Table of Contents

API-First Banking: Building Partner Ecosystems for Embedded Finance in North America

Author

Subject Matter Expert

Date

Book a call

Key Takeaways

- API-first banking turns financial services into modular components, allowing banks, credit unions, and licensed financial institutions to scale faster, integrate with platforms easily, and unlock new revenue channels through embedded finance.

- North America’s financial ecosystem is shifting toward partner-led distribution—platforms that embed payments, lending, and identity services are capturing customer ownership, while institutions without API maturity risk being pushed into low-margin infrastructure roles.

- Winning in this landscape requires clear partner governance, standardized APIs, compliance-ready architecture, and strong observability across every transaction—capabilities that define successful embedded finance ecosystems.

North America's financial system is entering a decisive phase. Banks no longer compete only with banks. Marketplaces, SaaS platforms, retail giants, and mobility apps have become the new distribution channels for financial services.Their strength lies in the ability to embed financial features directly into user journeys, removing friction and owning the customer experience.

Regulated financial institutions across North America—banks, credit unions, and large financial service providers—move faster when they adopt an API-first strategy. They launch products sooner, build partnerships with less friction, and respond to regulatory demands with greater control. Institutions that delay this shift risk slipping into low-margin infrastructure roles while competitors strengthen customer relationships and capture more revenue.

How Customer Expectations Are Driving API-First and Embedded Finance Adoption

Customers in North America expect financial interactions to match the speed and simplicity of modern digital products. They want instant credit decisions, seamless in-app payments, and smooth checkout experiences. Whether they shop, book a ride, manage payroll, or sell through a marketplace, they expect financial features to appear naturally within the platforms they already use.

Kumar Pratik

CEO, GeekyAnts

Insight:

Increasing Market Pressure in North America’s API-First Banking

Fintechs and technology platforms have moved quickly to build partner-led financial models. Retailers now integrate credit options at checkout. Payroll and HR systems embed wage disbursement and financial tools. Delivery platforms offer instant earnings access to workers. These capabilities work only when regulated financial institutions—banks, credit unions, and licensed financial service providers—expose their core financial functions as clean, programmable API services.

Banks and credit unions remain essential because they handle compliance, capital requirements, and regulatory oversight. But speed is becoming as important as control. When non-financial companies evaluate potential banking partners, they prefer institutions that can integrate smoothly, maintain reliable API performance, and reduce onboarding friction.

API-First Embedded Finance: Operating Model for Banks and Platforms

API-first embedded finance transforms how regulated financial institutions—including banks, credit unions, and licensed financial service providers—deliver their capabilities. Instead of building new products end-to-end, these institutions expose core functions such as payments, identity verification, account creation, balance checks, and credit decisioning as standardized APIs. Non-financial platforms such as retailers, HR systems, SaaS companies, and marketplaces then embed these financial capabilities directly into their user experience.

How the API-First Embedded Finance Ecosystem Works

API-first embedded finance works only when every participant in the ecosystem plays a defined role. Banks, credit unions, and licensed financial institutions provide the regulatory and capital backbone. They handle compliance, consumer protections, KYC/AML oversight, and credit policies that keep financial services safe and lawful. BaaS and API infrastructure providers sit between banks and platforms, turning complex financial capabilities—payments, identity verification, underwriting, transaction monitoring—into clean, programmable APIs. They also maintain documentation, uptime, sandbox environments, and operational governance. Non-financial platforms such as retailers, SaaS companies, and marketplaces deliver these capabilities to end users. They manage the experience layer, design the interface, and ensure the interaction feels natural within their product. Customers benefit when this chain works smoothly. To them, the financial task—whether paying, borrowing, or receiving funds—should feel instant, predictable, and safe.

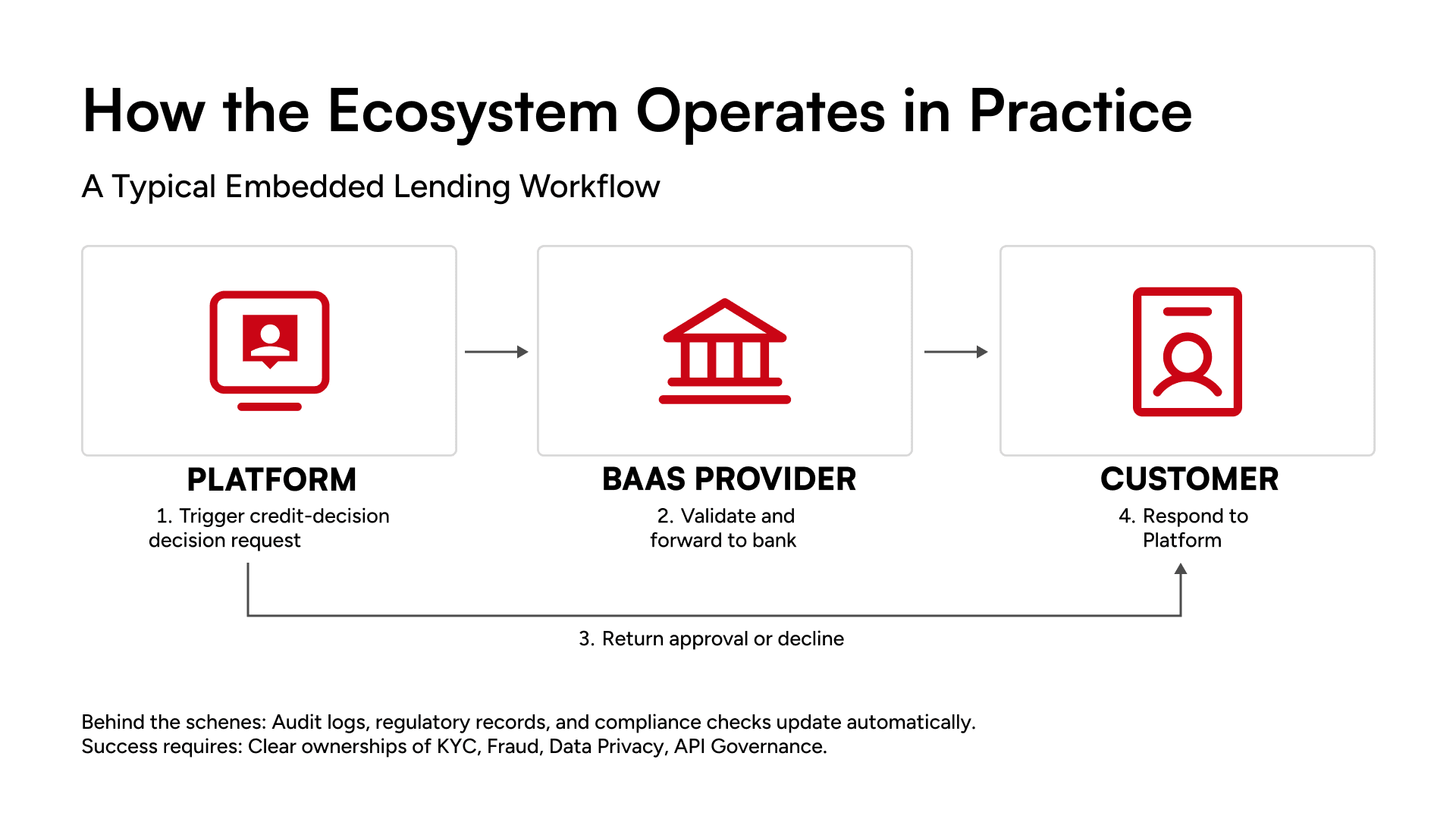

How the Ecosystem Operates in Practice?

A typical embedded lending workflow shows how these roles connect:

- The platform triggers a credit-decision request through the BaaS provider.

- The BaaS layer validates the call and forwards it to the bank’s risk engine.

- The bank reviews the request and returns an approval or decline.

- The response reaches the platform in seconds, allowing the customer to complete the action without interruptions.

- Behind the scenes, audit logs, regulatory records, and compliance checks update automatically.

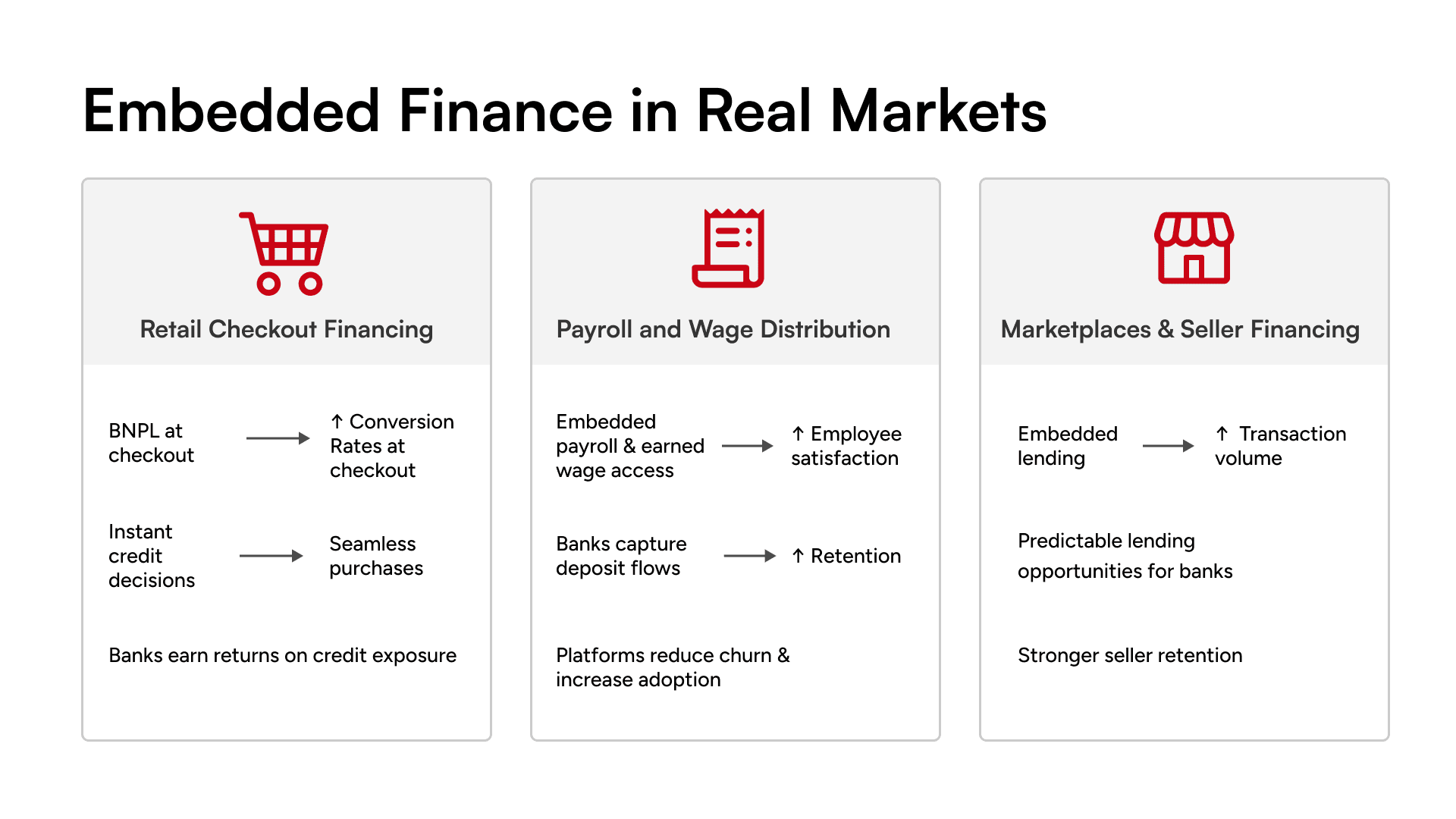

Embedded Finance in Real Markets: Retail, Payroll, Marketplaces

Retail Checkout Financing

BNPL options embedded at checkout have improved completion rates for retailers and opened new credit opportunities for banks. When decisions happen in seconds, customers complete purchases without disruption. Retailers see higher volume, while banks earn returns on credit exposure.

Payroll and Wage Distribution

HR platforms increasingly embed payroll and earned wage access. This provides immediate value to employees and positions banks to handle deposit flows they would otherwise lose. Platforms benefit from reduced churn and higher adoption.

Marketplaces and Seller Financing

Large marketplaces use embedded lending to help sellers manage inventory and cash flow. These financing tools increase transaction volume, strengthen retention, and give banks predictable lending opportunities tied to real business activity.

How to Integrate API-First Banking Solutions with Legacy Platforms

Moving to an API-first architecture is rarely a clean-slate exercise. Most regulated financial institutions rely on decades-old systems built for stability, not composability. Core ledgers, underwriting engines, card systems, and payment processors often operate on proprietary protocols, batch schedules, or tightly coupled interfaces. Because of this, the integration path depends on an institution’s current constraints, risk tolerance, and long-term vision. The goal is to modernize without disrupting active operations, while creating a foundation that supports scalable partnerships and faster product launches.

Common Integration Patterns (With Real-World Context)

The Strangler Pattern

The strangler pattern introduces new API services alongside existing systems and gradually shifts traffic to the new architecture. Legacy components remain operational until their replacements prove stable. This model works well for large institutions that want modernization without major business disruption.

Why financial institutions choose it:

- It supports progressive migration.

- Teams can rebuild high-impact services first (e.g., decisioning, onboarding).

- It reduces the risk of moving mission-critical workloads all at once.

How it plays out in practice:

- Teams wrap specific legacy functions with new API layers.

- Traffic is routed through a gateway that directs requests to the newer or older component, depending on readiness.

- Over time, legacy modules are retired without a hard cutover.

The API Wrapper Pattern

The wrapper pattern allows institutions to keep existing systems intact while exposing their capabilities through a clean API abstraction layer. This does not modernize the core system, but it creates a consistent interface for partners, developers, and internal teams.

Why financial institutions choose it:

- Fastest path to enabling embedded finance.

- Reduces partner onboarding friction immediately.

- Requires limited changes to legacy systems.

Limitations:

- Technical debt remains.

- Underlying system constraints—latency, batch processing, data silos—still exist.

- Overreliance on wrappers can delay modernization if not followed by a longer-term plan.

Hybrid Approaches

Most institutions adopt a hybrid approach. They use wrappers to quickly expose key capabilities—payments, KYC, transaction history—while rebuilding foundational components using strangler techniques. This creates momentum and allows teams to test new partner integrations before committing to deeper modernization.

Why this becomes the practical choice:

- Balances speed with long-term resilience.

- Reduces internal resistance by demonstrating early wins.

- Supports a step-by-step migration tied to business priorities rather than technology alone.

Selecting the Right BaaS and API Partners

Choosing a BaaS or API infrastructure partner is a strategic call, not a procurement exercise. The right partner influences speed-to-market, compliance posture, and the technical reliability of every integration the institution supports.\

Key evaluation areas include:

1. Uptime Guarantees and Incident Transparency

Partners should provide verifiable uptime records, detailed incident postmortems, and contractual penalties for SLA breaches. Embedded finance collapses without predictable availability.

2. API Quality and Documentation

Clear documentation, SDKs, versioning policies, sandbox environments, and real-world examples reduce integration time for internal teams and external partners. Weak documentation increases dependency and creates bottlenecks.

3. Compliance and Audit Readiness

The partner must maintain certifications relevant to the services they provide—SOC 2 Type II, PCI DSS, ISO standards—and support audit trails that regulators can review. Institutions should verify that the partner can adapt to U.S. state-by-state lending laws and Canadian provincial requirements.

4. Latency, Load Handling, and Observability

API-first models fail if performance suffers during high-volume periods. Institutions should test partner APIs under load, examine p99 and p999 latency, and confirm the presence of distributed tracing.

5. Exit Strategy and Vendor Lock-In

Performance and Observability (The Make-or-Break Capability)

Financial transactions require consistent performance and transparent operations, especially when multiple systems—from core banking to risk engines to payment gateways—operate across the workflow.

Institutions maintain performance by:

- Monitoring latency across each microservice and ensuring sub-500ms responses for high-volume transactions.

- Implementing distributed tracing (e.g., OpenTelemetry) to follow a request across the entire ecosystem.

- Creating operational dashboards that track error rates, timeouts, queue delays, and third-party dependencies.

- Running continuous load tests to simulate partner traffic and validate system resilience.

- Establishing clear SLOs and error budgets for internal teams and external partners.

Security, Compliance, and Risk in an API-First World for North American Institutions

Financial services in North America operate under strict regulatory expectations. Adding partners increases both reach and risk, so institutions need strong frameworks for oversight.

Regulatory Requirements

Regulated financial institutions in the United States must comply with privacy rules, consumer protections, credit reporting standards, and federal and state lending laws. In Canada, provincial data rules and national privacy legislation add another layer. Embedded finance does not reduce regulatory responsibility; it requires better coordination and clearer controls.

Securing the API Layer

Security begins with authentication and authorization. OAuth and mutual TLS ensure only approved partners can access sensitive systems. Rate limits prevent misuse. Encryption protects data both in transit and at rest. API gateways serve as traffic governors, ensuring requests follow established rules.

Managing Third-Party Risk

Each additional platform introduces a new point of exposure. Institutions must verify certifications, test vendor security posture, audit logs, and enforce clear boundaries on data use. Strong contractual language, continuous monitoring, and defined breach protocols are essential for maintaining trust.

Compliance Automation

The Challenges of API-First Banking—and How To Overcome Them

Shifting to an API-first operating model delivers clear advantages, but regulated financial institutions encounter structural, regulatory, and cultural barriers along the way. Addressing these challenges early creates a smoother transformation path and ensures that embedded finance partnerships scale without friction.

Legacy System Constraints

Regulated financial institutions often operate on decades-old cores designed for stability, not composability. These systems create slow data access, rigid workflows, and limited integration points.

A practical path forward:

- Start by modernizing non-critical flows such as onboarding verification, account lookups, or reporting APIs.

- Redirect traffic through gateways that sit on top of legacy systems.

- Expand API coverage only after teams validate reliability and performance.

This phased approach builds confidence, avoids disruptions, and creates measurable wins that support long-term modernization.

Fragmented Regulatory Requirements

Financial institutions in North America must navigate a patchwork of federal, state, and cross-border regulations. Lending rules, data privacy statutes, and KYC/AML obligations vary significantly between jurisdictions.

Institutions that adapt fastest:

- Replace static rule engines with configurable compliance layers that handle different states, provinces, and product types.

- Maintain audit-ready logs and data lineage to simplify regulator reviews.

- Embed regulatory decisioning into APIs so partner platforms receive consistent, compliant outputs.

A flexible compliance infrastructure turns regulatory complexity into a manageable workflow.

Growing Security Exposure

Every new API, partner, and integration point expands the institution’s attack surface. Without disciplined governance, vulnerabilities multiply.

Effective institutions:

- Centralize authentication, authorization, and API key management.

- Apply continuous monitoring and anomaly detection across the entire transaction path.

- Maintain zero-trust policies for all partner interactions.

- Conduct periodic penetration tests that include both internal systems and partner-facing APIs.

A unified security strategy is essential when multiple participants contribute to a single financial action.

Organizational and Cultural Resistance

Transformation fails when technology changes, but culture does not.

Institutions that shift culture successfully:

- Launch pilot squads that integrate engineers, compliance experts, and product teams.

- Invest in hands-on API training, documentation standards, and shared architectural patterns.

- Set measurable goals—such as reducing integration time or eliminating manual review steps.

Cultural alignment accelerates every subsequent partnership and reduces operational friction.

Performance Pressure in Distributed Systems

API-first ecosystems distribute responsibilities across banks, BaaS providers, partner platforms, and third-party vendors. Latency issues in any component affect the entire customer journey.

To maintain reliable performance, institutions:

- Use distributed tracing to map the full request lifecycle.

- Set strict performance targets for internal teams and external partners.

- Stress-test APIs under realistic partner volumes.

- Build retry logic, circuit breakers, and fallback paths into all critical workflows.

Why Leading Financial Platforms Partner with GeekyAnts

Kumar Pratik

Founder and CEO, GeekyAnts

GeekyAnts helps financial institutions and digital platforms modernize their architecture for API-first, embedded-finance ecosystems. Our teams design secure, modular services that align with regulatory standards and accelerate partner onboarding. With deep expertise in fintech engineering—covering payment flows, identity verification, API gateways, and scalable microservices—we help organizations reduce development friction and move to market with greater confidence.

Why Choose GeekyAnts

- Proven experience building large-scale fintech and financial services products

- Strong engineering capability in API design, microservices, and secure system integration

- Deep understanding of regulatory-aligned workflows (KYC, AML, auditability)

- Ability to build partner-ready developer portals, sandboxes, and clean API documentation

- End-to-end support—from architecture planning to deployment and optimization

The Road Ahead: How API-First Banking Will Evolve in North America

Regulators in the U.S. and Canada are actively evaluating open-finance standards. These advancements will require stronger API governance, interoperable data frameworks, and higher oversight of third-party integrations. Banks, credit unions, and licensed financial institutions that modernize early will be better prepared for these shifts.

Artificial intelligence is also reshaping financial operations. Enhanced transaction data flowing through API ecosystems will power more accurate credit models, faster fraud detection, and real-time risk evaluation. Meanwhile, market dynamics are changing—some fintech players are consolidating, and new vertical-focused platforms are emerging across healthcare, logistics, manufacturing, and education.

Conclusion

API-first banking is not an industry trend; it is a structural redefinition of how financial services are delivered. For banks, credit unions, and licensed financial institutions across North America, the strategic opportunity lies in becoming partners—not bottlenecks—as financial services move into the platforms customers already use.

The transition demands technical discipline, cross-functional alignment, and clear decisions on governance. But those who act now stand to shape the next decade of embedded finance—capturing new partner relationships, accelerating product launches, and maintaining direct relevance in a platform-driven economy.

FAQs

1. What is the way API-first architecture facilitates embedded finance?

With API-first architecture, financial services—such as payments, identity verification, credit checks, and compliance workflows—are packaged into modular components that approved platforms can access through standardized APIs. This removes dependence on legacy workflows and allows financial institutions to deliver their products inside retail apps, SaaS platforms, and marketplaces without re-engineering core systems.

2. What are the most important advantages of API-first banking to customer experience?

API-first delivery removes friction. Customers receive instant credit decisions, in-app payments, or wage advances without being redirected to a separate banking interface. This reduces abandonment, improves trust, and ensures a smooth experience across digital touchpoints. Platforms that offer this level of integration strengthen user engagement and repeat usage.

3. What can a financial institution do to guarantee the security and compliance of APIs?

Financial institutions use layered controls, including secure authentication (OAuth 2.0 or mTLS), encrypted traffic, rate limits, audit logs, and continuous monitoring. They also rely on flexible regulatory policies for KYC, AML, lending limits, and data privacy to meet state and federal requirements. Strong governance, third-party due diligence, and SOC 2–certified partners ensure all API interactions remain compliant and traceable.

4. What are the principal difficulties in establishing an API-based partner ecosystem for embedded finance?

Key challenges include legacy system constraints, fragmented U.S. regulatory requirements, inconsistent data flows, and increased security risks from third-party access. Institutions that succeed address these issues through clear responsibility matrices, well-documented APIs, configurable compliance engines, and strong operational controls across all partners.

5. What effects does API-first banking have on revenue growth and scalability?

API-first models expand product distribution. Instead of relying solely on traditional acquisition channels, institutions embed lending, payments, or deposit flows within partner platforms. This increases transaction volume, reduces acquisition costs, and builds recurring revenue streams tied to partner growth. The architecture also accelerates product launches, allowing institutions to scale as demand rises.

6. What are the ways banks can work well with non-financial platforms through APIs?

Effective collaboration requires predictable interfaces, clear SLAs, shared security responsibilities, open onboarding workflows, and documentation that supports fast integration. When banks provide technical clarity and compliance guidance, they build stronger partnerships and reduce time-to-market for joint products.

7. What are the effects of API-first banking on time-to-market for new financial products?

With API-first architecture, institutions no longer need to modify core systems for each new product. Reusable services—such as risk checks or payment initiation—can be combined to launch offerings in weeks rather than months. This accelerates partner deployment and enables institutions to respond quickly to market demand.

8. What makes compliance more complex for embedded finance platforms in the United States?

The U.S. regulatory landscape is fragmented. Each state has its own lending, disclosure, and data-handling rules. Federal regulations add requirements for privacy, consumer protection, and credit reporting. Embedded finance doesn’t reduce these obligations—it multiplies them across partners and platforms. Institutions need configurable compliance engines and policy automation to manage this complexity effectively.