Table of Contents

Automating U.S. Corporate Loan Underwriting with AI & Data and Risk Intelligence

Author

Subject Matter Expert

Date

Book a call

Key Takeaways-

- Traditional methods make lending slow and still overlook risks. The real shift will come when banks treat AI, automation, and risk intelligence as core infrastructure rather than add-on tools.

- Automation clears routine checks in minutes, while AI runs stress tests and monitors borrowers in real time. This allows lenders to move approvals faster while keeping regulatory safeguards intact.

- Banks that adopt AI sooner gain smarter models, cleaner data, and stronger portfolios—building an advantage that slower adopters will find hard to match.

Saurabh Sahu

CTO GeekyAnts

The Broken State of Corporate Loan Underwriting in the U.S.

AI as the Missing Piece in Corporate Loan Underwriting

Artificial intelligence is beginning to close the gaps that have long undermined corporate loan underwriting. For years, lenders have leaned on balance sheets, tax records, and a few financial ratios to make their calls. That worked in a slower economy, but today it leaves too much hidden. A business can look steady on paper yet show signs of stress in places the old models never check.

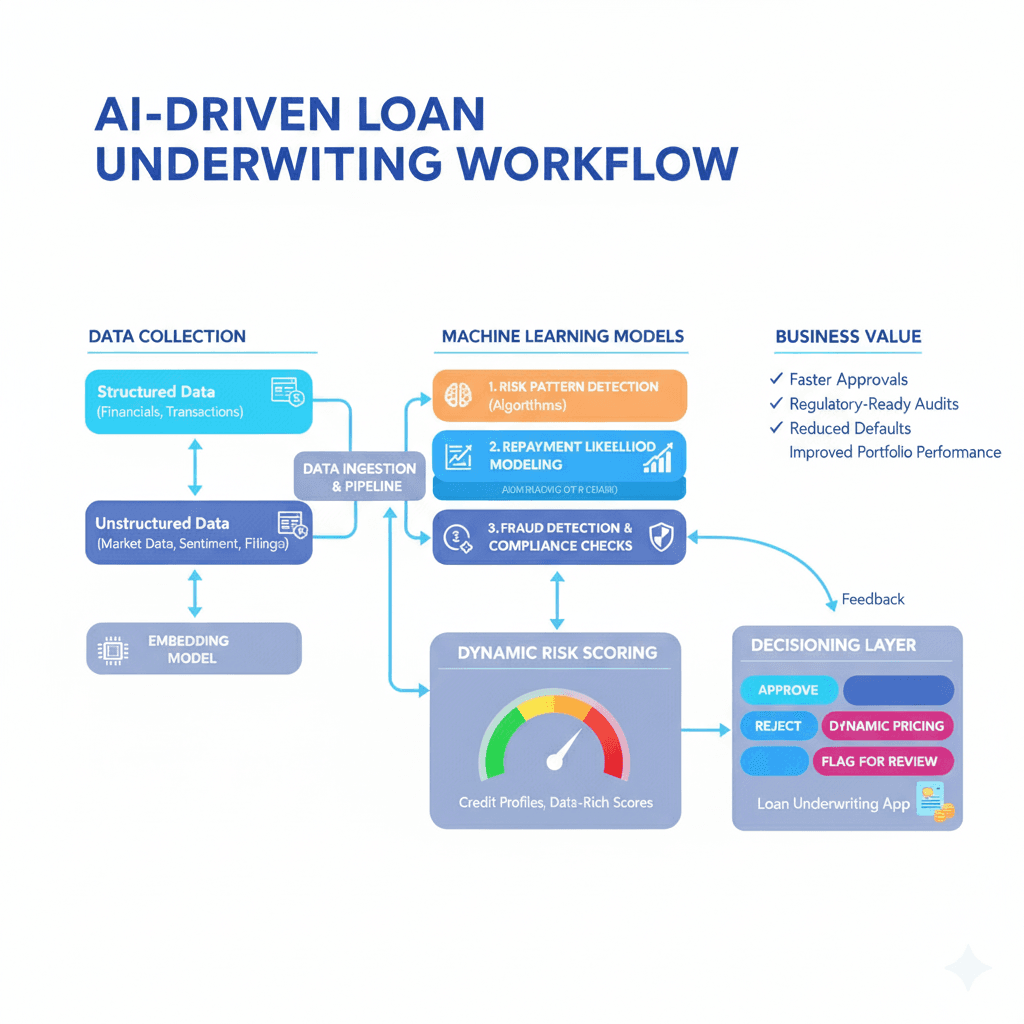

Turning Data into Decisions: AI’s Workflow in Loan Underwriting.

But how does this actually play out inside a bank? The process isn’t magic—it’s a series of steps that turn messy, raw data into lending decisions that executives can act on.

Automation as a Driver of Modern Underwriting

Pushkar Kumar

GeekyAnts

The challenge with underwriting isn’t diligence—it’s speed. By the time the paperwork clears, the borrower’s circumstances may already look different,” explained a senior risk officer at a U.S. commercial bank. The mentioned fact is common in numerous lenders and explains the reason why the process of automation is being embraced at a rapid rate.

The Strategic Value of Risk Intelligence in Underwriting

- AI collects and interprets signals.

- Automation executes reviews at scale and speed.

- Risk intelligence converts those results into a forward-looking strategy.

Comparison: Traditional vs AI-Powered Underwriting

| Dimension | Traditional Methods | AI-Powered Methods |

|---|---|---|

| Speed | Weeks to approve; paperwork delays | Instant or same-day decisions with automated workflows |

| Accuracy | Reliance on past data; slower detection of risk | Real-time signals from varied sources catch risk early |

| Compliance | Manual checks; prone to human error and oversight | Automated compliance with built-in checks reduces infractions |

Risk Management | Reacts after defaults appear | Predicts potential defaults; stress-tests portfolios beforehand |

| Scalability | An increase in loan volume requires more staff | Scales without proportional hiring; handles volume with ease |

| Cost Efficiency | High operational costs; inefficiencies persist | Lower cost per loan; fewer wasted resources |

Where AI and Automation Create Value in Underwriting

Lenders across banks, fintechs, and NBFCs now use AI and automation as everyday tools. The focus is on cutting delays, keeping checks accurate, and reducing compliance effort.

1. Automated Credit Scoring

2. Real-Time Document and Compliance Verification

3. Predictive Fraud Detection

4. Dynamic Risk Pricing

5. Loan Portfolio Monitoring & Optimization

Barriers to Adopting AI and Automation in Loan Underwriting

Data Governance and Implementation Best Practices

Banks handle borrowers' financial details, credit histories, and business records daily. Written procedures covering data gathering, storage limits, and usage boundaries must exist before anything else. Without these frameworks, lenders encounter regulatory violations and damaged reputations. Ongoing validation and external reviews ensure models remain transparent and follow requirements like CCPA and GLBA.

The Road Ahead for Corporate Lending with AI

The next phase of corporate lending in the U.S. won't be defined by faster workflows alone—it will be shaped by lenders who treat AI as core infrastructure rather than a bolt-on tool. Predictive analytics will give banks portfolio-wide foresight, stress-testing industries against rate shifts or supply chain shocks before risk materializes. Advanced systems will expand beyond basic document handling to produce full regulatory filings and compliance documentation, tasks that now require substantial manual effort from specialized teams. Connected platforms will merge risk evaluation, regulatory verification, and operational workflows into unified processes, removing the departmental divisions that cause bottlenecks and extended approval times.

How GeekyAnts is Reshaping the Corporate Loan Underwriting

Banks across America need better underwriting systems, and GeekyAnts delivers them. We've spent nearly twenty years building financial software, and we know what works.

Conclusion

Corporate underwriting won’t fix itself. Manual reviews, legacy cores, and paperwork-heavy compliance slow lending and still miss risk. That gap costs revenue and invites surprises. The path forward is clear: build underwriting as a system—AI for signals and prediction, automation for clean execution, and risk intelligence for early warnings and portfolio control. Done well, lenders cut cycle time, price with precision, explain every decision, and spot trouble before it hits the P&L. Yes, hurdles remain: bias, privacy rules, legacy integration.

FAQs

1. How is AI transforming corporate loan underwriting in the U.S.?

AI lets banks look past balance sheets. It uses live signals—payments, supplier activity, and market news—to create risk insights. Decisions move faster, and lenders catch warning signs that older models overlook.

2. How does automation help to save time and cost of underwriting?

A majority of the delays are paperwork and compliance checks. Automation removes such a backlog within minutes rather than weeks. Banks reduced the approval process and were spending less money on manual review teams.

3. What are the benefits of AI-informed corporate lending decisions?

Risk applications execute stress tests and monitor sectors in real time. In case of any change in the conditions, banks will be able to change the prices, to rebalance the exposure, and to take action before the accumulation of the defaults.

4. What are the compliance concerns that the U.S. lenders must take into consideration in adopting AI underwriting?

The lenders are required to comply with privacy regulations such as CCPA and GLBA, demonstrate fairness of models, and be able to explain the decision. Older legacy systems create complexity, and therefore integration must be thought over.