized disclosures across channels.

Cost & Impact: Requires legal review of all campaigns and automated compliance tracking, but safeguards brand credibility and prevents regulatory fines.

Hiring Models for Buy Now Pay Later App Development That Drive ROI and Compliance

Choosing the right hiring model has a direct impact on the overall cost, efficiency, and scalability of BNPL app development. Models like in-house and dedicated development teams offer greater control and long-term consistency, while fixed-cost and T&M models help manage budgets during early or evolving project stages. Hybrid models combine offshore development with local coordination, giving global BNPL operators the advantage of faster delivery and cost optimization without compromising quality.

| Hiring Model | Description | Cost Range (USD/hr) | Financial Impact on BNPL | Best Suited For |

|---|---|---|---|---|

| In-House Model | Provides a managed in-house team working directly within the client’s project scope — full control, full-time engagement, and often colocated management. | $50–$90/hr | Ensures premium delivery quality- Ideal for sensitive fintech systems needing regulatory precision | Enterprises with regulated BNPL systems |

| Dedicated Team Model | The Exclusive GeekyAnts team acts as a remote extension of the client’s in-house workforce. | $25–$60/hr | Saves 40–50% vs U.S. in-house- Sustainable ROI- Long-term consistency | Mid-to-large BNPL fintechs |

| Fixed-Cost Project Model | Predefined scope, cost, and deadline for an MVP or pilot BNPL build. |

(Project-based) $30K–$80K

| High ROI for MVP validation- Budget-safe for early startups | Startups validating BNPL concept |

| Time & Material (T&M) Model | Payment based on hours/resources; perfect for evolving BNPL features or compliance-driven iterations. | $30–$70/hr | Adaptive to changing compliance- Reduces downtime & rework | Scale-ups & compliance-heavy BNPLs |

| Hybrid Model | A mix of offshore and client-region coordination (U.S./EU PMs or product leads). Balances cost, communication, and speed. | $30–$80/hr (avg.) | Fast global delivery with balanced cost- Ideal for multinational fintech ecosystems | Global BNPL operators & cross-border lenders |

Kunal Kumar

Chief Revenue Officer

Why GeekyAnts — Your Trusted BNPL & FinTech App Development Company

For over 18 years, GeekyAnts has delivered leading-edge fintech and BNPL solutions globally. With more than 550+ clients globally and a deep focus on U.S.-grade compliance and offshore efficiency, we position ourselves as your go-to BNPL and fintech app development company.

We bring three core strengths:

- Proven BNPL / FinTech Delivery Experience: For example, our “Fintech Mobile Web App Development For Global Payment Processing” case study shows that we processed 400 M+ global payments annually, served 120k+ active users across the UK, Canada, Europe & Australia, and built a system capable of handling rapid growth.

- PCI-DSS & Fintech Compliance Expertise: Our blog post “Building a Scalable, Compliant Payment Platform: An Approach” outlines how we built fintech platforms with automated KYC/KYB, bank connectivity, and security-first architecture.

- U.S. + Offshore Delivery Model: We combine U.S. product-leadership with offshore engineering to deliver premium quality at cost efficiency—giving you the control of a domestic team and the scale advantages of offshore talent.

Building BNPL Platforms That Last Beyond the Trend

Sustainable BNPL platforms require strategic planning beyond initial launch. Every platform that scales securely and sustainably will do so because it chose to treat compliance not as red tape but as a compass—guiding growth, protecting users, and ensuring trust.

Measure your compliance, architecture, and costs with precision before you build. That is how businesses turn regulatory pressure into a strategic advantage and transform a good idea into a lasting financial ecosystem.

FAQs

1. What are the essential security compliances for BNPL apps?

BNPL apps must follow PCI-DSS, GDPR/CCPA, and CFPB Regulation Z standards to ensure secure data handling, transparency, and credit accountability.

2. Why is PCI-DSS compliance critical for BNPL app development?

It protects payment data through encryption and tokenization, helping avoid million-dollar breach penalties and ensuring merchant partnerships.

3. How long does BNPL app development take per tier?

- MVP build: 3–5 months

- Mid-tier BNPL: 6–8 months

- Enterprise platforms: 9–12 months

4. How does scalability affect BNPL app cost?

Scalable cloud architecture adds 15–25% upfront cost but prevents downtime and expensive re-engineering as user volumes grow.

5. How do cost and ROI align for BNPL solutions?

ROI improves when compliance, fraud prevention, and credit scoring are built from day one—lowering defaults and boosting repeat transactions.

6. What’s the expected ROI of investing in a BNPL app?

Enterprises typically see 10–16% higher revenue through increased order value, conversion rates, and new customer segments.

7. What features should be prioritized in the first version (MVP)?

Focus on KYC, checkout integration, repayment tracking, and fraud detection to validate market demand quickly.

8. How do 2025–26 regulations impact BNPL app costs?

New CFPB and state-level rules raise compliance costs by 10–20% but improve user trust and investor confidence.

9. Can I launch faster with a white-label BNPL solution instead of custom development?

Yes, but white-label platforms limit flexibility and data control; custom builds offer stronger compliance and brand differentiation.

10. How can fintech founders control BNPL development costs without compromising quality?

Use modular architecture, API-first design, and hybrid teams to balance cost, speed, and compliance while ensuring scalability.

References

https://www.grantthornton.co.uk/insights/new-bnpl-rules-in-the-us-financial-resilience-is-key

https://www.consumerfinance.gov/rules-policy/final-rules/code-federal-regulations

https://www.stinson.com/newsroom-publications-new-cfpb-interpretive-rule-to-regulate-bnpl

https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2025/future-outsourcing-rethink-everything.pdf