Table of Contents

Modernizing Fintech Apps with Generative AI

Author

Date

Book a call

The fintech sector has been leading the charge in digital transformation, constantly adopting cutting-edge technologies to improve service delivery and enhance customer experiences.

According to recent data by Statista, the revenue of the global fintech industry increased sharply between 2017 and 2023. In 2023, the total revenue of the industry was estimated at 79.38 billion U.S. dollars. The revenue of the global fintech sector is forecast to increase further in the coming years, exceeding 141.18 billion U.S. dollars in 2028.

In this fast-evolving landscape, generative AI stands out as a game-changer, offering transformative potential to revolutionize various aspects of fintech operations.

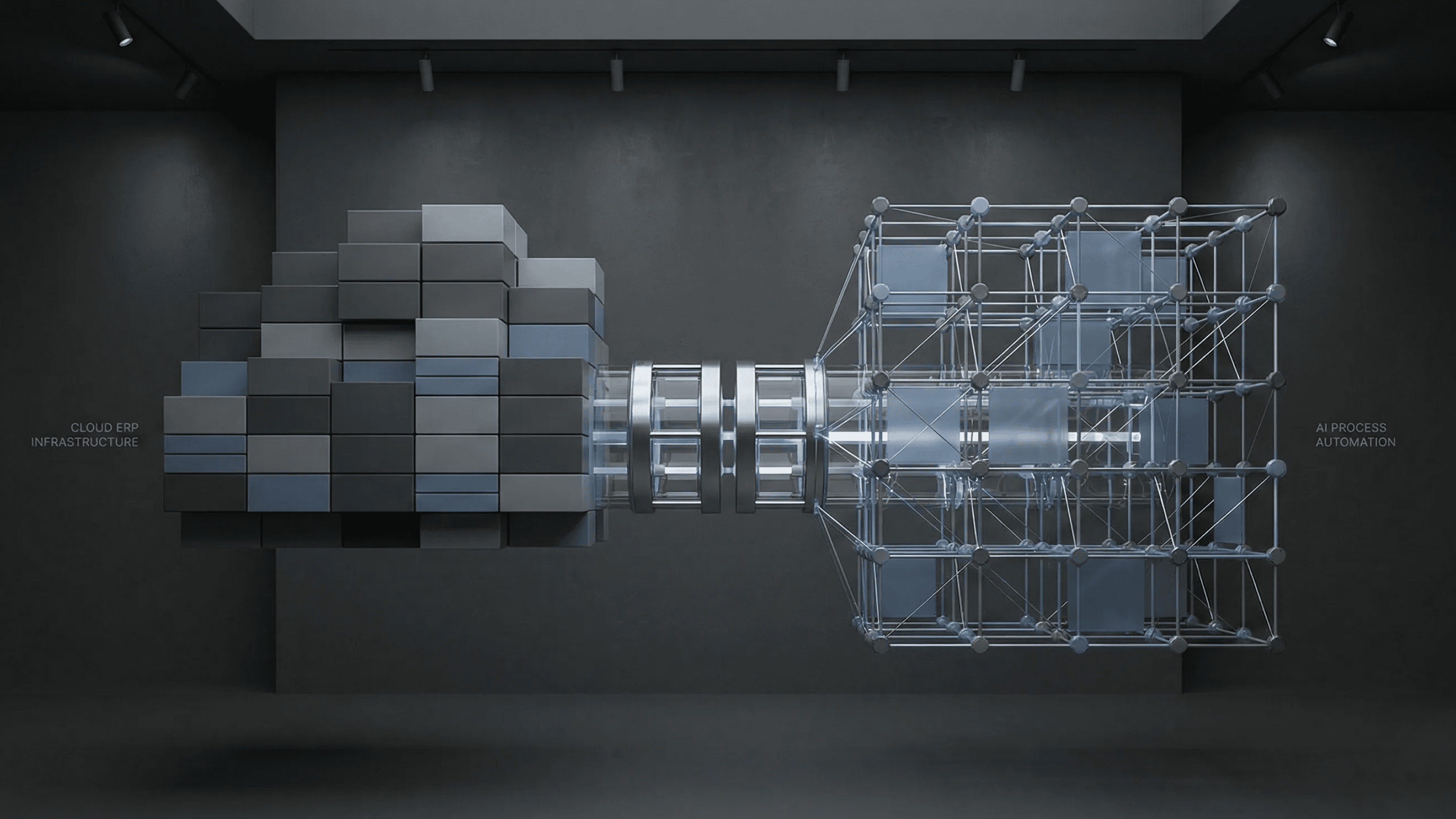

Generative AI, a subset of artificial intelligence, utilizes advanced machine learning algorithms to create new content spanning text, images, music, and more. Its capabilities go beyond traditional AI, enabling highly sophisticated and personalized solutions within fintech. As financial institutions increasingly embrace AI technologies, generative AI is emerging as a critical component in the modernization of fintech platforms.

Advantages of Generative AI for Fintech

1. Personalization

- Customized Financial Products: Generative AI can analyze vast amounts of customer data, including spending habits, investment preferences, and life events, to create highly tailored financial products and services. For instance, personalized investment portfolios or loan offers that align with individual financial goals and risk tolerance.

- Enhanced Customer Experience: By understanding customer behavior and preferences, Generative AI enables the creation of personalized communication and recommendations, leading to increased customer satisfaction and loyalty. For example, AI-driven chatbots can provide customized financial advice and support, enhancing the overall customer experience.

2. Efficiency

- Automation of Routine Tasks: Generative AI can automate repetitive and time-consuming tasks such as data entry, reconciliation, and reporting. This reduces the burden on human employees and allows them to focus on more strategic, value-added activities.

- Operational Cost Reduction: By streamlining operations and improving process efficiency, generative AI helps financial institutions reduce operational costs. Automated processes also minimize errors and improve accuracy, leading to cost savings and enhanced productivity.

3. Risk Management

- Improved Risk Assessment: Generative AI can analyze vast amounts of structured and unstructured data to identify potential risks and vulnerabilities. Advanced pattern recognition and predictive analytics enable more accurate risk assessment and mitigation strategies.

- Enhanced Fraud Detection: By continuously monitoring transactions and identifying unusual patterns, generative AI can detect fraudulent activities in real-time. This proactive approach to fraud detection helps protect financial institutions and their customers from potential losses.

4. Innovation

- Generation of New Ideas and Solutions: Generative AI's ability to generate novel ideas and solutions fosters innovation within the fintech sector. For example, AI-driven models can develop new financial products or services that meet emerging customer needs and market trends.

- Staying Competitive: By leveraging generative AI, fintech companies can stay ahead in a competitive market. Continuous innovation driven by AI enables businesses to adapt quickly to changing market dynamics and customer demands.

5. Enhanced Decision Making

- Deeper Insights from Complex Data: Generative AI can process and analyze large volumes of complex data, providing deeper insights into market trends, customer behavior, and financial performance. These insights enable financial institutions to make more informed and timely decisions.

- Strategic Decision Support: With generative AI, financial institutions can enhance their decision-making processes, from investment strategies to risk management. AI-driven analytics provide actionable intelligence, supporting more strategic and data-driven decision-making.

10 Use Cases of Generative AI in Fintech

1. Automated Customer Support

Generative AI-powered chatbots and virtual assistants provide 24/7 support, instantly and accurately handling customer inquiries across multiple communication channels, thus improving customer service and satisfaction.

2. Fraud Detection and Prevention

Generative AI algorithms enhance security by identifying unusual patterns and potential fraud activities in real-time, continuously adapting to new fraud patterns to reduce financial losses.

3. Algorithmic Trading

Generative AI optimizes trading performance by analyzing market trends and executing high-frequency trading strategies with minimal human intervention, while also managing associated risks.

4. Credit Scoring

By analyzing alternative data sources, generative AI offers more accurate credit scoring, thereby expanding access to credit for underserved populations with a comprehensive assessment of creditworthiness.

5. Personalized Financial Advice

Generative AI-driven robo-advisors provide tailored financial advice and investment strategies based on individual profiles and preferences, dynamically adjusting recommendations in response to market changes.

6. Regulatory Compliance

Generative AI automates compliance processes, ensuring adherence to regulatory requirements by monitoring transactions, processing compliance documents accurately, and reducing the risk of fines and legal issues.

7. Risk Assessment

Generative AI models predict market risks and offer actionable insights to mitigate potential losses through predictive modeling and scenario analysis, helping financial institutions develop robust risk management strategies.

8. Financial Forecasting

Generative AI generates accurate financial forecasts by utilizing historical data and market indicators, dynamically updating predictions as new data becomes available to aid in strategic planning and decision-making.

9. Document Processing

Generative AI automates the verification and processing of documents such as loan applications and insurance claims, speeding up operations, reducing manual errors, and increasing efficiency.

10. Customer Insights and Segmentation

Generative AI analyzes customer behavior and transaction data to provide deeper insights, enabling better segmentation and targeting for more effective marketing strategies, and predicting future customer needs and behaviors.

Risks of Generative AI in Fintech

Despite its advantages, the integration of generative AI in fintech is not without risks:

1. Bias and Fairness

AI models can inadvertently perpetuate biases present in training data, leading to unfair outcomes. For instance, if historical financial data contains biases against certain demographics, the AI may continue to disadvantage these groups in credit scoring or loan approvals, exacerbating existing inequalities.

2. Data Privacy

The extensive use of customer data by generative AI raises significant concerns about data privacy and security. Unauthorized access, data breaches, and misuse of sensitive information can lead to severe legal and reputational consequences for financial institutions, undermining customer trust.

3. Regulatory Challenges

Navigating the complex regulatory landscape for AI in finance can be challenging, with varying requirements across jurisdictions. Ensuring compliance with these diverse regulations requires significant effort and resources, and non-compliance can result in hefty fines and legal repercussions.

4. Model Interpretability

Generative AI models, especially deep learning ones, can be seen as "black boxes," making it difficult to interpret and explain their decisions. This lack of transparency can hinder trust and accountability, making it challenging for financial institutions to justify AI-driven decisions to regulators and customers.

5. Dependence on Data Quality

The accuracy and reliability of generative AI outputs are heavily dependent on the quality and completeness of the input data. Poor-quality data, including incomplete, outdated, or erroneous information, can lead to inaccurate predictions and decisions, potentially causing financial losses and damaging the institution's credibility.

6. Operational Risk

The implementation of generative AI systems introduces new operational risks, including system failures, software bugs, and cyberattacks. These technical issues can disrupt financial services, leading to financial losses and damage to the institution's reputation.

7. Ethical Concerns

The use of generative AI in decision-making processes raises ethical concerns, particularly regarding the transparency and accountability of AI-driven decisions. A report by the European Commission (2020) emphasized the importance of accountability in AI, noting that without proper oversight mechanisms, AI can perpetuate biases and lead to unfair outcomes. This is particularly relevant in the financial sector, where AI decisions can significantly impact individuals' economic status.

8. Scalability Issues

Scaling generative AI solutions across large, diverse financial institutions can be challenging due to differences in legacy systems, data infrastructures, and business processes. Ensuring seamless integration and consistent performance across all parts of the organization requires significant investment and coordination.

9. Cost of Implementation

The development, deployment, and maintenance of generative AI systems require substantial financial investment. Financial institutions must balance the costs against the potential benefits, ensuring that the adoption of AI technologies delivers a positive return on investment without straining their financial resources.

How We at GeekyAnts Help with Your Fintech App Requirements

Why Choose Us for Your Fintech App Development Project?

- User-centric Approach: At GeekyAnts, we prioritize the needs and preferences of end-users. Our design and development processes are focused on creating intuitive and engaging user experiences that drive satisfaction and loyalty.

- Maximum Security: Security is paramount in fintech. We implement robust security measures, including encryption, multi-factor authentication, and secure coding practices, to protect sensitive financial data and ensure compliance with industry standards.

- Wide Variety of Payment Integration: We offer seamless integration of various payment gateways and systems, ensuring your app can handle multiple payment methods, including credit/debit cards, digital wallets, and bank transfers, to provide a smooth transaction experience for users.

- AI-powered Bots and Solutions: Leveraging the latest in AI technology, we develop intelligent bots and automated solutions to enhance customer service, streamline operations, and provide personalized financial advice, making your fintech app smarter and more efficient.

- Compliance Standards: We stay up-to-date with the latest regulatory requirements and industry standards, ensuring that your fintech app meets all necessary compliance standards, reducing the risk of legal issues and enhancing user trust.

- Expert Consultation on Technology: Our team of experts provides strategic consultation on the latest technologies and trends in the fintech industry. We help you choose the right technology stack and solutions to meet your business objectives and stay ahead of the competition.

Fintech App Solutions We Provide

Banking App Development

Our expertise lies in developing comprehensive banking apps tailored to meet your needs. From enabling real-time transactions and managing savings goals to integrating loyalty programs and facilitating international money transfers, we ensure a seamless banking experience. We simplify account opening with digital verification and offer options for investing in mutual funds.

Personal Finance Management App

Our personal finance management solutions empower users to set and track financial goals, invest regularly through Systematic Investment Plans (SIPs), and connect seamlessly with various financial platforms. We provide tools for assessing financial risks and offer personalized investment portfolios based on individual preferences.

Crowd Funding Solution

We provide robust crowdfunding solutions supporting diverse funding models: reward-based, equity-based, debt-based, and donation-based. Whether you're launching a project or supporting a cause, our platforms facilitate secure transactions and effective campaign management.

Digital Banking Apps

We excel in creating digital banking solutions that leverage emerging technologies such as AI to enhance user experiences and operational efficiency. Understanding user behavior allows us to anticipate and exceed customer expectations with intuitive and effective solutions.

Trading & Stock Market Platforms

We specialize in developing robust trading and stock market platforms designed to provide real-time data, analytics, and seamless transaction capabilities. Our platforms are built with advanced security measures and user-friendly interfaces, ensuring that both novice and experienced traders can navigate and utilize the tools effectively.

Insurance Solutions

Our insurance solutions harness AI, blockchain, cloud computing, and IoT to innovate processes from onboarding to post-sales services. We enhance customer experiences through streamlined operations and advanced technological integration.

What Possibilities Does Generative AI hold for the Fintech Industry in Coming Years?

Several trends are poised to shape the future of generative AI in fintech:

- Increased Collaboration: Partnerships between fintech companies and AI startups will accelerate innovation and the development of new generative AI-driven solutions. These collaborations will leverage the agility of startups and the extensive resources of established fintech firms to create advanced, scalable AI applications. Cross-industry alliances, such as those with healthcare, retail, and telecommunications sectors, will also enrich data sources and AI capabilities, leading to more comprehensive and innovative financial solutions.

- Explainable AI (XAI): As regulatory bodies and consumers place greater emphasis on transparency, efforts to make AI models more interpretable will gain traction. XAI aims to make AI models understandable, allowing financial institutions to explain how decisions are made, which is crucial for compliance and building consumer trust. This trend will drive the development of tools and methodologies that enhance the interpretability of complex AI systems.

- Ethical AI: There will be a growing focus on developing ethical AI frameworks to ensure fairness, accountability, and transparency in AI applications. Financial institutions will prioritize creating and adhering to ethical guidelines to prevent biases, protect consumer rights, and ensure that AI-driven decisions are made responsibly. This includes establishing oversight mechanisms and ethical review boards to monitor AI deployment.

- Integration with Blockchain: Combining generative AI with blockchain technology could enhance security, transparency, and trust in financial transactions. Blockchain's immutable ledger can provide a secure foundation for AI-driven processes, while generative AI can analyze and automate blockchain transactions, leading to more efficient and trustworthy financial systems. This integration will also support the development of smart contracts and decentralized finance (DeFi) applications.

- Advanced Personalization: Generative AI will continue to evolve, providing even more precise and context-aware personalization in financial services. Future advancements will enable AI to deliver highly tailored financial products, services, and advice based on real-time data and deep behavioral insights. This level of personalization will enhance customer experiences and foster greater loyalty by meeting individual needs more accurately.

Summing Up

By embracing generative AI responsibly, fintech companies have the potential to revolutionize the financial services industry, ushering in a future that is not only more personalized and secure but also significantly more efficient. As these technologies continue to evolve, they will undoubtedly play a pivotal role in shaping a financial landscape that caters more closely to individual needs, enhances security measures, and streamlines operational efficiencies across the board. The responsible integration of generative AI promises to lead the industry towards unprecedented levels of innovation and customer-centricity.