Table of Contents

How to Create a Digital Wallet App – A Complete Guide

Author

Subject Matter Expert

Date

Book a call

Key takeaways:

- Digital wallets create new growth channels by strengthening customer engagement, loyalty programs, and seamless payments.

- A well-built wallet integrates compliance, security, and scalability to align with both user expectations and regulatory standards.

- GeekyAnts delivers fintech platforms that scale globally, combining UX, real-time monitoring, and API-driven extensibility.

Understanding Digital Wallet Apps

How It Works

- User Authentication – Multi-factor authentication, biometrics (fingerprint, facial recognition), or PIN codes confirm identity before a transaction is authorized.

- Transaction Handling – Once verified, the wallet uses tokenization and encryption to initiate payments through card networks, bank rails, or alternative payment systems.

- Value Storage & Management – Users can link bank accounts, store prepaid balances, or even hold digital assets like cryptocurrencies.

- Integration Layer – APIs connect the wallet to payment processors, KYC/AML services, loyalty systems, and merchant networks.

Consumer vs. Business Digital Wallets

| Aspect | Consumer Wallets (e.g., Apple Pay, PayPal) | Business Wallets (e.g., Merchant, Closed-loop) |

|---|---|---|

|

Primary Goal

| Convenience & speed in daily payments | Cost reduction, engagement & financial control

|

| Key Features | Instant checkout, P2P transfers, rewards | Multi-user access, settlement, expense tracking

|

User Focus

| Individuals & shoppers | Merchants, enterprises, fintechs, banks

|

Integration

| Retail POS, e-commerce, loyalty programs

| ERP, CRM, accounting, custom business systems |

| Strategic Value | Everyday usability & consumer trust

| Efficiency, loyalty, and modernization of payments |

Saurabh Sahu

CTO, GeekyAnts.

Different Types of Digital Wallet Apps You Can Build

| Wallet Type | Description & Business Examples |

|---|---|

|

Closed‑Loop Wallet

| Proprietary wallets usable only within a brand’s ecosystem. Example: Starbucks Wallet—loads, spends, and earns rewards solely within Starbucks. |

Semi-Closed Wallet

| Usable across partnered merchants, but not interoperable with banking rails. Example: Google Pay India or MobiKwik in India. |

|

Open Wallet

| Linked to bank or card systems; widely accepted. Examples: PayPal, Apple Pay, and Google Pay. |

Crypto Wallet

| Stores digital asset keys (public/private). Subtypes include hot vs cold and custodial vs non-custodial.

|

Emerging / IoT Wallets

| Embedded in IoT devices—e.g., transit fare payment in wearables or smart devices. |

Which Wallet is Best Suited for Your Business Goal?

| Business Type | Recommended Wallet Type | Why It Aligns with Goals |

|---|---|---|

| Retailers / Loyalty Brands | Closed-Loop or Hybrid | Drives customer retention with brand control and rewards. |

Banks / Financial Institutions

| Open Wallet | Seamless integration with banking rails and functionality. |

| Marketplaces / Platform Ecosystems | Semi-Closed or Hybrid | Balances reach and collaboration with partners. |

|

SaaS / Payment Service Providers

| Open or Crypto Wallets | Prioritize scalability, diverse payment options, and asset control.

|

Why Create a Digital Wallet: Benefits for Your Business

Building Your Digital Wallet Step-by-Step Process

Robin Ranjan

Senior BA at GeekyAnts

How to use this roadmap

Phase 0 — Outcomes, Constraints, and Success Metrics

Phase 1 — Licensing & Regulatory Pathfinding

Phase 2 — Product Strategy & CX Foundations

Phase 3 — Reference Architecture & Ledger Design

Core components:

- API gateway (rate limits, auth, request validation).

- Identity & auth (OAuth 2.1 / OIDC, FIDO2/WebAuthn, device binding).

- Wallet service & double-entry ledger (idempotency, compensations, immutable journal, reconciliation).

- Payments orchestration (card networks, A2A/open banking, RTP, UPI, SEPA Instant, Faster Payments).

- Tokenization & encryption (network tokenization; vault/HSM/KMS, TLS 1.2+ everywhere, at-rest envelope encryption).

- Risk engine (rules + ML, velocity checks, device fingerprint, sanctions).

- Notifications (push, SMS, email), support tooling (case management), analytics (feature and fraud telemetry).

Tools & frameworks:

- Services: Node.js/TypeScript, Java (Spring), or Go; gRPC/REST; OpenAPI.

- Data: PostgreSQL/CockroachDB for ledger; Redis for caches; S3/object store for artifacts; Kafka/Redpanda for events.

- Keys/Secrets: Cloud KMS + HSM; HashiCorp Vault.

- Standards: ISO 20022 message models; EMVCo tokenization.

Phase 4 — Security-by-Design & Compliance Controls

- Identity assurance: NIST SP 800-63; step-up auth for risky actions.

- PCI DSS v4.x scope: SAQ-D or ROC route; PAN isolation; tokenization; quarterly ASV scans; annual penetration tests.

- AppSec: OWASP ASVS, secure SDLC; SAST/DAST; secrets rotation; SBOM and dependency scanning.

- Data privacy: GDPR/CCPA; data-minimization; retention schedules; data-subject tooling.

- Observability & audit: Structured logs, immutable audit trails, traceability (OpenTelemetry).

Phase 5 — Identity, KYC/AML, and Account Funding

- KYC: Document, biometric liveness, sanctions/PEP screening; waterfall to reduce drop-off.

- Account linking: Open Banking/aggregators (e.g., Plaid/Tink/Yodlee) or direct bank rails; card on-file tokenization; A2A mandates.

- Funding & payouts: ACH/SEPA/RTP/UPI; card top-ups; wallet-to-bank withdrawal; settlement windows and cut-offs.

Phase 6 — Core Wallet Features (MVP → V1)

- Processing/issuing: Stripe Issuing, Adyen, Marqeta, Checkout.com (as appropriate).

- Bill pay & utilities: Local biller hubs; regional aggregators.

- Loyalty/engagement: Braze/Customer.io; in-house rewards service.

Phase 7 — Mobile & Front-End Delivery

Phase 8 — Risk, Fraud, and Trust Engineering

Phase 9 — Money Movement, Reconciliation, and Ledger Integrity

Phase 10 — Data, Analytics, and Personalization

Phase 11 — DevOps, SRE, and Release Engineering

Phase 12 — Quality, Certification, and Readiness to Operate

Phase 13 — Launch, Scale, and Continuous Improvement

Must-Have Features of a Digital Wallet App

Digital wallets succeed when they balance user convenience with business control and security. To achieve this, features must be designed to address both sides of the ecosystem, consumers who expect speed and simplicity, and businesses that require scalability, compliance, and insights.

User-Facing Features

- Quick Onboarding & KYC – Seamless sign-up with automated KYC verification ensures compliance while minimizing friction. Apps like Paytm and Revolut leverage AI-driven KYC to cut onboarding time by up to 70%.

- Multi-Payment Options – Support for cards, UPI, bank transfers, QR payments, and even crypto ensures flexibility. PayPal’s strength lies in its ability to act as a universal payment layer across geographies.

- Real-Time Balance & Transaction History – Users expect instant visibility of balances and detailed transaction logs. Transparency builds trust, especially in high-frequency retail payments.

- Rewards & Loyalty Integration – Wallets such as Starbucks’ closed-loop system have turned loyalty into a $1.6 billion revenue driver. Reward points, cashback, and gamification anchor engagement.

- Security Features – Biometrics, PIN, tokenization, and fraud alerts protect users. Apple Pay’s tokenization model remains the industry benchmark.

- P2P Transfers & Bill Splitting – Venmo and Cash App owe much of their popularity to simple peer-to-peer transfers, making wallets indispensable in social and daily contexts.

- Cross-Border Payments – Increasingly relevant in global marketplaces. Wise and Payoneer have built their competitive edge on seamless international transfers with lower fees.

Admin/Business-Facing Features

- Merchant & User Management Dashboards – Centralized tools to monitor activity, approve merchants, and manage compliance.

- Settlement & Reconciliation – Automated settlements reduce errors and improve financial transparency for enterprises running high-volume transactions.

- Expense & Limit Controls – Especially important for enterprise wallets, where CFOs want visibility and control over employee spending.

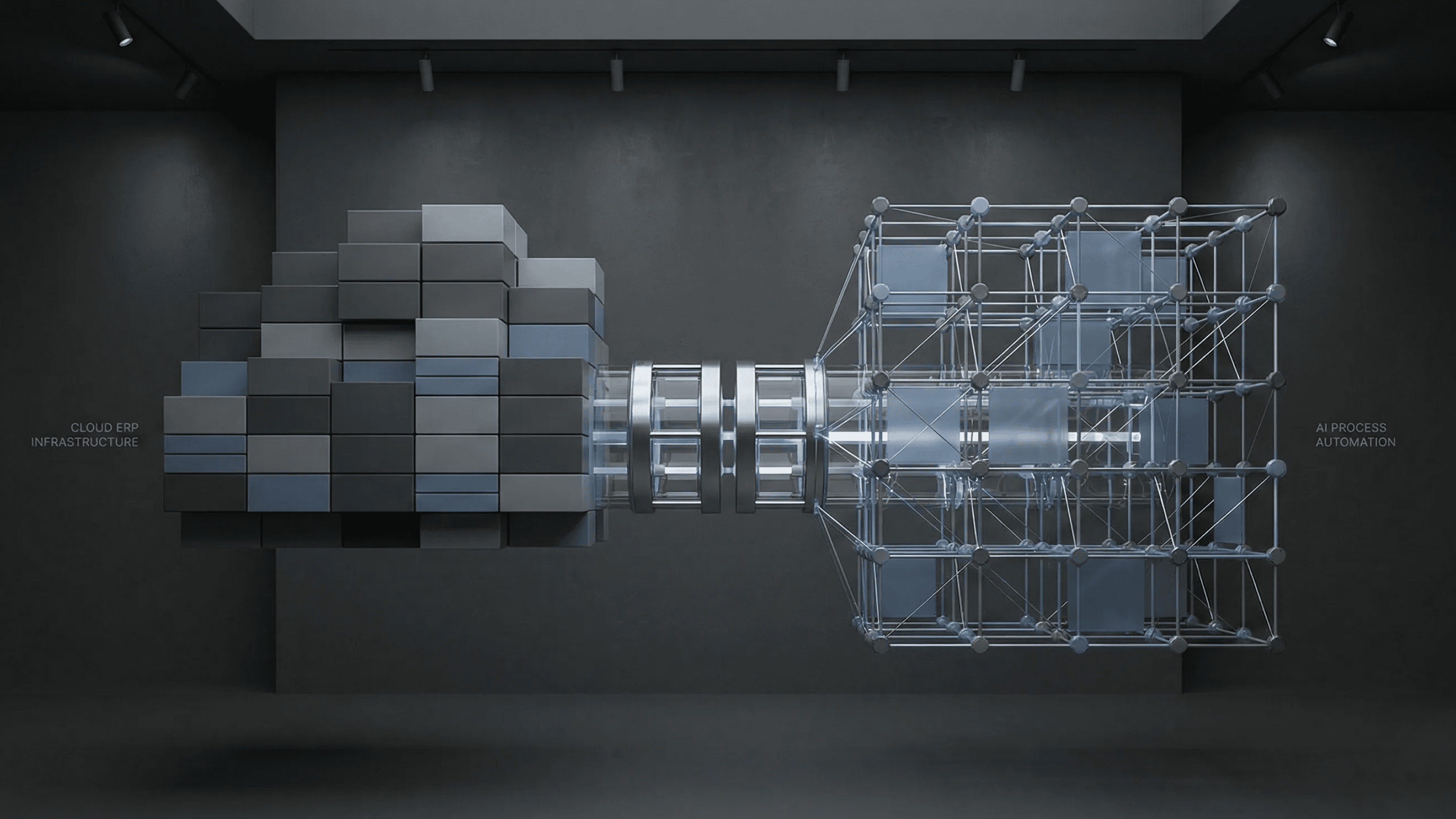

- Integration with ERP/CRM Systems – A must for businesses scaling beyond payments. For example, fintechs and retailers integrate wallets with Salesforce or SAP to unify customer engagement.

- Analytics & Insights – Wallet usage data is a goldmine. Platforms like Square offer transaction insights that help businesses optimize pricing, offers, and customer targeting.

- Fraud Detection & Risk Scoring – AI-driven anomaly detection helps safeguard against transaction fraud, chargebacks, and identity theft.

- Regulatory Compliance & Audit Trails – Full compliance with PSD2, PCI DSS, and GDPR standards ensures long-term viability.

- Multi-Currency & Localization – Businesses expanding globally need wallet systems that adapt to local regulations, currencies, and languages.

Cost Breakdown of Building a Digital Wallet App

- Feature Depth & Complexity – Basic wallets with payments and balance tracking cost far less than enterprise-grade wallets with loyalty systems, multi-currency support, and analytics dashboards.

- Security & Compliance – PCI DSS, PSD2, KYC/AML checks, and data tokenization can account for 20–30% of the budget. Skimping here risks long-term trust and regulatory approval.

- Integrations & Ecosystem Fit – Whether connecting with ERP, CRM, POS, or blockchain systems, integration can double the development effort.

Estimated Cost by Components

How To Set Up a Secure Digital Wallet: Security & Regulatory Compliance

| Component | Description | Range (Min – Max) |

|---|---|---|

| UI/UX Design | Wireframes, user flows, branding, prototyping | $8,000 – $20,000 |

Core Features Development

| Onboarding, KYC, transactions, P2P, wallet balance

| $25,000 – $60,000 |

| Advanced Features | Rewards, loyalty, multi-currency, QR/NFC, cross-border

| $15,000 – $40,000 |

| Admin Panel / Business Tools | Merchant dashboards, settlements, analytics, reconciliation | $12,000 – $30,000

|

| Security & Compliance | Encryption, tokenization, biometrics, PCI DSS, KYC/AML | $15,000 – $40,000

|

| Third-Party Integrations | Payment gateways, banks, ERP/CRM, APIs, blockchain | $10,000 – $30,000 |

| Testing & QA | Functional, performance, security, device testing

| $8,000 – $20,000 |

| Deployment & Infrastructure | Cloud hosting, CI/CD, monitoring, DevOps setup | $5,000 – $15,000

|

| Post-Launch Support | Maintenance, updates, scaling, new features

| $3,000 – $10,000 / month

|

For any digital wallet, trust is the true currency. Users entrust their most sensitive financial information to these platforms, and businesses stake their reputation on ensuring it never falls into the wrong hands. Security and compliance are not optional add-ons; they are the foundation that determines whether a digital wallet can scale, earn user trust, and pass regulatory scrutiny.

Core Security Measures

- Two-Factor Authentication (2FA): Biometrics, OTPs, and hardware keys provide layered protection, ensuring only verified users can access funds.

- Data Encryption: End-to-end encryption safeguards card details and transaction history, making intercepted data unusable.

- Tokenization: Replaces sensitive data with randomized tokens, reducing the risk of fraud during payment processing.

Regulatory and Compliance Standards

- KYC/AML Protocols: Know Your Customer (KYC) and Anti-Money Laundering (AML) checks validate identities and prevent financial misuse.

- PCI-DSS: Ensures secure storage and transmission of cardholder data across payment rails.

- GDPR and Data Privacy Laws: Protects users in Europe and beyond, demanding transparent data handling.

- Regional Banking Norms: Compliance with RBI guidelines in India or U.S. Federal banking standards ensures market access and regulatory acceptance.

Key Challenges in Building Digital Wallet Apps

1. Development Complexity

2. Security and Compliance

3. User Experience vs. Feature Bloat

4. Integration with Ecosystems

5. Scaling Beyond MVP

Digital Wallet Success Stories: Strategy, Adoption, and Growth

GPay (Google Pay)

- Surpassed 67 million monthly active users within two years of launch in India.

- Captured 59% of online transactions in key regions.

- Expanded coverage to over 200,000 stores across 3,500 cities and 2,700 online merchants.

PayPal

- 400 million+ active user accounts by 2021, accepted across millions of merchants.

- Mobile payment volume reached $311 billion in Q2 2021 (58% YoY growth).

- Mobile wallets used by 63% of U.S. digital wallet users; especially popular among Gen Z (56% weekly in-store usage).

Venmo (PayPal’s Peer-to-Peer Growth Engine)

- Contributed to PayPal’s strong performance in Q2 2025—Venmo revenue grew 20%, while PayPal expanded its total payment volume to $443.5 billion, supported by Venmo’s ecosystem play.

| Platform | Strategy Highlights | Success Metrics |

|---|---|---|

| GPay | Built on UPI; early ecosystem partnerships | 67M MAUs; 59% online share; 200K+ stores |

| PayPal | Secure checkout focus; early mobile launch

| 400M+ users; $311B mobile volume |

| Venmo | Social P2P flow embedded in PayPal ecosystem | 20% revenue growth; part of $443B TPV

|

Saurabh Sahu

CTO, GeekyAnts

Why GeekyAnts Is Your Ideal Partner for Digital Wallet App Development

Case Study: Crypto Payments Wallet App for Zapit

- Upgraded to Flutter 2.0 across mobile and web platforms, ensuring long-term maintainability and a unified codebase.

- Designed UX/UI flows that prioritized simplicity and responsive interactions for a crypto-first audience.

- Refactored and migrated legacy code, resolving user token decryption issues to enhance security and performance.

- Extended web support, replacing incompatible packages and ensuring consistent behavior across platforms.

- Executed rigorous QA and partnered closely with the client through delivery, guaranteeing a flawless launch.

- Streamlined cross-platform performance and modernized tech stack

- Resolved critical decryption and token-handling bottlenecks

- Delivered a robust and scalable wallet that earned positive global feedback within the launch phase