Fintech App Development Services

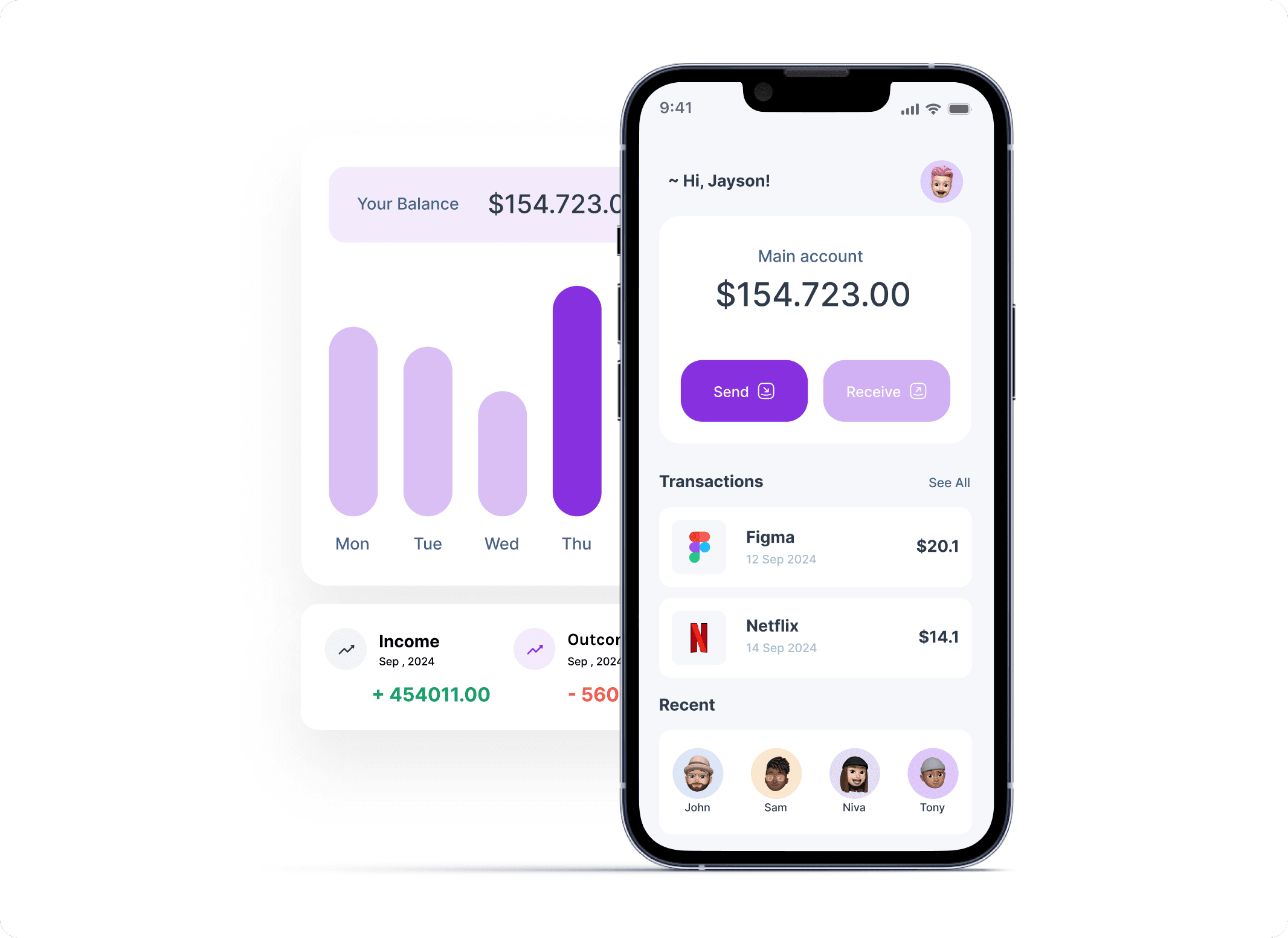

Scale your fintech operations with GeekyAnts’ cutting-edge product for modern financial companies.

From developing intuitive financial management apps to engineering secure internal systems, we deliver top-notch product finance app development services and solutions that enhance customer engagement and operational efficiency.

CASE STUDY

END-TO-END FINTECH APP DEVELOPMENT SERVICES

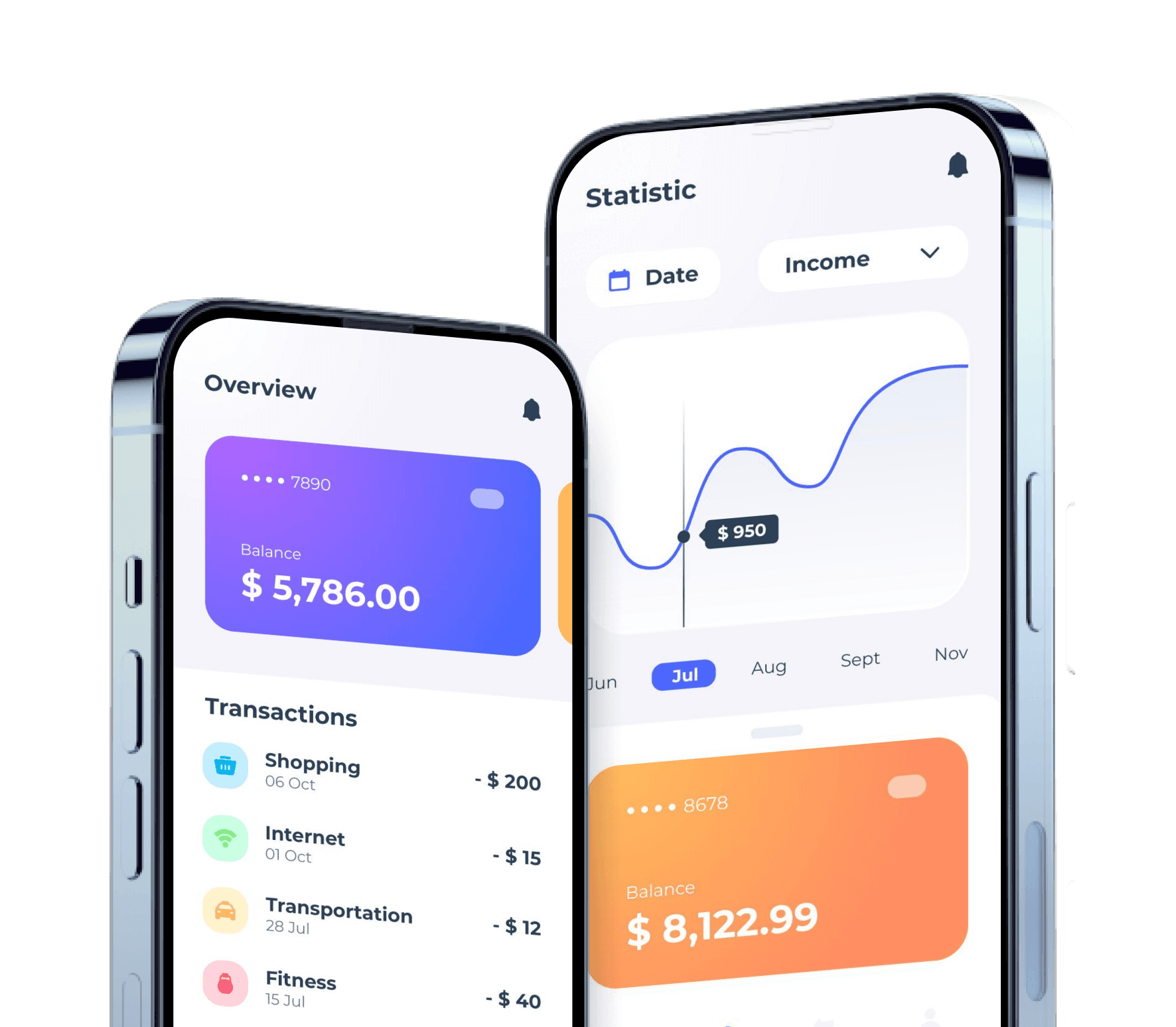

We Help You Scale Fintech Operations Rapidly and Securely, While Strengthening the Bottom Line

Through our extensive expertise in the Fintech industry, we can provide tailored solutions that cater to your unique business needs. Our specialized teams collaborate closely with you, whether by managing projects from inception to completion or by integrating seamlessly as an extension of your team. This ensures that every solution we build delivers measurable value and drives a strong return on investment.

Banking

- Savings accounts

- Loans and risk analysis

- Cards and forex

- Savings plans

Dashboards

- Fundraisers statistics

- Hypertrance

Transactions

- Cross border banking

- Money exchange for 150+ countries

- GPS, QR Code

- UPI Payments

Investments

- Fund management application

- Investment banking application

- Mutual funds

User Experience (UX)

- Multilingual

- Gamification

- Animations

- Underwriting

- Claims

- Policies

Our Fintech App Development Solutions

We Deliver Thoroughly Researched Solutions and Products, Without Compromising Data Security

From custom apps (for increasing user experience and establishing industry leadership) to reducing labor costs — we build solutions that are unique to your Fintech business needs. Our offerings include end-to-end development and ensure solutions that maximize your ROI.

User-centric Approach

Maximum Security

Wide-variety of Payment Integration

AI-powered Bots and Solutions

Compliance Standards

Expert Consultation on Technology

GEEKYANTS FINTECH PORTFOLIO

Why Choose GeekyAnts As Your Fintech App Development Company

For over half a decade, GeekyAnts, a leading fintech app development company has been delivering innovative solutions and services for leaders in the fintech app development industry. Our portfolio is extensive and the products we build now have transactions in the millions. Currently, we are upgrading our fintech offerings for Age AI rapidly.

Dedicated Fintech Engineers

Fintech Projects Delivered

Years of Fintech Delivered

TECHNOLOGY EXPERTISE

We Specialize in AI Solutions, Experience Design, and End-to-End Development Frameworks

GPT

Llama Index

Prompt Engineering

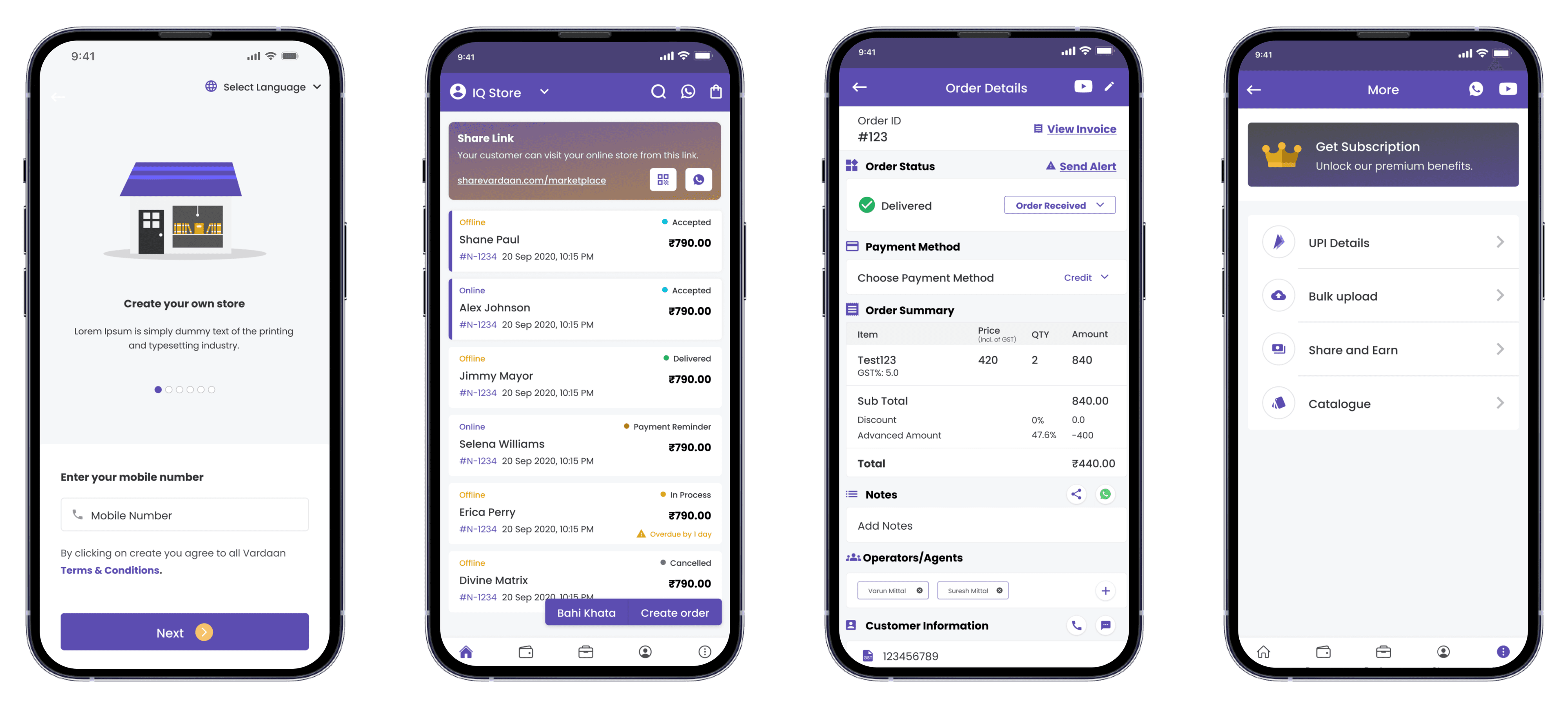

PRODUCT SHOWCASE

Vardaan: Customizable Sales and Accounting Application Managing Online Business

Vardaan is a showcase application that displays our ability to create multiple areas of our fintech app development expertise. It allows you to manage your business through one app and one device. The focus is on simplicity, superior performance, and security. The features are meant to be a practical companion for scaling businesses.

Hire Our Fintech App Development Experts

Get a free discovery session and consulting to start your project today.

FAQs

Learn More About Our Fintech App Development Services

The cost of building a Fintech app varies based on its complexity, the features required, and the level of customization involved. Here’s a breakdown of potential costs based on application types:

- Simple Fintech App: A basic app with core functionalities like user account management, simple transaction tracking, or financial calculators generally costs between $10,000 and $20,000. These apps are ideal for startups or businesses testing the market.

- Average Fintech App: Apps with features like secure payment gateway integration, multi-currency support, advanced data security, and user analytics typically fall in the $20,000 to $35,000 range. This category often includes apps for personal finance management, basic loan management, or expense tracking.

- Complex Fintech App: Apps with advanced features like AI financial insights, real-time fraud detection, and blockchain security start at $35,000. The price can go higher based on the app's complexity. These apps target established businesses or enterprises aiming to offer top-tier financial services.

The final cost varies based on factors like technology choice, design complexity, compliance, and third-party needs. For instance, opting for blockchain or machine learning can raise costs. At GeekyAnts, we offer custom Fintech solutions. We aim to balance affordability with innovative features, aligning with your business goals.

The development timeline for a Fintech app can vary greatly depending on the application's complexity and the specific features it requires. Here’s how different levels of complexity can impact the timeline, with real-world examples to illustrate:

- Basic Fintech Apps (3-6 months):

- Example: A simple expense tracker or a budgeting app like YNAB (You Need A Budget).

- These apps have straightforward functionalities such as transaction tracking, basic analytics, and simple user interfaces. Since they require fewer integrations and minimal customization, they can be developed relatively quickly.

- With GeekyAnts' streamlined development process, we can deliver these types of applications efficiently, helping you launch in as little as 3 to 6 months.

- Moderately Complex Fintech Apps (6-9 months):

- Example: A digital wallet or payment app similar to Venmo or Revolut.

- These applications often include features such as user authentication, payment gateways, multi-currency support, in-app chat, and P2P transfers. Integration with banking APIs, security measures, and compliance with financial regulations make the development timeline longer.

- Our team employs an agile approach to ensure that such apps are built with robust architecture while still accelerating the time-to-market, aiming for a development timeline of around 6 to 9 months.

- Highly Complex Fintech Apps (9-15 months or more):

- Example: Comprehensive financial platforms like Robinhood or Mint.

- These apps offer advanced functionalities such as real-time stock trading, AI-driven analytics, personalized investment recommendations, and multiple third-party integrations. Ensuring top-tier security, handling high data volumes, and providing seamless user experiences make these projects significantly more time-intensive.

- Despite the complexity, the GeekyAnts team is equipped with proven methodologies and cutting-edge tools to efficiently handle such intricate projects, aiming to reduce the timeline while ensuring top-quality delivery.

Outsourcing fintech app development services has a lot of advantages. The first and most impactful is cost efficiency. Through outsourcing, you can save huge expenses for hiring and training.

The second advantage of outsourcing is the access to a diversified pool of talent. Take, for example, what happens when you partner with GeekyAnts. We give you access to a huge range of skills and talented professionals with extensive knowledge in the Fintech development space.

Finally, outsourcing provides flexibility and scalability. This means faster growth and adaptability without the hassle of recruiting and training new staff.

The Fintech app development process is multi-layered. Here is a brief breakdown of the process we follow:

- We analyze the business requirements and map the features to the impact they will have in the long run.

- Our team of developers and designers work to create a skeleton to make the application user-friendly and visually appealing.

- We implement robust encryption protocols and adherence to industry best practices.

- We integrate the necessary APIs and third-party services to enable seamless transactions and financial functionalities.

- We test all the features with a thorough Quality Assurance process.

- We also update the development flow according to specific requirements.

There are various types of Fintech apps that can be developed, each serving distinct financial needs:

- Payment and Money Transfer Apps: Facilitate seamless transactions, allowing users to send, receive, and manage money effortlessly. Examples include digital wallets or peer-to-peer payment apps like PayPal and Venmo.

- Investment and Wealth Management Apps: Empower users to monitor their portfolios, make investments, and manage assets. Think of apps like Robinhood or Wealthfront that provide real-time data and investment tracking.

- Personal Finance Management Apps: Offer budgeting tools, expense tracking, and financial planning features to help users manage their finances more effectively. Popular examples include Mint and YNAB (You Need A Budget).

- Lending and Borrowing Platforms: Connect borrowers with lenders, offering services such as personal loans, microloans, or peer-to-peer lending. Apps like LendingClub and Kiva fall into this category.

- Insurance Apps (InsurTech): Allow users to compare, purchase, and manage insurance policies, making the insurance process more accessible and user-friendly. Examples include apps like Lemonade and Policygenius.

- Crowdfunding Apps: Enable individuals and businesses to raise funds for projects, ventures, or causes. Popular platforms include Kickstarter and GoFundMe.

At GeekyAnts, our developers are equipped to design and build all these types of Fintech applications, ensuring they are tailored to your unique business needs and market demands.

Choosing the correct tech stack is crucial to building a popular application. Our team guides you in selecting the right blend of tech stacks from the initial stages.

For the front-end, we excel in using React Native, Next.js, Flutter, HTML, CSS, and Angular. These frameworks and languages are proven to deliver a seamless user experience, captivating design, and optimal performance.

For back-end development, expertise extends to powerful tools such as Molecular, Node.js, Java Spring Boot, and Golang.

We also value your expertise and consult your business team to provide a comprehensive solution

Some of the must-have features that a Fintech app should include are:

- Secure login and authentication

- Personalized user experience

- Seamless transactions and payments

- Real-time alerts and notifications

- Budgeting and financial planning tools

- Data analytics and reporting

- AI-powered chatbots for customer support

- Integration with third-party financial services

- Multi-currency support

- Fraud detection and prevention

A powerful financial app allows you to offer your customers convenience and accessibility. With a user-friendly app, you can reach your customers easily and build trust.

Having an app includes new avenues for revenue generation. You can add value-added services (like personalized finances, investment management, and budgeting) and create multiple ways of interaction.

GeekyAnts places the highest priority on ensuring the security and compliance of its Fintech solutions. Here’s how we maintain top-tier security and adhere to industry regulations:

- End-to-End Encryption:

- We implement robust end-to-end encryption for data in transit and at rest, ensuring that sensitive financial information is protected from unauthorized access.

- By using advanced encryption standards (AES-256), we safeguard user data against potential breaches.

- Multi-Factor Authentication (MFA):

- We incorporate MFA to provide an additional layer of security, requiring users to verify their identity through multiple methods, such as passwords, OTPs, or biometric verification.

- This reduces the risk of unauthorized access, even if login credentials are compromised.

- Compliance with Industry Regulations:

- Our team stays up-to-date with key financial regulations such as PCI-DSS, GDPR, PSD2, and other data protection laws to ensure that your Fintech app meets all necessary compliance requirements.

- We build solutions that adhere to KYC (Know Your Customer) and AML (Anti-Money Laundering) guidelines to maintain the integrity and legality of financial transactions.

- Secure API Integrations:

- We implement secure API protocols (e.g., OAuth 2.0, JWT) to protect data exchanged between different systems, ensuring that all integrations with third-party services are secure and compliant.

- Regular API audits are conducted to identify vulnerabilities and maintain secure data flows.

- Regular Security Audits and Penetration Testing:

- Our security experts perform regular audits, vulnerability assessments, and penetration testing to identify potential security gaps and address them proactively.

- We leverage third-party security testing tools to ensure that our Fintech solutions are resilient against the latest threats.

- Data Masking and Tokenization:

- Sensitive data such as credit card details, personal information, and bank account numbers are masked or tokenized, ensuring that even if data is intercepted, it cannot be used maliciously.

- This adds an extra layer of security, especially for applications handling large volumes of sensitive financial data.

- Secure Development Practices:

- GeekyAnts follows secure coding guidelines and employs best practices such as OWASP (Open Web Application Security Project) to prevent vulnerabilities like SQL injection, cross-site scripting (XSS), and other common threats.

- Code reviews, static code analysis, and security testing are integrated into our development lifecycle to ensure security is maintained from the ground up.

- Dedicated Compliance and Security Team:

- We have a dedicated team of security experts and compliance specialists who monitor the evolving regulatory landscape and update our security practices accordingly.

- They work closely with developers to ensure that security and compliance are embedded throughout the project lifecycle.

By integrating these rigorous security measures and compliance practices, GeekyAnts ensures that your Fintech solution is not only secure and reliable but also meets the highest industry standards, protecting your users' data and maintaining their trust.

An NDA option is shared with you even before our first meeting. We do not divulge any data from our discussion if the NDA is signed by you.

We also sign very strong NDAs that are vetted by your legal team when the project commences. Our in-house legal team will also ensure that the NDAs are strong and binding.

Yes, GeekyAnts offers comprehensive post-production maintenance services to ensure your Fintech app remains secure, up-to-date, and fully optimized after launch. Our services include regular updates and enhancements to keep the app compatible with the latest technologies, along with introducing new features based on evolving business needs. We conduct continuous security monitoring to identify vulnerabilities and implement necessary patches to protect against cyber threats. Performance optimization is a key focus, as we monitor and improve load times, latency, and overall efficiency.

Our team also provides ongoing bug fixing and issue resolution to maintain smooth operation, minimizing downtime. As your app grows, we offer scalability solutions and manage infrastructure updates to handle increased traffic and data loads. Additionally, we stay on top of regulatory changes, ensuring your app remains compliant with industry standards. With 24/7 technical support, our team is always available to assist with troubleshooting and provide guidance, ensuring your Fintech app continues to meet your business goals even after it goes live.

Fintech App Development

Inside Global FinTech Fest 2025: How GeekyAnts Is Powering Enterprise AI Adoption and Legacy Modernization

IoT Usage in Transforming the Life of Diabetic Patients

AML (Anti-Money Laundering) Software Development Guide: Build Secure Fintech Apps

A Beginner's Guide to Front-End Security for Fintech Apps Using ReactJS and React Native

Modernizing Fintech Apps with Generative AI