Digital Wealth Management Platform For Bambu

Digital Wealth Management Platform For Bambu

- 1

Strategy

We collaborated with Bambu to revolutionise investment banking by creating a Fintech platform that could handle these transactions with ease. The project was based on the time and model where we interacted with the client based on the scrum methodology to ensure that the end product was a result of our collaborative ideas.

- 2

Analysis Planning

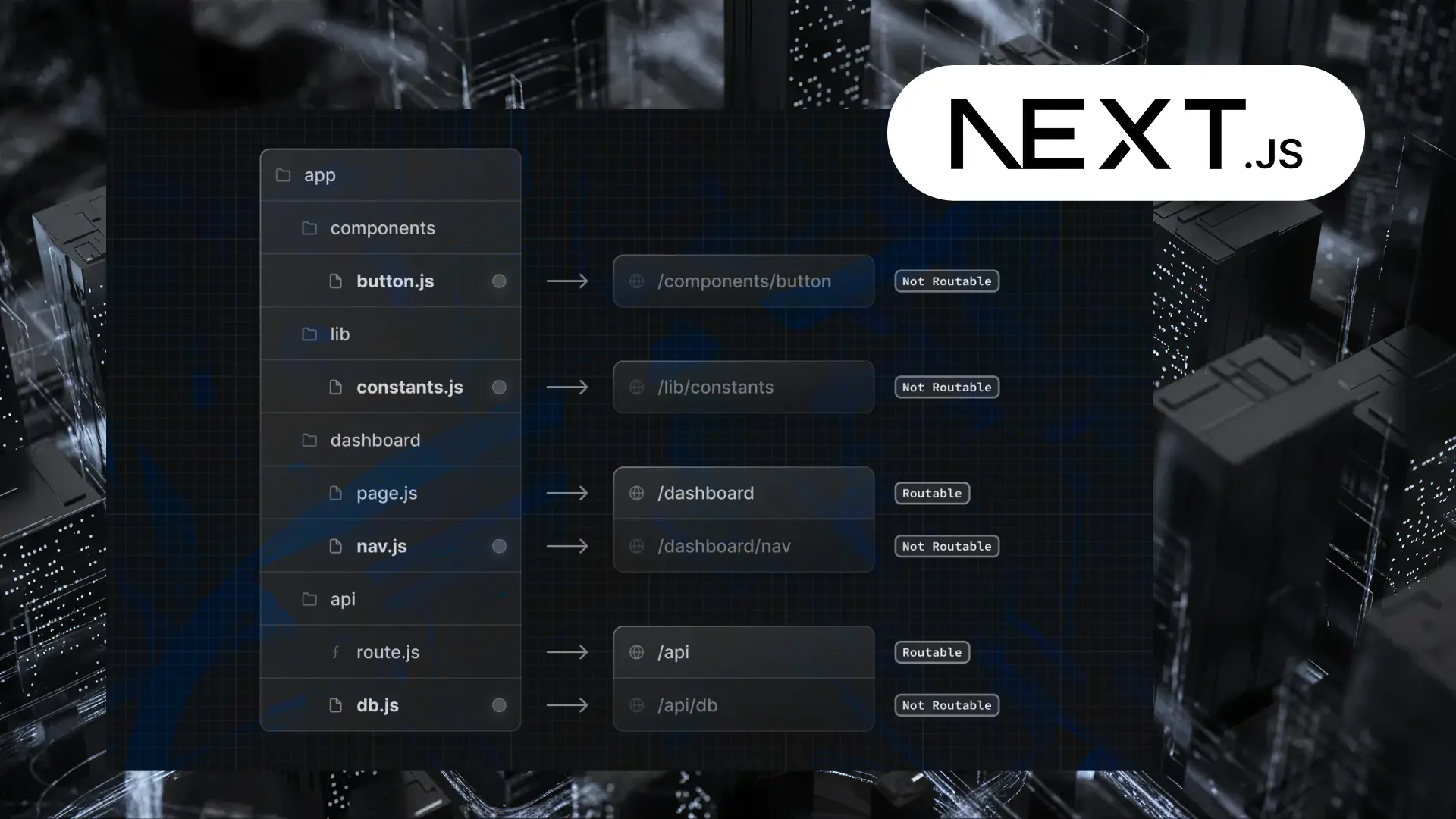

The partner required the platform to have a native feel because of which the technologies for the application were finalised to be React, for its many cross platform features alongside Zeplin, a cloud-based and on-premise collaboration software.

- 3

UI/UX

Our developers worked on the designs which had been formulated by the client to give the user interface of the application an overhaul.

- 4

Development

The client required an innovative FinTech app which had avant-garde features because of which the team invested time on research and implemented features like a platform where user’s portfolios would be displayed, an option for RSP and handle multiple accounts and a feature to calculate financial risk.

- 5

Testing

Intensive QA testing, both manual and UAT, was conducted after the creation of a new feature and it was decided that the versioning would be Major.Minor.Patch.

- 6

Delivery

The positive outcome of the development process has led to its extension with the app being constantly improved to provide digital solutions to the financial world that are truly seamless.

Established in 2016 and headquartered in Singapore, Bambu is the brainchild of Ned Phillips and Aki Ranin. The founders, in their pursuit to provide smart tech solutions for financial organisations, came up with the idea of a Fintech application that could enable users to save and invest for the future by managing their spendings. Over the years, the dynamic duo has led the company from its humble beginnings to an organisation that has its presence globally.

Jay, the head of projects at Bambu, reached out to us after hearing about our work in the app development arena. The problem was simple and the end-goal was to work on the UI of the app to reinvent the Frontend of both the mobile and web applications using the designs provided by the client as the framework. One of the primary goals was to implement a platform that could showcase the portfolio of users hence making it more convenient.

After much consideration, the Time and Material model was chosen for the course of the project which was intended to be implemented in sprints. The client’s preference was inclined towards using the Scrum methodology for the management of the project and that is what we initiated for the project as well. This model was chosen as it allowed for flexibility during the run of the venture.

Considering the nature of the project, it was essential to assemble the right team with the suitable skill-set. We onboarded two expert Frontend Developers spearheaded by an Engineering Manager who would take the venture forward. The team was formally introduced to the client and after thorough discussions where the prerequisites were set, we commenced the work on the project. As the work on the project progressed, daily standups were held to review the progress as well as set the milestones for going forward.

To revamp the frontend of both the mobile and web applications using the designs provided by the client.

To implement a platform that could showcase the portfolio of clients.

Implement certain features that would improve the manageability of the apps.

After thorough research and discussions with the client, work was initiated on the applications. Our partner’s goal was to make the financial processes of companies digital to enhance manageability of money. The intent behind the project was to redesign the Frontend of the application to give the UI of the app a new look.

Complying with our partner’s requirements, React was chosen to work with on the Frontend for its many cross platform features alongside Zeplin, a cloud-based and on-premise collaboration software. Since the designs were previously formulated by the client, our designers lay easy on this one.

Once the software was finalised, it was time to amp the hustle and get started on implementing the features. One of the prime requirements was to create a feature in the form of a platform where user’s portfolios would be neatly displayed, hence rendering the app to be more user-friendly. A Regular Savings Plan(RSP) for the fund was also implemented which would act as a recurring deposit wherein the customer could opt to pay either monthly or quarterly, depending on his/her convenience. Post this, we also designed an Edit Profile feature wherein agents can edit the profile of the customers, based on the requirements.The next step was to create a feature which would enable a feature to handle multiple accounts, i.e, both cash and KSWP (Employee Provident Fund), as this made navigating through the website easier. Lastly, the client also required us to implement a feature where their customers could manually retake the risk assessment once their previous session was over, as not all of the functionalities of the funds can be enabled till this is verified. Bitbucket, a Git-based source code repository was chosen for storage for its end-to-end visibility and automation features.

Intensive QA testing was done after the creation of each feature where the QA engineer would manually run tests to check for any bugs or discrepancies. Jira was the tool of choice to run tests to track, organise and prioritise bugs. It was manually decided that the versioning of the format would be Major.Minor.Patch. At the end of the feature test, which also essentially marked the end of that particular sprint, the build was delivered to the client who would run his own set of tests to check for bugs which would be fixed before proceeding to work on the next feature. At the end of the release of each sprint, the features implemented are demonstrated to get a feel of how the app would function. We would also hold discussions with the client for any probable suggestions on how to go forward. The project is currently ongoing, with new features being released ever so often.

As with any major project, the team came across many challenges which could only be overcome through thorough research. The client has previously resorted to using Redux as the tool for form handling and it was integral to continue the project using the same. In order to adhere to this requirement, one of our UI developers had to master Redux Form in order to implement the Edit Profile feature. Another hurdle that was faced by the team was to stick to stringent deadlines to ensure that the deliverables were ready on time. The team handled this quite adeptly through constant and effective communication, both within the team and with the partner.

- The primary requirement of the project was to implement a Frontend for the app based on the design framework that was provided by the client.

- Zeplin, a cloud-based and on-premise collaboration software, was used to manage the design process.

- The versioning of the application was finalised to be Major.Minor. Patch.

The impressions that we made on our partner by how the group performed and how the project looked at its current stage were considerable. The client who was impressed by the team’s commitment to meet expectations as well as their zeal to deliver perfection at every step has extended the project to a more long haul plan with exciting new features being implemented. We are delighted to be part of our partner’s endeavor to provide seamless digital solutions for the financial world.