Table of Contents

Real-Time Fraud Detection Using AI-Powered Behavioral Biometrics

Author

Date

Book a call

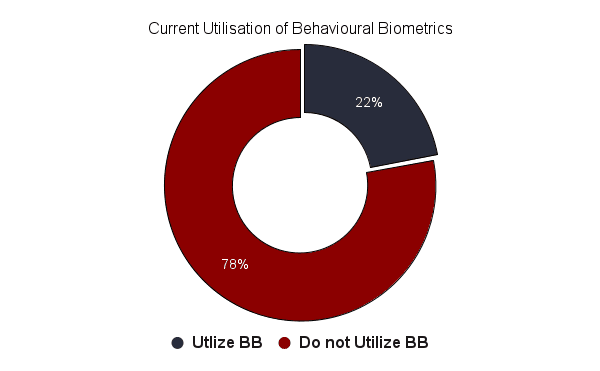

As we can infer from the graph above, despite 79 percent being confident about behavioral biometrics being a promising extension of artificial intelligence, only 22 percent actually utilize it. Although the global implementation of AI for fraud detection has exceeded 75 per cent across financial institutions, the deployment of behavioral biometrics remains limited. This deviation suggests that while the perception is favorable, there are risks and challenges that are slowing the adoption.

What is Behavioral Biometrics?

- Typing speed and rhythm

- How a user taps a screen or moves a mouse

- Scrolling Patterns

- Angle, pressure, and speed of mobile touches

- GPS movement

- Session navigation pattern

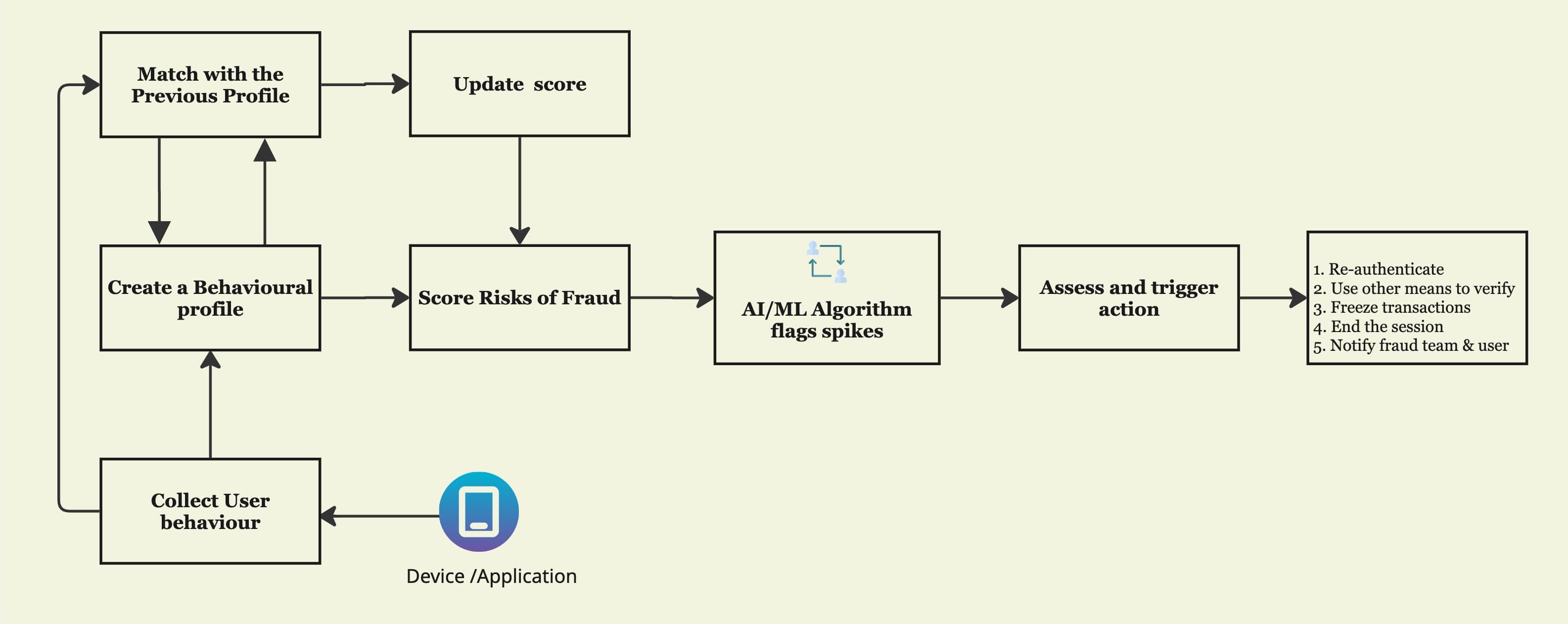

How does it work in real-time?

Why is it powerful and effective in fintech?

- Continuous and Passive: There’s no extra input required from the users’ point of view, which makes it invisible yet effective.

- Nearly Impossible to Spoof: Unlike the situations where the credentials are stolen or OTP is intercepted, or the device is cloned, it’s nearly impossible to replicate the human behavior, like (swipe pattern or typing speed).

- Real-time response to threats: the system immediately analyses the risk score spike and takes action in real-time rather than after the damage is done.

- Real-world fraud use cases:

- Financial institutions are betting high on it (Bloomberg Intelligence, 2024):

What are the associated Challenges in implementation?

- Legacy infrastructure: The legacy banking system architecture doesn’t support the implementation and requires a complete overhaul, which will incur significant costs to institutions.

- Regulatory uncertainty: Lack of clear guidelines from the governing body of financial institutions

- Data privacy concern: Financial institutions must be GDPR and PSD2 compliant for secure and consent-based data collection, processing, and preservation.

- False Positives: An early-stage system might flag legitimate user behavior until the algorithm is fully trained

- Integration complexities: Computational intensity required to process continuous behavioral data demands a high-performing, scalable system with a real-time response architecture.

Conclusion

Behavioral biometrics is quietly transforming fraud detection in fintech, providing a seamless, intelligent, and real-time layer of protection that operates unobtrusively in the background. As fraud methods grow more sophisticated, particularly with the rise of AI-generated identities, this approach is increasingly vital for safeguarding both users and institutions by finding a middle ground on privacy and regulatory concerns.

Dive deep into our research and insights. In our articles and blogs, we explore topics on design, how it relates to development, and impact of various trends to businesses.