Inside Global FinTech Fest 2025: How GeekyAnts Is Powering Enterprise AI Adoption and Legacy Modernization

Author

Date

Book a call

Amid the energy of the Global FinTech Fest 2025 (GFF), Kunal Kumar, COO of GeekyAnts, and Rakesh Ningthoujam, Head of Growth Marketing, stepped aside to reflect on the conversations and ideas shaping the Fintech industry. How India’s FinTech moment is echoing across the world, and how technology, AI, and human foresight are reshaping the enterprise?—Kunal and Rakesh answer these questions based on their learnings from the GFF.

The conversation that follows is edited only for flow and clarity, keeping the candid tone of a discussion that happened right on the GFF grounds.

KK: Yes, it’s not there yet. The framework is still not defined clearly on how AI will integrate into everyday operational activities to actually improve efficiency.

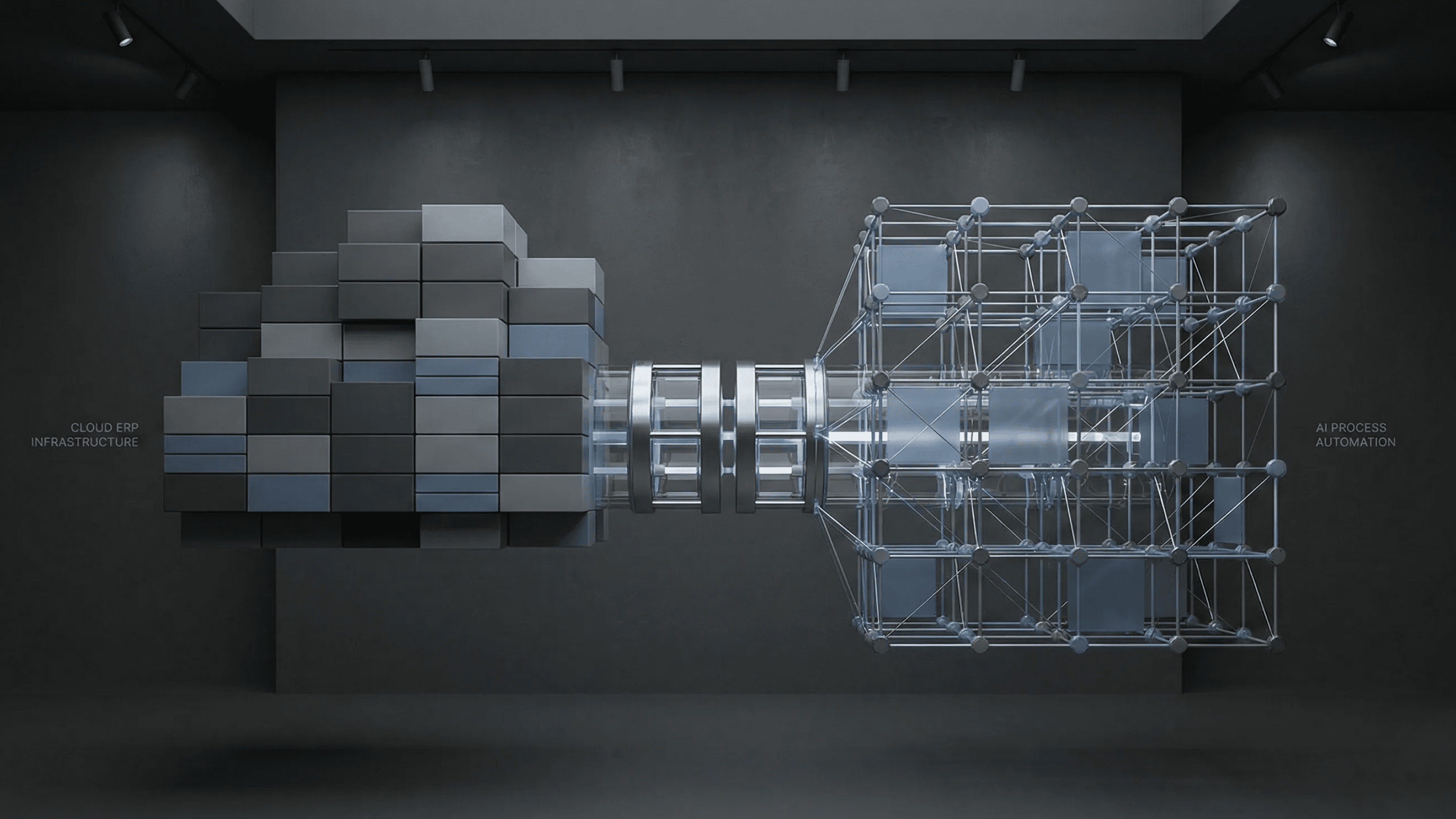

RN: So what if a company or enterprise wants to modernize its entire legacy system? Because we get this question quite often at our booth. Visitors come and say, “I have a legacy modernization requirement. I have millions of lines of code, an entire architecture in place, I want to use AI—but I’m afraid there will be downtime.” What’s your judgment on this?

KK: Legacy system modernization isn’t new. The only new element now is how you’re inserting AI in that process. If the framework is clear and the architecture is well-defined, the risk reduces. However, there needs to be a proper protocol for using AI in coding, along with the right training for people to succeed in the endeavor of integrating AI.

KK: Of course, risks will always exist. But if you have a clear implementation strategy, the chances of anomalies reduce drastically. Since AI is considered the new kid in town, defining how it fits into your system is critical.

The goal is to improve efficiency. AI should act as a support function, but within proper governance. We’re building that governance internally and already testing it with smaller clients to see how it performs.

I believe in the next 12 months, massive changes in the development process will happen. AI will be adopted across industries. The key is how everything talks to one another —connected technologies and connected data. For example, in fintech, where if you’re enabling cross-border transactions, data has to be seamless, and policies must align.

KK: I’d like to see more clarity surrounding the adoption of AI in the fintech industry. We need clearer frameworks and risk controls. If AI integrates properly with existing fintech systems, it can transform client experiences.

I also want to see how enterprises are adopting AI responsibly — under compliance and governance — because that’s the biggest risk right now. Those learnings will be valuable next year.