Table of Contents

Personalization in US Wealth Apps: AI Portfolios That Pass FINRA/SEC Compliance

Author

Subject Matter Expert

Date

Book a call

Key Takeaways

- AI-driven recommendations in wealth management apps must adhere to existing US regulations like Reg BI and FINRA Rule 2210.

- XAI (SHAP/LIME diagnostics) is essential for proving the SEC's Care Obligation by documenting the rationale behind every personalized investment recommendation.

- Proactive wealth management is powered by a hybrid human–AI workflow that uses predictive analytics for routine tasks and frees human advisors for high-value client interactions.

- Robust Model Risk Management (MRM) is necessary to prevent systemic bias, data drift, and conflicts of interest in AI systems, protecting the firm from regulatory sanctions.

- Businesses must adopt a multi-phase roadmap to implement immutable audit trails, continuous monitoring, and FINRA-compliant supervision throughout the AI system's lifecycle.

Getting an AI Personalised Portfolio is easy; making the AI explain itself to FINRA is the tough task.

Investors want highly personalized portfolios on their wealth management apps, but regulators expect every AI-driven recommendation to be clear and traceable. This creates a tension because the systems that deliver deep personalization often rely on complex models that are difficult to explain.

Regulators in the United States, including the SEC and FINRA, apply existing fiduciary rules and Reg BI to all AI systems without exception. The SEC is particularly focused on conflicts of interest that may arise when algorithms optimize for engagement instead of investor benefit. Their proposed rules go beyond disclosure and push firms to remove or neutralize these conflicts altogether.

However, FINRA adds another layer of pressure. Any AI model used in communications or decision support must be supervised at the enterprise level. Businesses need to demonstrate that their systems are accurate, fair, and compliant with Rule 2210, which treats AI-generated messages in the same manner as those produced by registered professionals.

In this environment, Explainable AI has become essential as the demand for transparency shapes how AI tools are selected and built for wealth management apps.

What Powered the Rise of AI-Driven Proactive Wealth Management?

Predictive analytics now help firms recognize patterns in spending, income, and goals, allowing recommendations to be shaped before a client asks for them. AI also tracks progress in real-time and adjusts portfolios throughout the day, maintaining steady plans during changing market conditions. These two abilities form the base of more reliable and personalised guidance.

A hybrid approach further strengthens the model in 2025. Automation manages routine work such as rebalancing and tax optimization, while advisors focus on major choices and life events. Clients receive faster responses, and advisors gain more time for meaningful conversations.

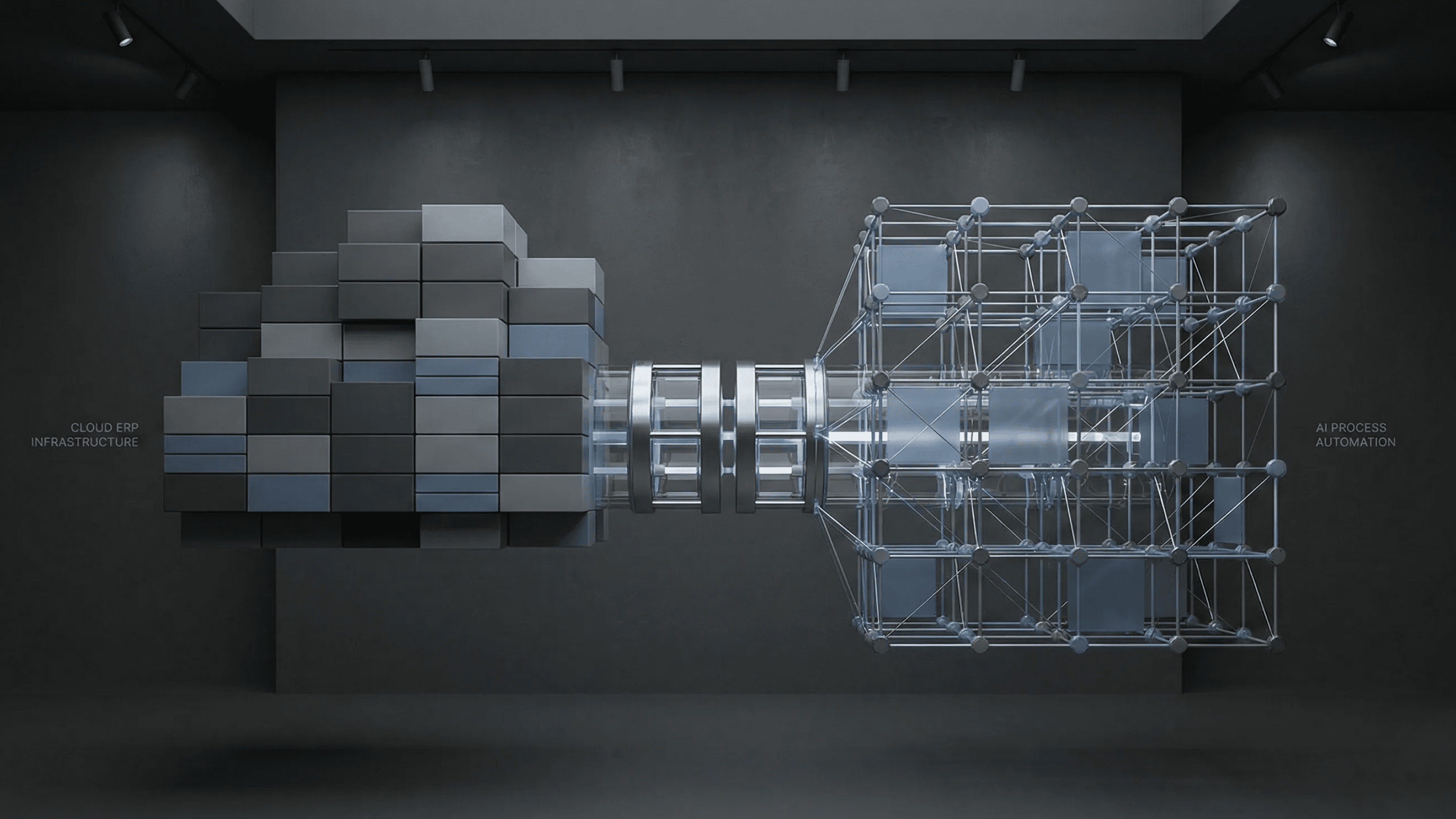

This rise is made possible by the technology running underneath. Agent-style systems can complete multi-step tasks with limited manual work. Firms are also integrating these tools directly into daily workflows, ensuring decisions are based on complete and consistent data. Focused models then use this data to shape advice that matches each client’s needs.

Kunal Kumar

COO, GeekyAnts

Three outcomes are projected in the near future. The first is the delegation of routine execution to autonomous agents, resulting in increased advisor capacity for high-value client interactions. The second involves the embedding of compliance and risk management directly within AI pipelines, requiring models to be instrumented with explainability diagnostics (such as SHAP/LIME), real-time monitoring, and complete audit trails to comply with U.S. regulatory mandates. The third outcome is the scaling of hyper-personalization, enabling bespoke strategies, proactive alerts, and contextual engagement for broad client bases, utilizing continuous market signals and natural language processing (NLP). To conclude, personalization has evolved from an optional feature to an operational standard, made possible by predictive analytics, consistent execution, and combined human–AI processes, while simultaneously being governed by the strict requirement to incorporate compliance and explainability into every action.

Core features of Wealth Management Apps

To be truly "future-proof," your wealth management app must move beyond basic portfolio tracking. Here are the four essential pillars that a high-performing wealth management platform should have:

1. The Integrated Intelligence Layer

Modern apps use predictive analytics to analyze spending patterns, life events (like home buying), and market signals. This enables the app to transition from a passive ledger to an active financial co-pilot.

2. Hybrid Human-AI Collaboration Tools

Trust is built on human relationships but sustained by digital speed. Features like secure in-app messaging, co-browsing for real-time advisor support, and video conferencing allow for a "phygital" (physical + digital) experience that builds long-term intimacy.

3. Advanced Alternative Investment Access

As investors seek alpha beyond public markets, your app should feature modules for Alternative Investments (PE, Hedge Funds, Real Estate). This includes AI-powered document ingestion that automatically tags and reconciles PDF capital calls and distribution notices.

4. Zero-Trust Security & Immutable Auditing

Given the sensitivity of HNW (High Net Worth) data, standard encryption isn't enough. Leading apps implement Zero-Trust Architecture and immutable audit trails, ensuring every change in a client's risk profile or portfolio is timestamped and logged for SEC Rule 204-2 compliance.

This is a critical area where innovation meets fiduciary responsibility. In the highly regulated world of wealth management, AI and personalization in apps are not subject to entirely new rulebooks, but rather must be proven to comply with existing, technology-neutral rules set by FINRA and the SEC.

Here is a deep dive into the regulatory landscape, connecting AI model explainability to these frameworks:

1. FINRA and SEC Guidelines: Connecting AI to Frameworks

The core challenge is ensuring that AI systems, especially those driving personalized advice in wealth management apps, adhere to rules written for human advisors.

- FINRA— Rule 2210 (Communications with the Public)

2. Supervised & Retained: Must undergo principal review and be subject to recordkeeping rules. If an AI-generated statement is found to be misleading, the firm must be able to trace the output back to its source data and logic to demonstrate that the error was not the result of systemic misconduct.

- SEC - Regulation Best Interest (Reg BI)

To prove the Care Obligation is met, the firm must explain why the AI's recommendation was suitable and in the client's best interest, demonstrating that the algorithm appropriately weighed the client's risk profile and goals. An inability to explain the model's recommendation is an inability to prove compliance with Reg BI.

- SEC- AI Risk Oversight

Conflicts and Risk The SEC has focused scrutiny on conflicts of interest arising from the use of predictive data analytics (PDA) and AI. If a firm's AI is optimized to maximize a firm's revenue (e.g., recommending proprietary products) or to influence client behavior through subtle "nudges" (a key aspect of personalization), a conflict of interest is created.

Firms must be able to explain and mitigate any model-driven conflicts. The firm needs documentation to show that the AI's logic is not primarily focused on increasing the firm's profit at the expense of the client's best outcome. The SEC has initiated "sweeps" to ensure compliance policies address AI risk, client data protection, and model accuracy (Wealth Management, 2024).

2. Recordkeeping and Supervision

Effective AI supervision requires making explainability a core part of daily operations. This process centers on two mandatory areas: Recordkeeping and Human Oversight.

- Recordkeeping (SEC Rule 204-2 & FINRA)

Any AI output that functions as advice, a recommendation, a communication, or a decision log—such as chatbot transcripts or model rebalancing decisions—is a regulated record and must be retained in accordance with SEC Rule 204-2. The app's back-end must capture a full auditable trail, including the initial AI output, any timestamped human edits, and the final action. Furthermore, there is a need to vet third-party AI vendors to ensure their data security and recordkeeping practices comply with SEC and FINRA rules.

- Supervision (FINRA Rule 3110)

FINRA Rule 3110 mandates that wealth management businesses establish and enforce Written Supervisory Procedures (WSPs) specifically tailored to AI use. Human oversight should involve review of all high-risk AI outputs. Still, this oversight is impossible without model explainability, as advisors must receive a clear, documented answer when questioning why the system made a particular recommendation. Human supervision should cover the entire lifecycle of the AI, from development and data sourcing through to deployment and monitoring.

3. Model Risk Management (MRM)

MRM is the formal process that ensures AI models are safe, reliable, and compliant. Explainability is a foundational component of a robust MRM framework.

- Bias and Fairness: Models trained on historical data can reinforce systemic bias. Explainability helps detect and test for these issues, and firms must perform disparate impact testing to ensure fair outcomes.

- Data Integrity and Governance: Since AI quality depends on data quality, firms must verify, clean, and document data sources. Poor data leads to unreliable advice and breaches the duty of care.

- Stress Testing and Validation: Models must be validated through back-testing, stress testing, and continuous monitoring to detect drift and maintain accuracy.

The Complete FINRA/SEC-Compliant Roadmap for Your Wealth Management App

Kunal Kumar

COO, GeekyANts

This roadmap follows four phases, ensuring the app is not only functional but audit-ready from day one.

Phase 1: Strategy, Licensing, and Foundational Risk

Timeline: 6-12 Weeks

This phase establishes the legal and technical baseline, ensuring the business model meets regulatory requirements before development begins.

Secure Firm Registration and Licensing: The firm must complete all FINRA membership requirements, including filing Form BD, meeting minimum capital requirements, and ensuring qualified principals are registered.

Define Business Objectives & Target Audience: Clarify the app's purpose (e.g., investment management, communication, etc.) and the target user (retail or institutional).

Conduct Compliance Evaluation & Risk Assessment: Assess the regulatory landscape and identify cybersecurity and financial misconduct exposure vulnerabilities. Implement written supervisory procedures (WSPs), which FINRA Rule 3110 mandates.

MVP Design & Validation: Define user journeys and digital onboarding processes while integrating initial KYC/AML requirements. Introduce basic, non-AI, rule-based portfolio logic.

Phase 2: Security Architecture and Data Governance

Timeline: 8-16 weeks

This phase builds the systems for security and required data storage. Put in a strong Cybersecurity Plan (encryption, MFA, controls) to follow SEC Regulation S-P. Create Permanent Recordkeeping to meet SEC Rule 17a-4, logging all client chats and risk choices for audits. Check all Vendor Contracts (AI, custodians) to ensure they follow regulatory rules. Design the App Look and Feel for clear disclosure of risks and fees.

Phase 3: AI Model Development and Governance

Timeline:12-24 weeks

This phase integrates advanced, personalized functionality while adhering to the new standards for AI transparency.

- AI Model Integration (Personalization Layer): Add a personalization layer based on user goals, risk appetite, and behavioral data. This leverages predictive analytics to deliver hyper-personalized advice.

- Implement Explainability Tools (XAI): Embed explainability tools (XAI dashboards and model versioning) to show how AI decisions are generated and which factors influence outcomes. This is critical for meeting regulatory transparency expectations.

- Content Approval (FINRA 2210): Implement a rigorous system for content approval of all client-facing recommendations. This ensures all AI-generated communications comply with FINRA Rule 2210 (Communications with the Public).

- Frontend Development and QA: Build the user interface and conduct rigorous quality assurance testing to validate usability, performance, and functionality.

Phase 4: Deployment and Continuous Audit Readiness

Timeline: 6-12 Weeks

This final phase focuses on operationalizing compliance and preparing for perpetual regulatory scrutiny.

Automate Compliance Reporting & Tracking: Automate the compliance report generation required for regulatory filings. Track every AI decision and user action for audit logs. Establish monitoring systems to track adherence to legal requirements and flag suspicious activities in real-time.

Key Challenges and Considerations for US Wealth Management Apps

AI-driven personalization brings enormous promise to wealth management, but it also introduces a set of intertwined challenges that need to be solved in unison. Both the SEC and FINRA expect firms to show exactly how an AI-generated recommendation was produced, why it served the client’s best interest, and how every input and output was recorded. Without explainability and clear audit trails, compliance becomes fragile.

Behind this regulatory pressure, an equally difficult data problem is present. Personalization relies on understanding information spread across CRMs, trading systems, banking platforms, and legacy tools. The volume and sensitivity of this data raise the stakes for privacy, consent, and cybersecurity. If integration is weak or data quality slips, personalization breaks instantly.

The ethical risks compound the challenge. AI models can inherit bias from historical datasets, influence client decisions too aggressively, or make recommendations that even advisors cannot interpret. Trust becomes harder to earn when the logic is opaque, and clients still expect human judgment to anchor automated guidance.

Key Criteria for Selecting Your WealthTech App

Choosing the right wealth management app requires businesses to focus on strategic integration and advanced functionality over basic features. The requirements for each fintech sector, like banking, asset management, and specialized private wealth, are unique, and the solution should address those specific needs.

For instance, specialized analytical tools are necessary for a real estate investment manager. These include geo-analytics to determine district market potential and profitability forecasting that takes into account the changes to demand and costs. The manager's app must seamlessly integrate with electronic document management systems (EDMS) to handle the illiquid, high-value assets and the associated legal documentation.

The platform must scale easily with asset increases and more client accounts while maintaining performance. AI-powered insights and prediction tools are key for personalization and risk oversight.

Why GeekyAnts Leads Wealth Management App Development Company

Kunal Kumar

COO, GeekyAnts

GeekyAnts brings deep experience across the FinTech and WealthTech domains. Development of showcase applications like Vardaan proves the firm's ability to build custom sales and accounting applications for online business management. This background ensures the delivery of stable solutions for complex financial ecosystems. GeekyAnts also runs Fintech Frontier, a dedicated magazine that tracks industry changes and trends.

Expertise in AI, Data, and Compliance-Driven Architectures

We build compliance-driven architectures essential for every financial advisor app targeting the US market. Our expertise rests on AI and data engineering, integrating advanced analytics and real-time fraud detection. We design solutions with compliance standards in mind, providing secure, scalable financial app development. We employ strong security measures, including encryption and multi-factor authentication, to protect sensitive data and ensure compliance.

Cross-Functional Delivery Model

We employ a cross-functional delivery model. Product teams collaborate with AI, Compliance, and Security experts. This alignment ensures security is integrated in the architecture and that every platform meets performance and regulatory requirements. This unified approach delivers quality and adherence across every stage of development.

Case Study

See AI Personalization in Action: The Bambu Case Study

Bambu needed a "Robo-Advisor" platform that gives automated, personal investment advice to users while following strict global financial rules.

What We Did

- AI Portfolios: Built a system that creates custom investment plans based on a user's specific goals and risk levels.

- Built-in Compliance: Designed the tech to automatically meet high data security and regulatory standards (like SEC/FINRA).

- User-Friendly: Simplified complex financial data into an easy-to-use mobile and web interface.

In Summary

Personalization is a key operational standard that drives client loyalty. However, this progress carries a direct fiduciary duty. The tension between achieving deep personalization and meeting the SEC and FINRA’s rules on explainability and conflict mitigation is the central challenge in modern wealth management.