Book a call

The Fintech Scenario

Even through the course of the Coronavirus pandemic (which still continues on), 2020 saw a total figure of $2.7 Billion in investments in the industry. Numbers that represent funding statistics are even more staggering, standing tall at $22.2 Billion in just Q1,2021, towering the previously set record of $14 Billion in 2018. These numbers clearly represent the ever-rising growth patterns of the industry. More so, the APAC region saw almost 48,000 new startups being established within it in the year 2020, increasing exponentially to 61,000 till February, 2021. The North American region still holds its position as the leader in these numbers. Based on statistics and trends, it is safe to predict that the industry as a whole is showing signs of executing progressive mindsets through continuous innovations, backed by decisions that are clearly directed towards achieving growth.

Build your Fintech product with GeekyAnts

We, at GeekyAnts have been lucky enough to have a piece of every flavor or cake that the Fintech bakery has to offer. In the past 6 years, we have worked with governments and current/future leaders in the industry to create truly futuristic web and mobile solutions using technology that have shaped the industry in the glorious form that it is in today. In short, we have done what we love to positively impact Fintech and lead digital growth. Some of our experiences are:

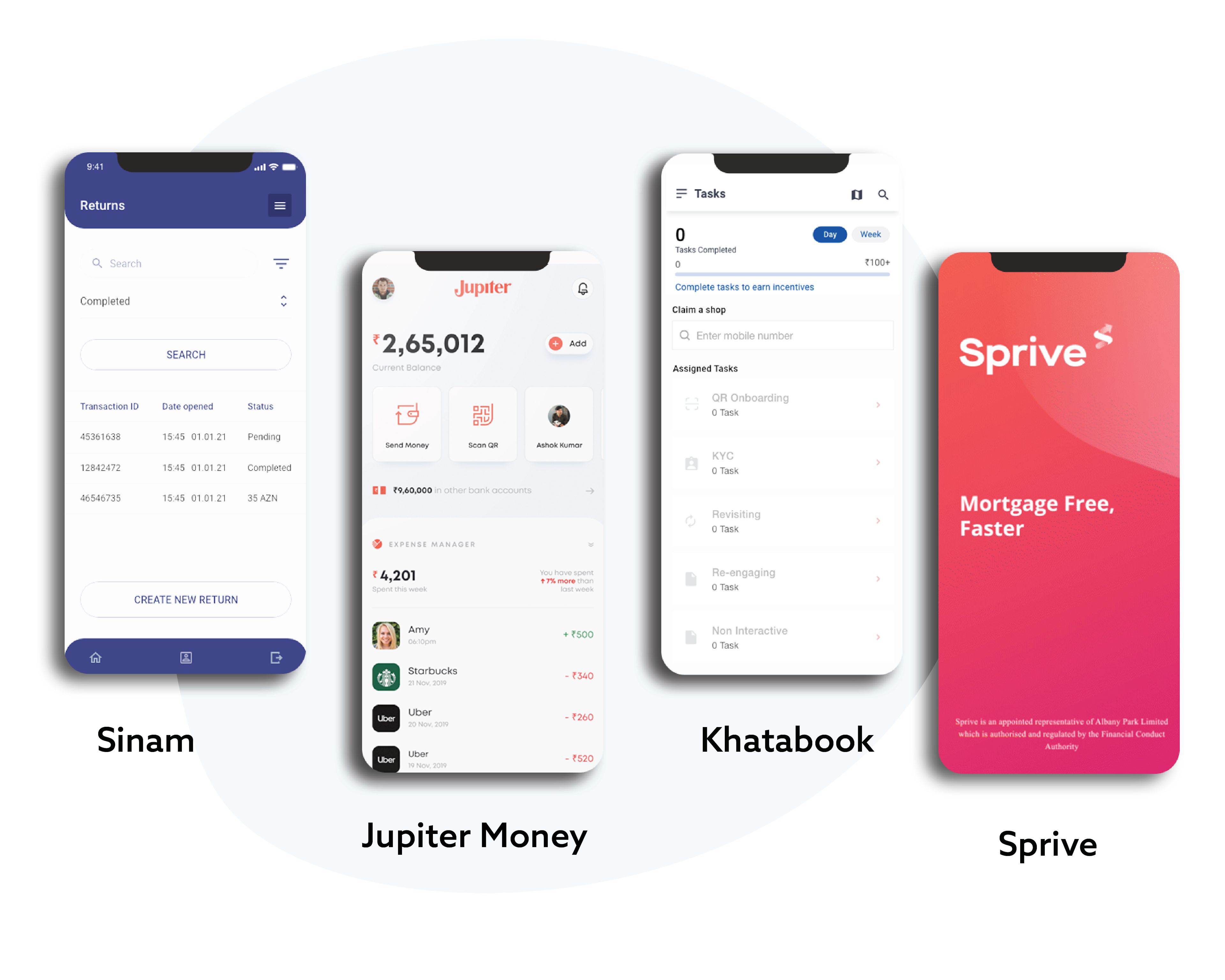

- We built an instant payment system for the Bank Of Azerbaijan to help the government introduce and promote digitalism in the country. Using our expertise in Flutter, we implemented the proposed system that was designed to fit a large number of consumers in the digital payment ecosystem as quickly as possible. The functions in this system would allow users to make transactions between agencies, businesses and other individuals fast and efficient using wireless technologies such as QR, NFC, etc.

- Jupiter Money dedicated its vision to develop a banking system centered around millennials, providing them with a well-rounded digital banking experience. We collaborated with Jupiter to help them realize their vision into a mobile application which centralizes the entire banking process in collaboration with major banks in India and do-away with the concept of 'waiting in line' to get things done. We also helped build a neat dashboard for the administrators to manage the app and the services within it with ease and efficiency.

- Who knew managing mortgages could be made digital. Sprive developed an idea of building a service that could enable people to manage their mortgages on their fingertips and we helped them cultivate this idea into a cross-platform mobile application. Using state-of-the-art technologies, we developed an intricate web of designs, frontend and backend of the mobile app that delivered the vision of Sprive while promoting ease of access and understanding.

- We also collaborated with Khatabook to create India's first premium utility solution for the MSME sector. Their vision is to simplify business processes for their owners and help them maintain a digital ledger of their transactions.

What makes GeekyAnts unique?

Research and experimentation lies at the heart of GeekyAnts. Our focus has not been on just applying age-old methods to build generic products, but put in the extra effort and walk the extra mile to truly transform Fintech businesses with new, state-of-the-art methods based on extensive research and the ability to 'understand the vision'. We have made efforts to solve problems that exist in the market through our Open Source products and the Fintech industry has benefitted from that to a great deal.

- Being in the industry for 16+ years, GeekyAnts has always delivered quality and future-ready solutions in Fintech.

- They have been an integral part of the Fintech industry since their very inception and have delivered over 20+ apps that have helped shape the industry worldwide.

- GeekyAnts always focuses on quality over quantity and goes the extra mile to understand your vision and improve upon it with insightful analysis.

- With GeekyAnts, you're not just a client. You are a part of a family that loves to Research, Collaborate & Build.

Forthcomings

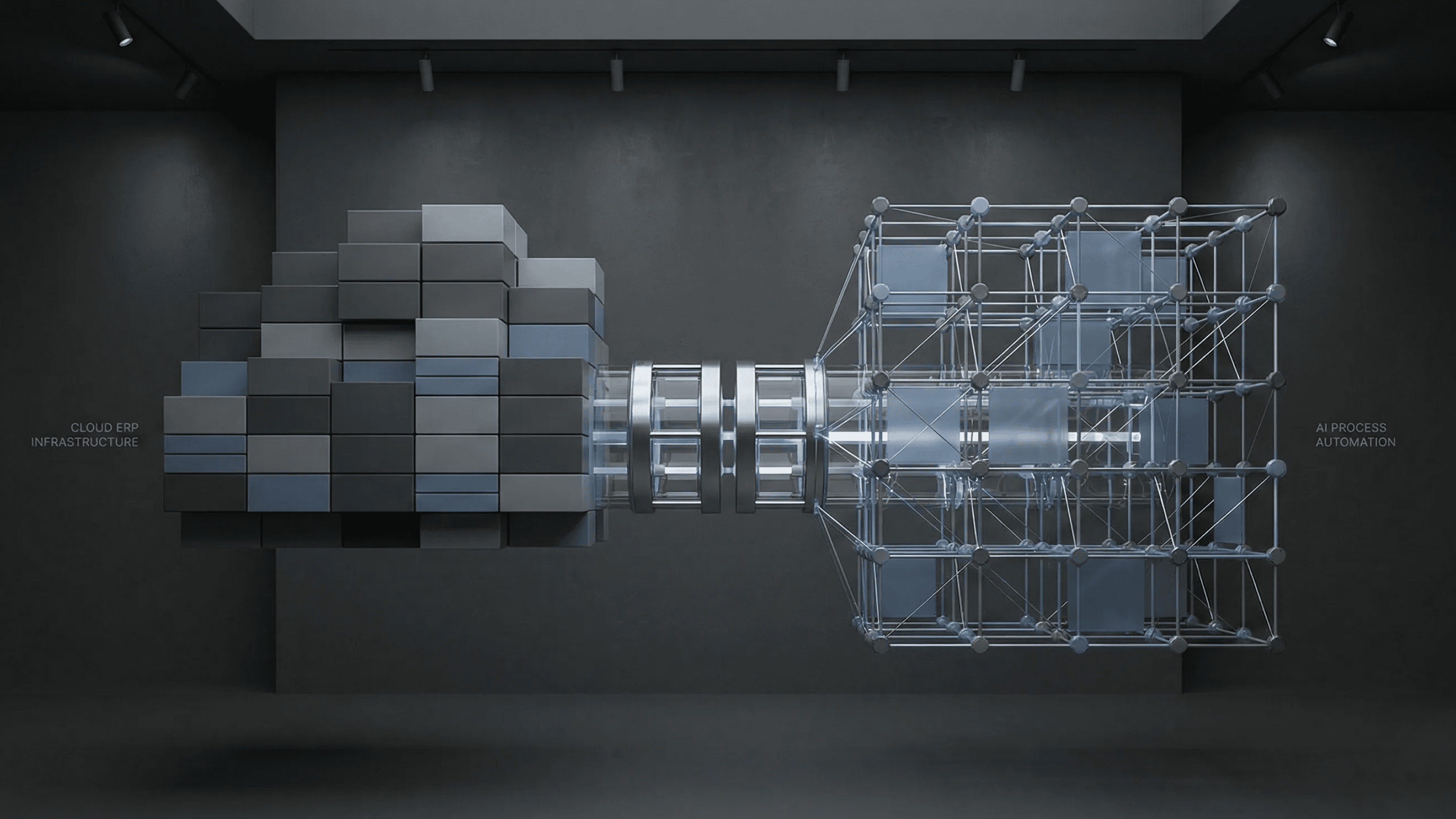

While doing our best to lead the sector into the future, we also have our own predictions of what that future would look like for the Fintech sector. These trends have started making their presence felt in the industry already and are the ones that will bear the brunt of the Financial institutions in the coming days. Embedded Finance is the next big step in the payments life-cycle. Buy now, pay later programs backed by solid business models in purchases, insurance and other related ventures is the vertical we are most looking forward to. Crypto-assets are already making their way into mainstream transactions but will soon take over the traditional money exchange. AI & Robotics will pave the way to better customer analytics and data driven decisions & Cybersecurity will still remain as the biggest concern and threat to Financial institutions operating within this sphere.

Closing Notes

Fintech has always been a core-competency in our basket of skills that we employ to ease industries into the future using tech. This article is a peek into what we have achieved in this industry and how we can help you achieve even more. If this write-up excites you about the new possibilities in the future, we would love to hear what you think.