Table of Contents

Building a Fintech App in 2023: UK Edition

Author

Date

Book a call

Understanding the Fintech App Landscape in the UK

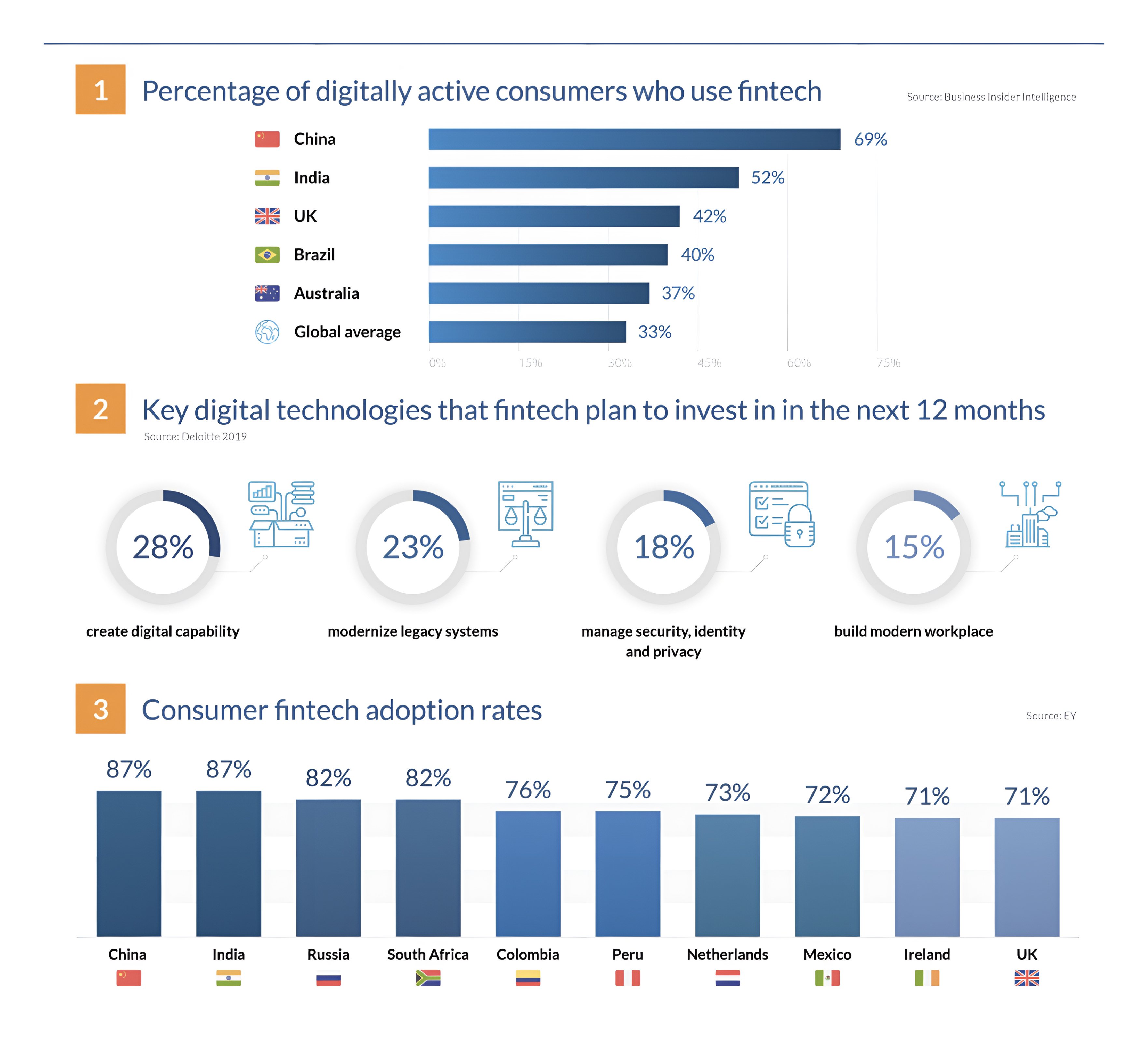

The financial industry is going through a whirlwind of transformations, and at the forefront of this revolution stands Fintech, the game-changer of our times. With a staggering $105 billion invested globally in Fintech in 2021, it's crystal clear that the allure of this dynamic sector has captivated the minds and wallets of investors worldwide

In the UK, the Fintech sector is thriving, with significant investments and regulatory support. According to a KPMG report, the UK has attracted £4.5 billion ($6.1 billion) in Fintech investment in 2021, a testament to the industry's strength.

The UK Fintech industry is known for its innovation and cutting-edge solutions. Key players include mobile banking apps, digital wallets, peer-to-peer lending platforms, and robo-advisors. The UK government has also introduced regulatory initiatives, such as the Open Banking framework, to promote competition and innovation in the industry.

As more funds are being invested in Fintech ventures, the demand for scalable fintech applications that can handle increased user activity and data volumes becomes even more crucial.

Learn how you can build one in the UK by 2023 with this comprehensive guide! Read on.

Key Trends in Fintech

Several key trends drive the Fintech industry in the UK. One significant trend is the increasing adoption of mobile banking apps and digital wallets. According to a survey by Statista, 74% of UK adults use mobile banking apps. The demand for convenient and accessible financial services has fueled the popularity of mobile apps in the UK.

Another trend in the UK Fintech industry is the rise of Open Banking. Open Banking allows consumers to share their financial data securely with authorized third-party providers. This has led to the development of innovative services, such as personalized financial management apps and streamlined lending platforms.

Regulatory Considerations for Fintech Applications

The UK Fintech industry operates under a robust regulatory framework. When building a Fintech application for the UK market, it is essential to understand and comply with the regulatory landscape. Key regulations include the Financial Conduct Authority (FCA) guidelines, which cover areas such as anti-money laundering (AML) and know-your-customer (KYC) requirements, data privacy laws (e.g., General Data Protection Regulation - GDPR), and consumer protection regulations.

Compliance with these regulations is critical to the success of your Fintech application in the UK. Failure to comply can result in fines, legal action, and reputational damage. Therefore, it is important to work with legal and regulatory experts to ensure that your application is compliant with all relevant laws and regulations in the UK.

Identifying Your Target Audience

To succeed in the UK Fintech market, you must define your target audience. The UK has a diverse population with varying financial needs and preferences. Conduct thorough market research and user testing to understand the specific needs and pain points of your target audience in the UK.

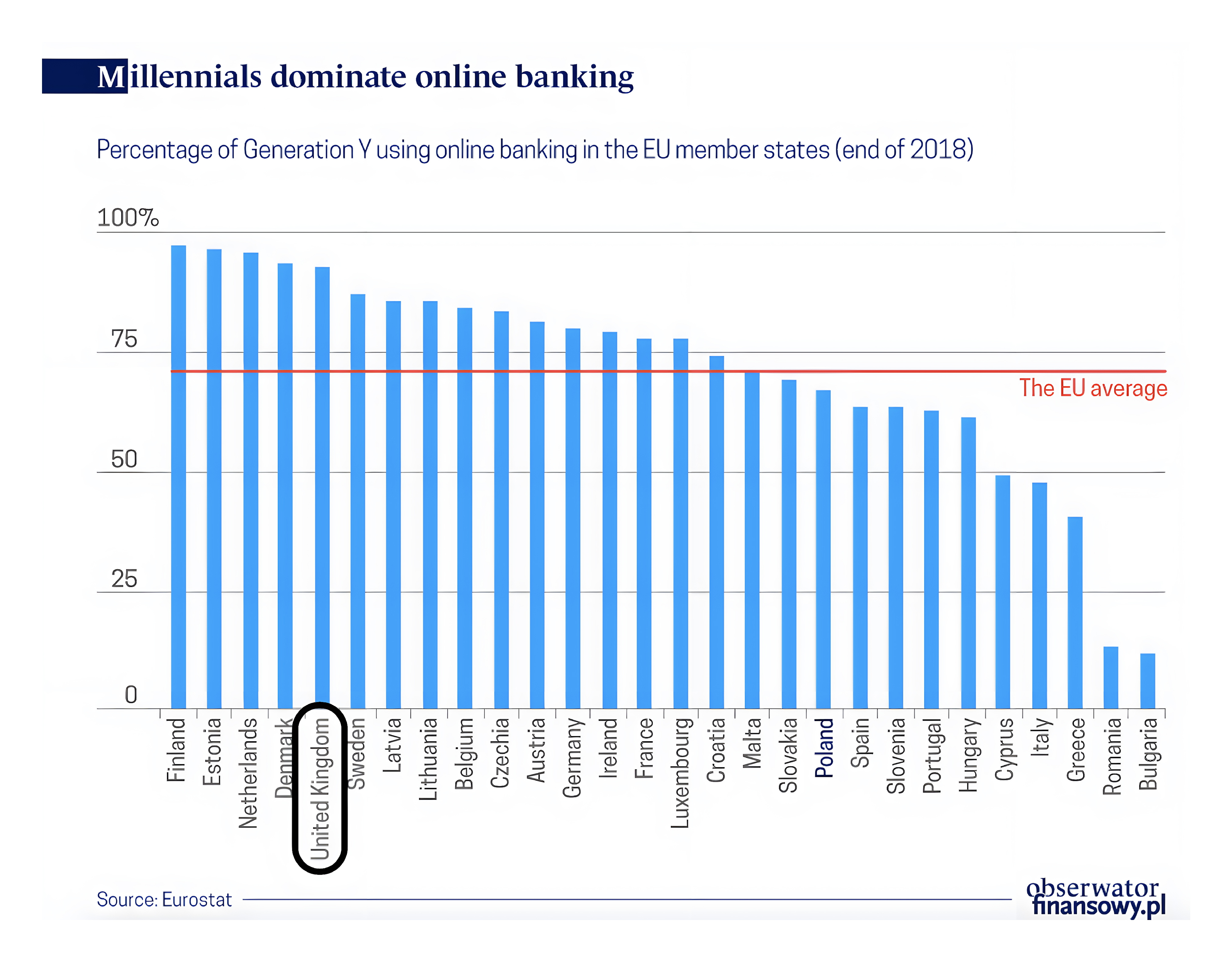

For example, in the UK, there is a significant demand for digital banking services among millennials and younger generations.

Developing a mobile app that offers user-friendly interfaces, personal finance management tools, and seamless integration with popular UK banking institutions can appeal to this target audience.

Furthermore, small business owners in the UK often require specialized financial tools for invoicing, payment processing, and accounting. Building a Fintech platform that caters to the unique needs of small businesses can be a valuable opportunity.

Understanding your target audience will enable you to develop a Fintech application that meets their specific needs, provides value, and differentiates you from competitors.

Key Considerations for Building Efficient and Scalable Applications in the UK

Choosing the right technology stack is crucial for building an efficient and scalable Fintech application. The technology stack you choose should align with the specific requirements and budget of your application. Here are some considerations for the UK market:

| Frontend Technologies | Description |

|---|---|

| React | Widely used for building complex user interfaces and has a large developer community in the UK. |

| Angular | Offers a comprehensive solution for building large-scale applications and has robust community support. |

| Vue.js | Known for its simplicity and ease of use, and is gaining popularity in the UK Fintech sector. |

| Backend Technologies | Description |

|---|---|

| Node.js | Well-suited for building scalable and high-performance applications due to its event-driven, non-blocking I/O model. |

| Ruby on Rails | Known for its stability, extensive feature set, and suitability for complex applications. |

| Django | Recognized for its robustness and security features, and is a Python-based framework. |

| Third-party APIs and Services | Description |

|---|---|

| Stripe | Payment processing |

| Plaid | Financial data aggregation |

| Twilio | Communication services |

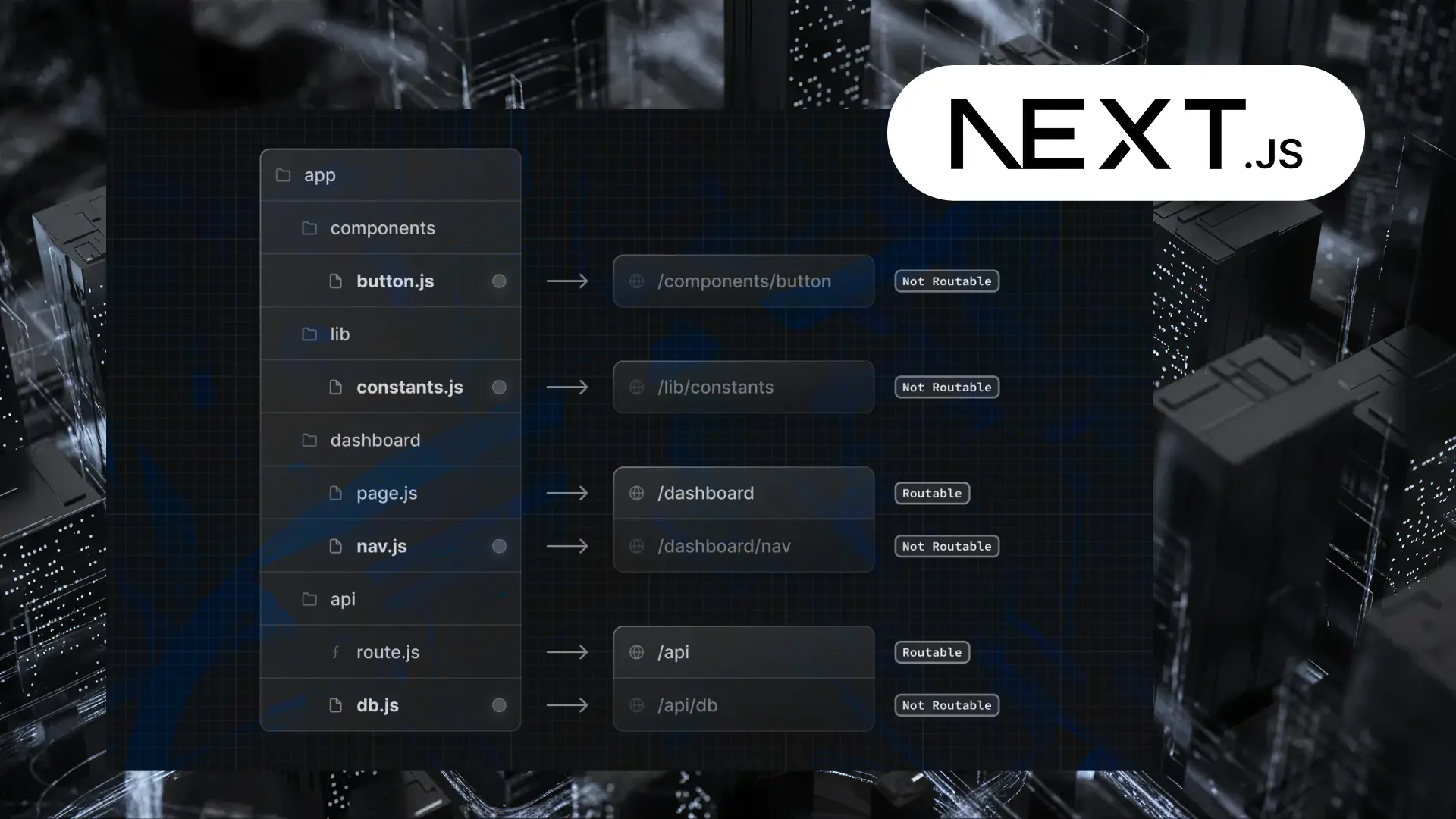

Designing an Unstoppable Architecture for the Booming UK Market

Designing a scalable architecture is essential for building a Fintech application that can handle a growing user base in the UK. Consider the following factors when designing your architecture:

Microservices vs. Monolithic Architecture

In the Fintech market, both microservices and monolithic architecture have their advantages. Microservices offer flexibility and scalability by breaking down the application into smaller, independent services. This approach allows for independent development and deployment of each service, which can be beneficial for handling increased traffic. Monolithic architecture, on the other hand, offers simplicity and ease of deployment, making it suitable for smaller Fintech applications.

Consider the specific needs and scalability requirements of your Fintech application when deciding between microservices and monolithic architecture.

Implementing data storage solutions

Data security is a paramount concern in the Fintech industry. Choose data storage solutions that offer encryption and secure access controls. Cloud-based solutions can handle large volumes of data and provide built-in redundancy measures, which are important for scalability and reliability. Optimize your data storage and retrieval processes by utilizing a combination of relational databases, NoSQL databases, and data lakes to store different types of data.

Ensuring high availability and fault tolerance

Ensuring high availability of your Fintech application is crucial for user satisfaction and adoption. Implement redundancy measures such as load balancing and failover mechanisms to handle unexpected failures. Leverage distributed systems like Kubernetes or Docker Swarm to handle increased traffic and unexpected failures effectively in the UK market.

By considering these factors, you can design a scalable architecture for your Fintech application that can accommodate a growing user base, frequent updates, and evolving user needs. Prioritize data security, high availability, and fault tolerance in your architecture to meet the demands of the UK market.

Security and Compliance in Fintech Applications

Security and compliance are paramount in the UK Fintech industry. Pay careful attention to these aspects when building your Fintech application:

- Data protection and encryption: Implement secure encryption practices to protect sensitive user information, such as passwords and transaction data. Encryption enhances data security and builds trust with customers.

- Authentication and authorization: Offer secure and reliable authentication practices in your Fintech application. Consider implementing multi-factor authentication methods to enhance security and prevent unauthorized access. This is especially important in the UK, where data breaches are a significant concern.

- Compliance with UK financial industry regulations: Ensure your Fintech application complies with relevant regulations, such as Anti-Money Laundering (AML), Know Your Customer (KYC), and data privacy laws. Compliance with these regulations helps you avoid legal issues and builds trust with customers.

- Regular security audits and testing: Conduct regular security audits, vulnerability assessments, and penetration testing to identify and address potential security weaknesses in your Fintech application. Stay proactive in protecting user data and preventing cyber threats.

- Incident response plan: Have a well-defined incident response plan in place in case of a security breach. This plan should outline the steps to be taken, including incident reporting, damage containment, and notification procedures for affected parties. Being prepared can minimize the impact of security incidents on your Fintech application.

Mastering the UK Fintech Landscape

Building a successful Fintech application in the UK requires a deep understanding of the market, the right technology stack, and a focus on security and compliance. By considering the specific needs of the UK audience, selecting the appropriate technologies, and prioritizing security and compliance measures, you can develop a Fintech application that meets the demands of the UK market. Keep user experience at the forefront of your design and development process, and stay updated with industry trends and best practices to ensure the success of your Fintech application in the UK.

Consider trusted development options like GeekyAnts. With almost 700 projects (including Fintech) delivered across the globe to clients spanning five continents, we certainly tick all the boxes for a reliable application development partner.